A strong retirement plan depends on having enough assets to cover future expenses. One way retirees are improving their financial security is by investing in real estate, which can increase their Funded Ratio—a key metric comparing assets to liabilities.

1. Passive Income

Rental properties generate steady income, reducing reliance on portfolio withdrawals.

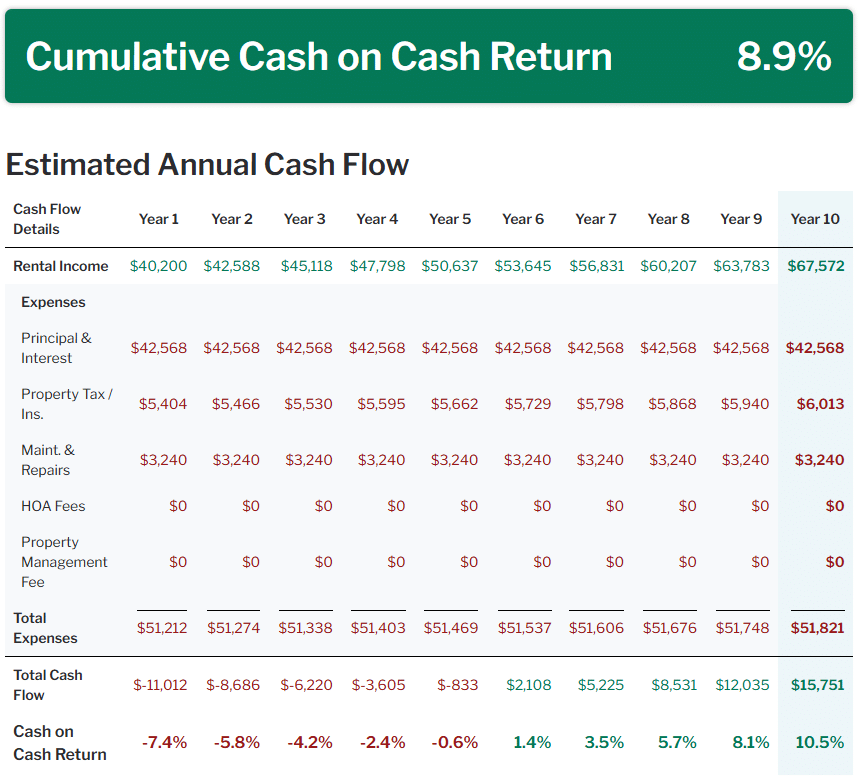

The Funded Ratio measures whether your assets can sustain your retirement. Real estate strengthens this ratio by providing reliable cash flow and supplementing pensions and Social Security. For example, as shown in the Estimated Annual Cash Flow chart below, rental income increases over time, and by Year 10, the property is generating a positive cash flow of $15,751 annually, with a 10.5% cash-on-cash return.

More income means a higher Funded Ratio and greater financial stability.

2. Inflation Hedge

Real estate helps protect retirement savings from inflation.

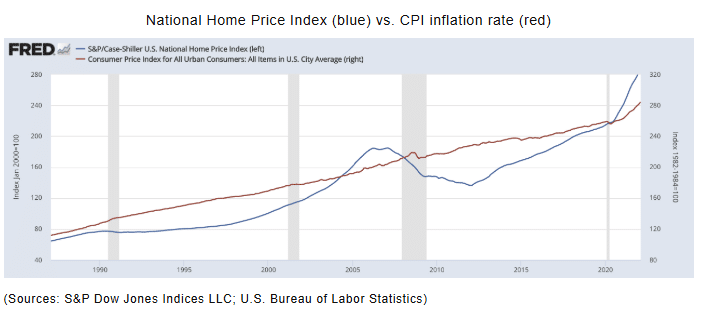

The cost of living rises over time, but so do property values and rental income. Unlike cash savings that lose value, real estate appreciates, maintaining purchasing power. The National Home Price Index vs. CPI Inflation Rate chart below shows how home prices (blue line) have historically outpaced inflation (red line), demonstrating real estate’s effectiveness as an inflation hedge.

Owning real estate preserves wealth in an inflationary economy.

3. Diversification

Adding real estate reduces reliance on stocks and bonds.

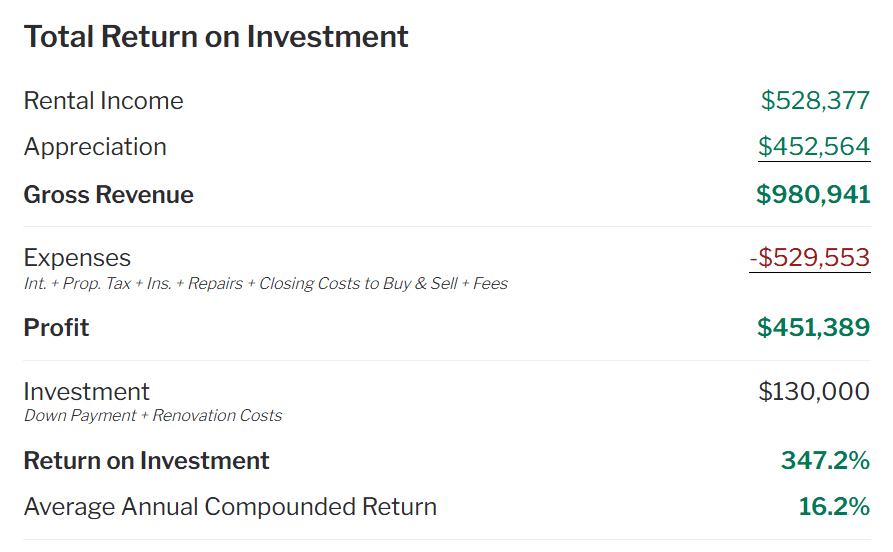

A portfolio too dependent on market-based investments is vulnerable to downturns. Real estate provides a non-correlated asset, offering stability when stocks decline. The Total Return on Investment chart below highlights the long-term benefits, showing a 347.2% ROI and a 16.2% average annual compounded return from rental income and appreciation.

Diversification strengthens financial resilience in retirement.

By incorporating real estate, retirees can improve their Funded Ratio, ensuring their assets outlast their expenses and providing long-term financial peace of mind.

Reach out to us and request your FREE investment report. Let us know a county, city, or zip code you’re interested in and we’ll send over the report for you to review.