In 2025, first-time homebuyers need to navigate a complex market, where home prices, income growth, and mortgage rates create a unique set of challenges.

1. Home Prices Are Staying Strong

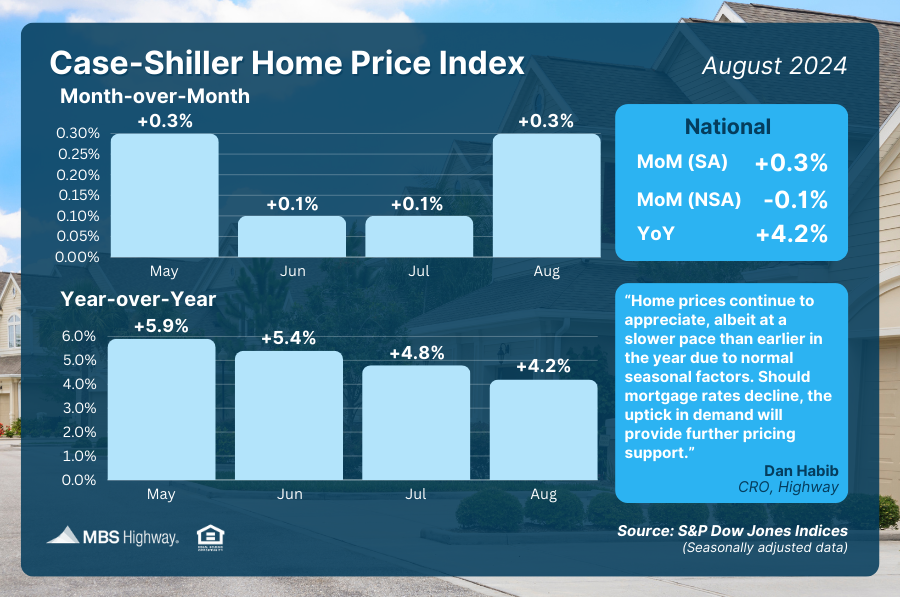

Home prices continue to increase, with year-over-year growth staying above the 63-year historical average of ~4.73%.

The Case-Shiller Home Price Index highlights the resilience of home values, even in a shifting economic landscape. Despite some seasonal dips, the overall trend shows that prices remain on an upward path, making it essential for buyers to understand this sustained demand. Waiting for prices to drop significantly may be a risky bet, especially when the data suggests prices will hold or increase.

Staying informed on market prices can help buyers make timely decisions.

2. Personal Income Growth Supports Buying Power

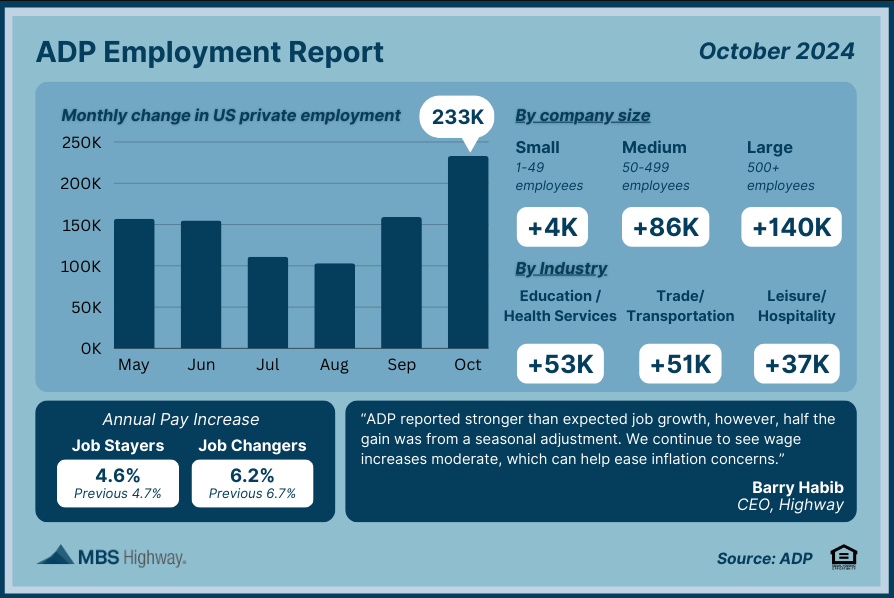

Income growth is helping first-time homebuyers keep pace with rising home costs.

