As we approach 2025, understanding the future of the real estate market is crucial for serious buyers looking to make informed decisions. With major organizations like Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo providing housing forecasts, prospective homebuyers can gain insights into critical areas like total home sales, home price trends, and mortgage interest rates. While forecasts aren’t guaranteed and may change as new data emerges, they can serve as valuable guides for planning your next move. Here’s what the leading forecasts predict for 2025.

Total Home Sales: Gauging Inventory Levels

Each forecast provides insight into the number of homes expected to be sold, which helps buyers understand the availability of inventory:

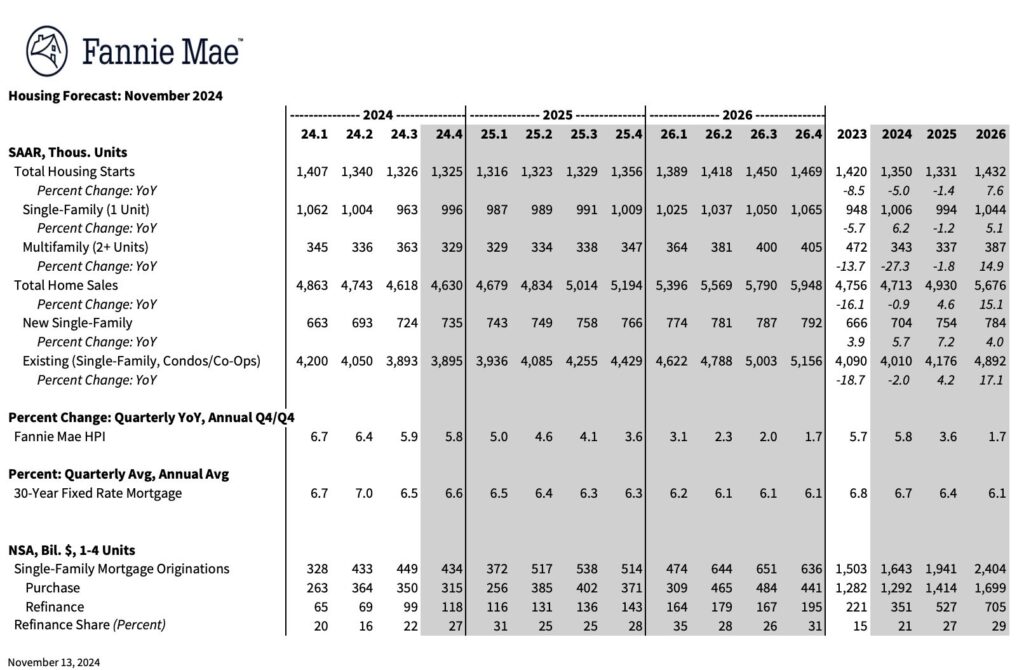

- Fannie Mae: Projects total home sales to increase from 4.63 million in 2024 to 4.93 million in 2025.

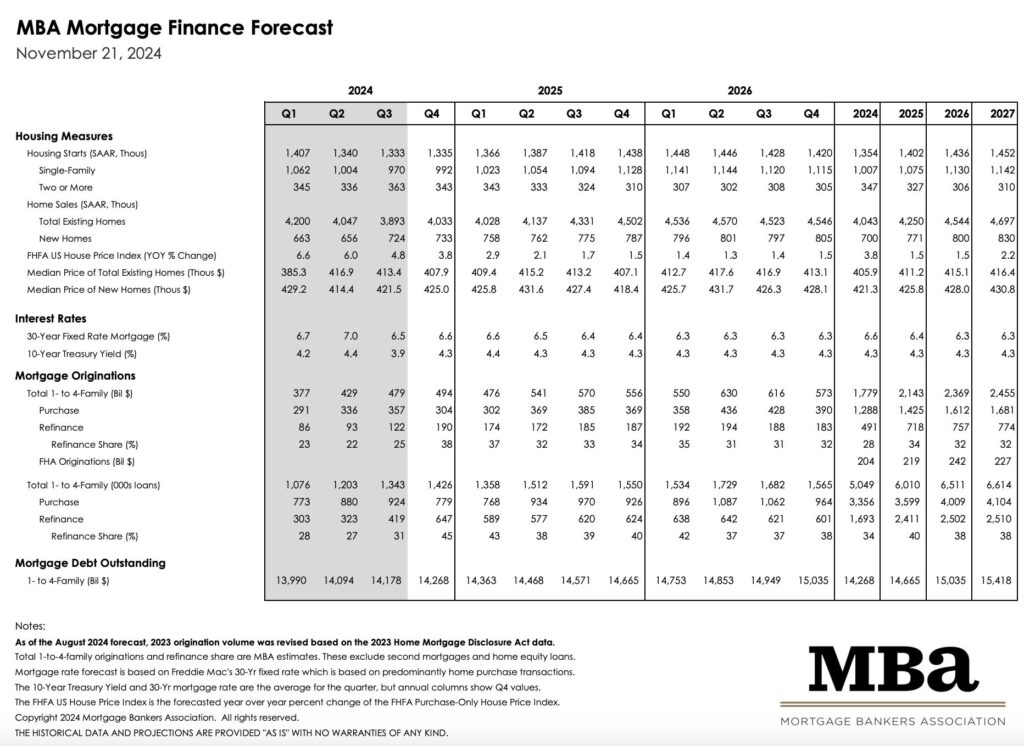

- MBA: Predicts a rise from 4.04 million in 2024 to 4.25 million in 2025.

