If you’re planning to buy a home in 2025, understanding two key data points can help you make a smart financial decision.

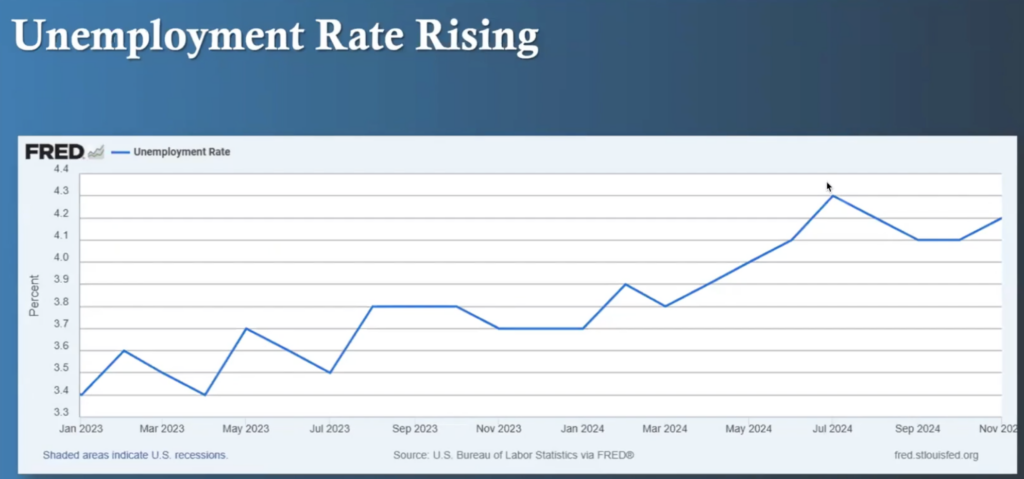

1. Track the Unemployment Rate

When unemployment starts rising from its low point, it often signals an economic shift.

Historically, as unemployment rises, the Federal Reserve tends to cut the Fed Funds rate to stimulate the economy. While this doesn’t directly lower mortgage rates, it often leads to a downward trend in rates to encourage homebuying. Pay attention to the unemployment rate chart—if the line keeps climbing upward and to the right, it’s a strong sign mortgage rates may begin to fall. This could be the perfect time to lock in a favorable rate and start shopping for your new home.

A simple way to stay ahead: keep an eye on unemployment reports and trends.

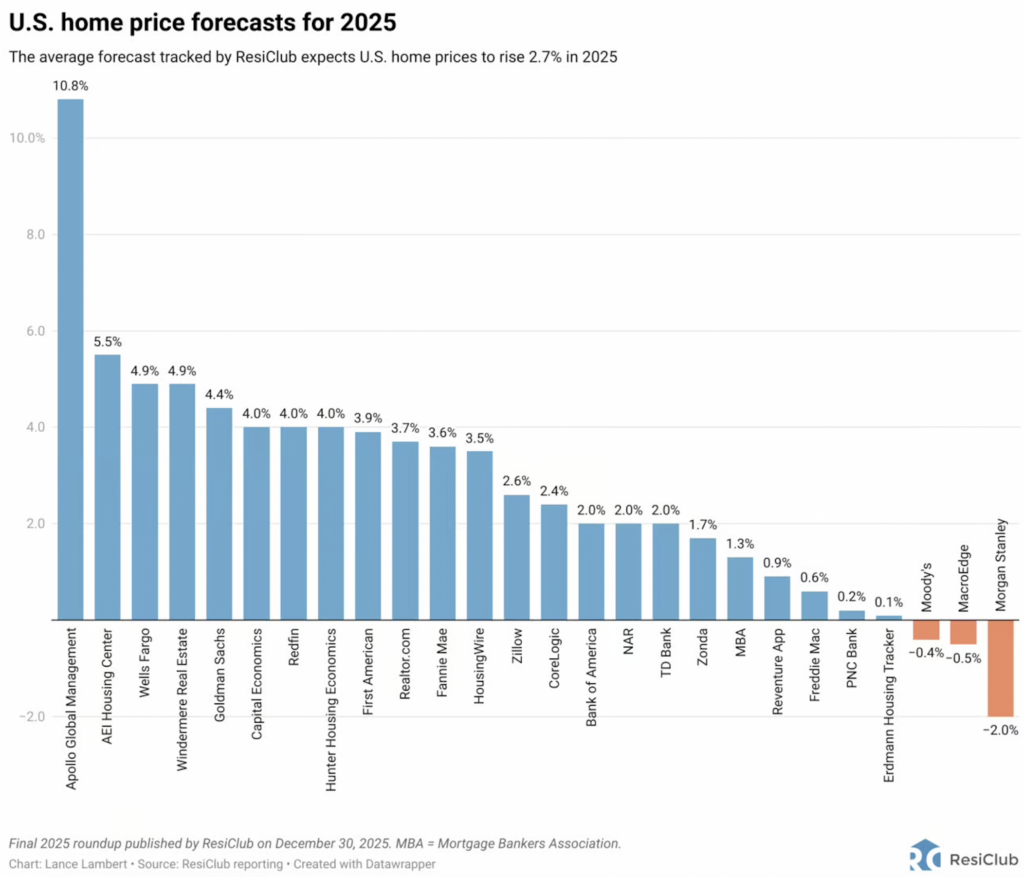

2. Monitor Home Prices

Rising home prices, combined with elevated mortgage rates, strain affordability—but waiting too long can cost you.

If home prices are climbing in 2025, buying sooner can help you start building wealth faster. Historically, homeowners who enter the market earlier see greater long-term financial benefits than those who wait for “better conditions” that may never arrive. Think of it as planting seeds in fertile soil—growth happens when you act.

To stay informed, check real estate reports or connect with a trusted advisor to watch for price trends in your area.

23 of the 26 firms expect national home prices to rise in 2025:

Homebuying isn’t about timing the market perfectly—it’s about understanding the trends and acting strategically. Keep these two tips in mind, and you’ll be prepared to make a smart move in 2025.

A Partner You Can Trust

I’m thrilled to share that I’ve joined a new company that not only encourages entrepreneurial thinking but also supports a client-first approach. This move allows me to serve you with greater flexibility, stronger resources, and direct mentorship from industry leaders.

My goal is simple: to help you make informed decisions that build your wealth and financial future. Whether it’s navigating mortgage rates, understanding home prices, or planning your next move, I’m here to help you succeed in 2025 and beyond.

Let’s work together to make this your year to grow!

Stay tuned for more updates, and feel free to reach out—I’d love to help you thrive this year!