So often we get offers suggesting that using home equity to reduce or eliminate consumer debt is a great way to improve our monthly budget. However, it’s crucial to look beyond the initial numbers and have a plan for using the savings to boost your overall financial situation.

After preparing several debt consolidation reports for my clients, I’ve found that these 3 steps can help you decide if restructuring your debts is worth the effort.

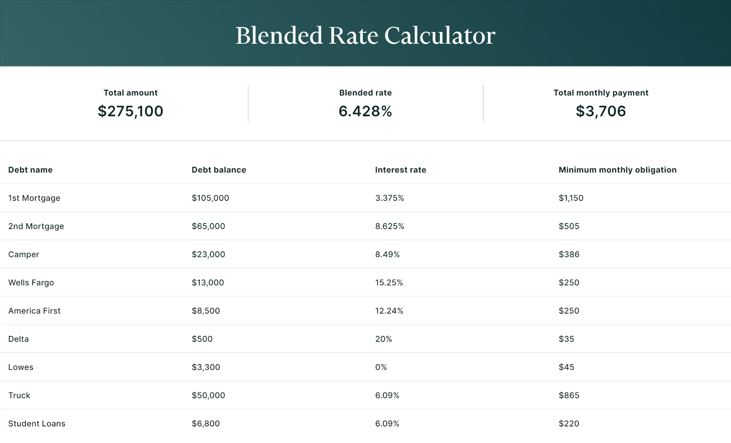

Step 1 – Know Your Blended Rate

This is a key starting point when considering a debt consolidation loan. The blended rate calculator takes your current debt balances, minimum payments, and annual percentage rates of each debt to produce the blended rate. Understanding this rate is crucial; if it’s significantly below the rate you would refinance to, it could worsen your situation. Don’t skip this step—it could save you time and money and prevent a major financial mistake.

Blended Rate Information:

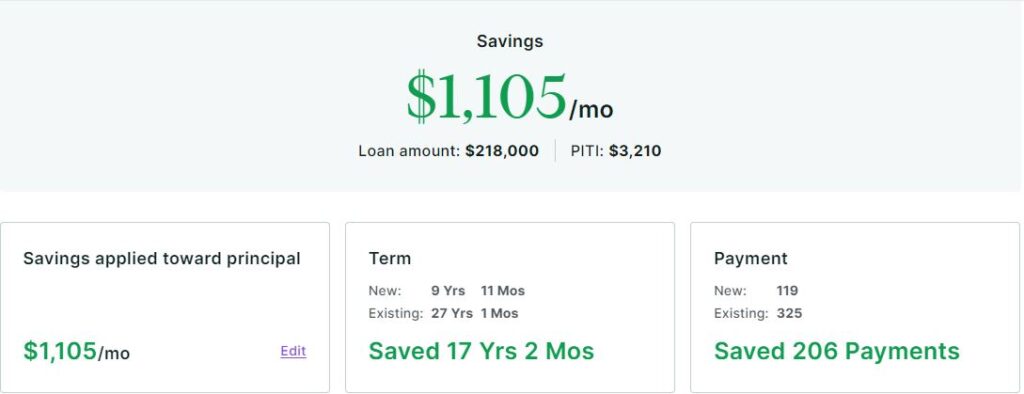

Step 2 – Plan to Use Savings to Improve Overall Wealth

Once you know your blended rate and it’s close to or higher than the new loan rate, start paying off debts to see which ones create the biggest monthly savings. Our Debt Consolidation report helps identify the right debts to pay off and shows the monthly savings as they are eliminated using the new loan proceeds. You can then use these savings to accelerate paying off the new loan or invest in other opportunities to boost your net worth.

Monthly Savings and New Term Payoff:

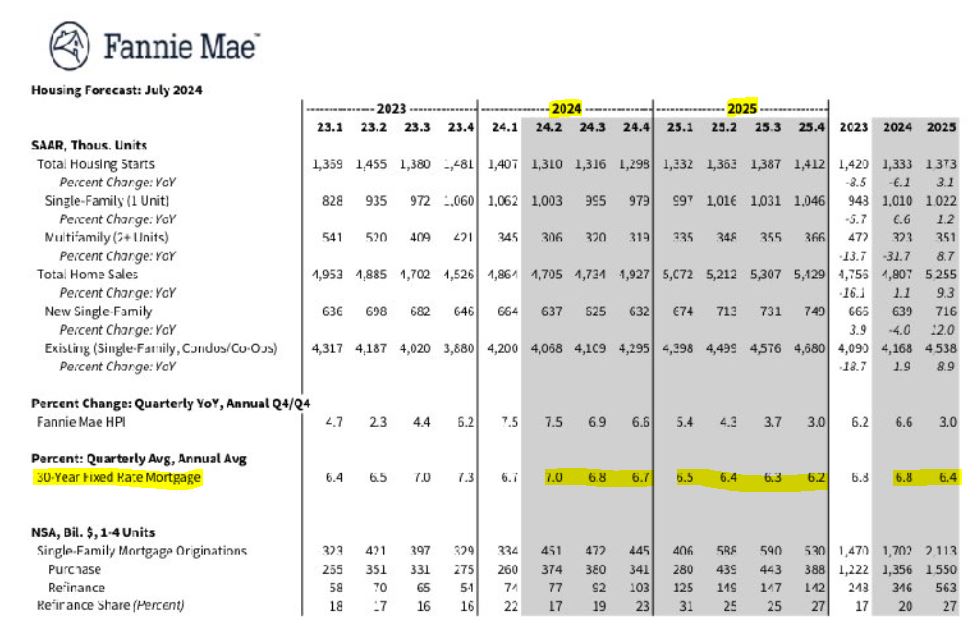

Step 3 – Monitor Mortgage Rates

Interest rates change daily, so connect with a mortgage professional who understands when to lock in the best terms. Their expertise will ensure you get the best terms available if you choose to consolidate your debts.

Forecast for Mortgage Rate ’24 & ’25 –

Fannie Mae’s revised forecast expects the 30-year fixed mortgage rate to average –

6.8% in Q3 2024 (p: 6.8%),

6.7% in Q4 2024 (p: 6.7%)

6.5% in Q1 2025 (p: 6.6%)

6.4% in Q2 2025 (p: 6.5%)

6.3% in Q3 2025 (p: 6.4%)

6.2% in Q4 2025 (p: 6.3%)

Following these 3 steps will help you determine if a debt consolidation loan will improve your wealth and better prepare you for retirement.

To receive a personalized debt consolidation loan report, reply with “DC report” and I’ll reach out to discuss this further with you.