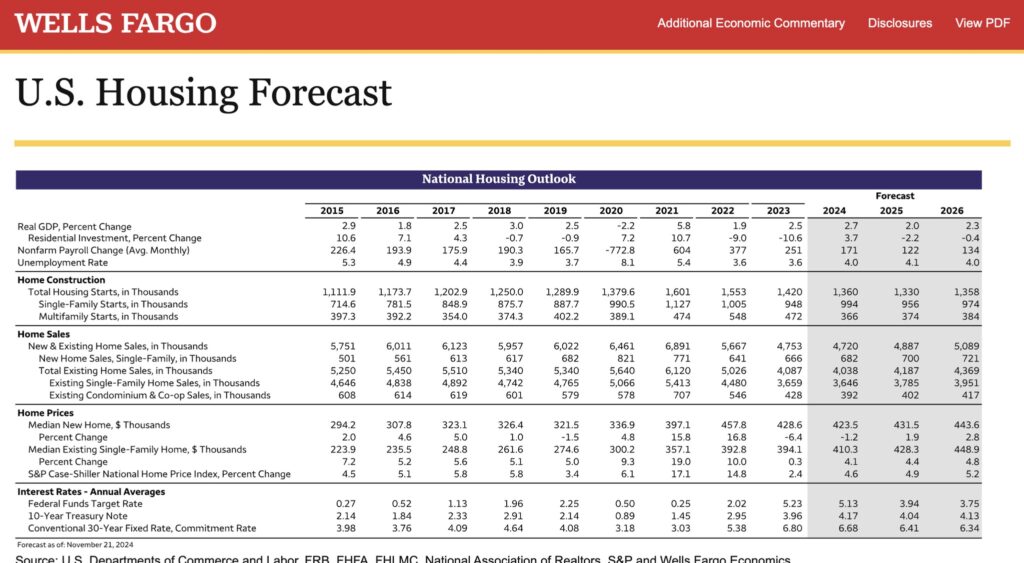

- Wells Fargo: Estimates total home sales at 4.89 million in 2025, climbing to 5.09 million in 2026.

While all three forecasters anticipate a rebound in home sales, the differences in projections highlight the uncertainties in the market. A key takeaway? Expect a moderate recovery in inventory compared to recent years, but remain prepared for fluctuations.

Home Price Appreciation: What to Expect in 2025

Understanding home price trends is vital for buyers aiming to maximize their investment. Here’s how each forecaster sees 2025 shaping up:

- Fannie Mae: Foresees home prices rising 3.6% in 2025 and 1.7% in 2026, signaling steady, moderate appreciation.

- MBA: Expect a smaller increase, with home prices up 1.5% annually in 2025 and 2026.

- Wells Fargo: It predicts that home prices will grow by 4.9% in 2025 and 5.2% in 2026, indicating stronger appreciation than its peers.

While all forecasts suggest growth, buyers should weigh these variations and consider how rising prices could impact affordability and equity-building potential.

Mortgage Interest Rates: What Will Borrowing Cost?

Interest rates remain a critical factor in housing affordability. Here’s what the experts predict:

- Fannie Mae: Expect the average 30-year fixed mortgage rate to fall to 6.40% in 2025, down from 6.70% in 2024.

- MBA: Anticipates rates averaging 6.40% in 2025 and 6.30% in 2026.

- Wells Fargo: Forecasts rates at 6.41% in 2025, with a slight drop to 6.34% in 2026.

Although slight declines are expected, rates are likely to remain elevated compared to pre-pandemic levels. Buyers should factor these rates into their budgets and consider how even a small change can impact monthly payments.

The Bottom Line

While these forecasts provide valuable insights, remember they are not set in stone. Changes in economic conditions, policy decisions, and other factors could shift these predictions at any time. As a homebuyer, staying informed about these trends can help you prepare for what’s ahead and make confident purchasing decisions.

Want to See How Home Appreciation Could Build Wealth for You?

I’d be happy to create a personalized graph that shows how home appreciation could help you build significant wealth over time. Just send me a quick email and I’ll put together a graph tailored to your specific situation!