According to the ADP Employment Report, job stayers and job changers are both seeing year-over-year wage growth that surpasses the rate of home price appreciation. This is good news for buyers, as it suggests that incomes are not falling behind home prices, at least for now. For example, job stayers are seeing 4.6% income growth, while changers see 6.2%, both above the current home price increase of 4.2%.

For buyers, wage gains provide a buffer against inflation, reinforcing their purchasing power.

3. Mortgage Rates May Not Drop Despite Fed Cuts

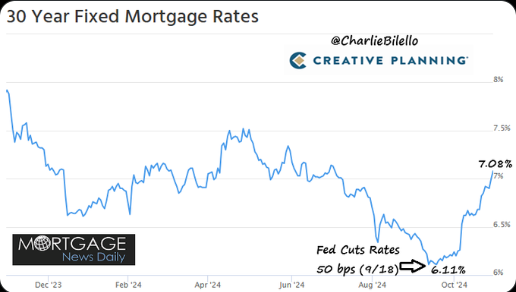

Even though the Federal Reserve recently cut rates, mortgage rates have continued to rise, jumping nearly 1% in a short period.

The 30-Year Fixed Mortgage Rates graph shows how quickly rates can climb, especially when inflation concerns are still present. Experts anticipate further Fed rate cuts through 2025, but this doesn’t necessarily mean mortgage rates will decrease. The direction of mortgage rates depends more on inflation than on direct Fed actions, as demonstrated by the recent rate climb despite cuts.

Understanding the dynamics of mortgage rates can help buyers prepare for fluctuating costs.

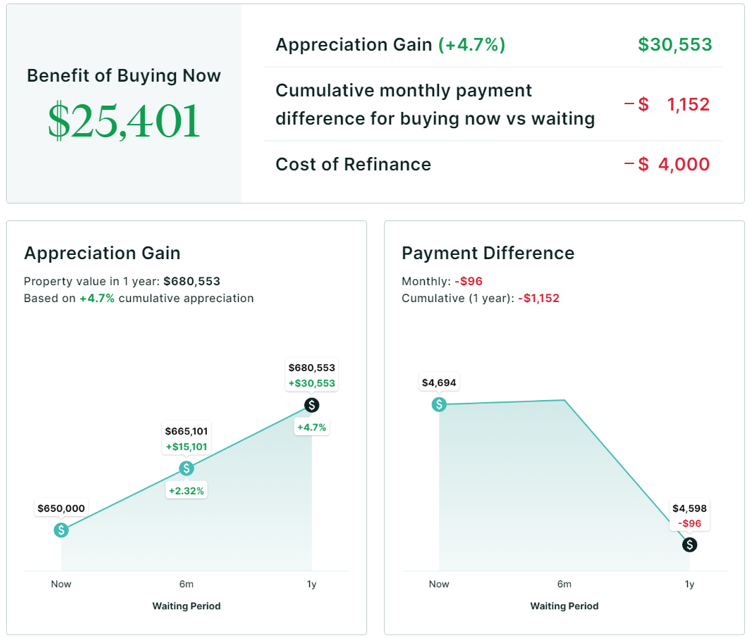

Homebuyers who wait may face a higher “Cost of Waiting” as rising home prices, steady income growth, and unpredictable mortgage rates add to the expense of delaying. According to the data, delaying a purchase by even a year could lead to higher home prices, increased monthly payments, and lost appreciation gains. In this example, buying now instead of waiting results in an estimated benefit of $25,401, due to both appreciation gains and avoided costs. For first-time buyers, acting sooner locks in today’s price capitalizes on current income growth, and potentially avoids rising mortgage rates.

Making an informed, timely purchase can be a powerful step toward building wealth in the current market.

If you’re considering buying your first home, don’t let the “Cost of Waiting” catch you off guard. I can generate a personalized “Cost of Waiting” report—just like the example above—to help you see how timing your purchase could impact your finances. Reach out to get your free report and make an informed decision about your future!