Deciding when to buy a home is tricky, but waiting for lower mortgage rates could cost you more in the long run.

1. Mortgage Rate Decreases Are Boosting Affordability

Mortgage rates have recently dipped, improving overall affordability for buyers.

For the first time since 2021, national affordability is on the rise, giving prospective homeowners more buying power. If mortgage rates drop to 6% by year-end, paired with moderate house price increases and steady income growth, affordability could jump by 7%. This positive trend is expected to continue, with many experts forecasting even lower rates by 2025, improving affordability further.

If rates continue to decline, more buyers will benefit from improved affordability.

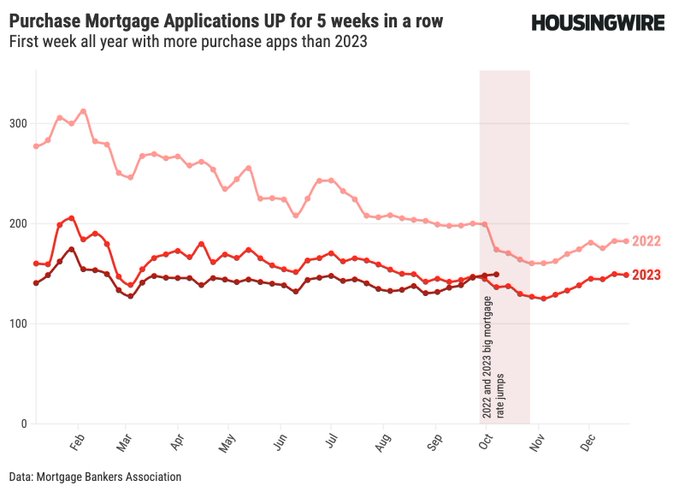

Rising Mortgage Applications, Better Than Last Year:

2. Buyers Want Rates Below 6%

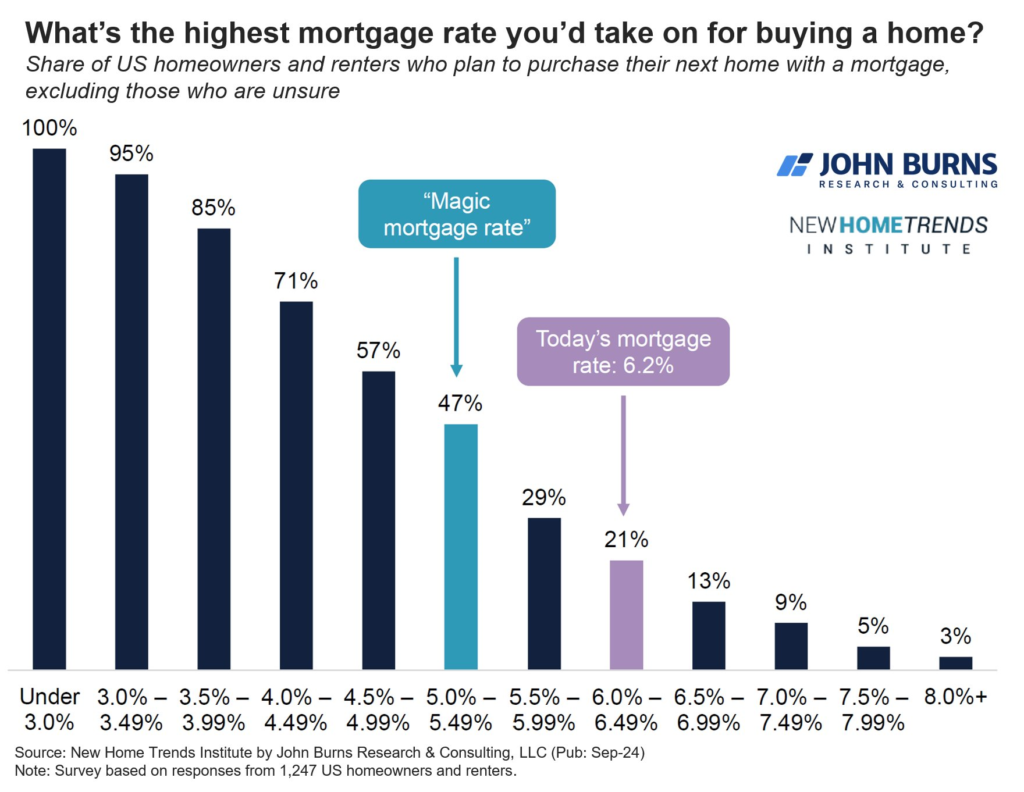

Many buyers are holding off for mortgage rates that start with a 5.

According to a recent survey of over 1,200 renters and homeowners, buyers are waiting for rates to hit the 5% range before reentering the market. This sentiment reflects a cautious approach, as people are concerned about long-term affordability and monthly payments. This could result in a wave of buyers flooding the market once rates dip, increasing competition.

Waiting for 5% rates may put you in a more competitive market later.

What Mortgage Rate Do You Want?

3. The Cost of Waiting Could Be High

Waiting for lower rates could cost more than acting now.

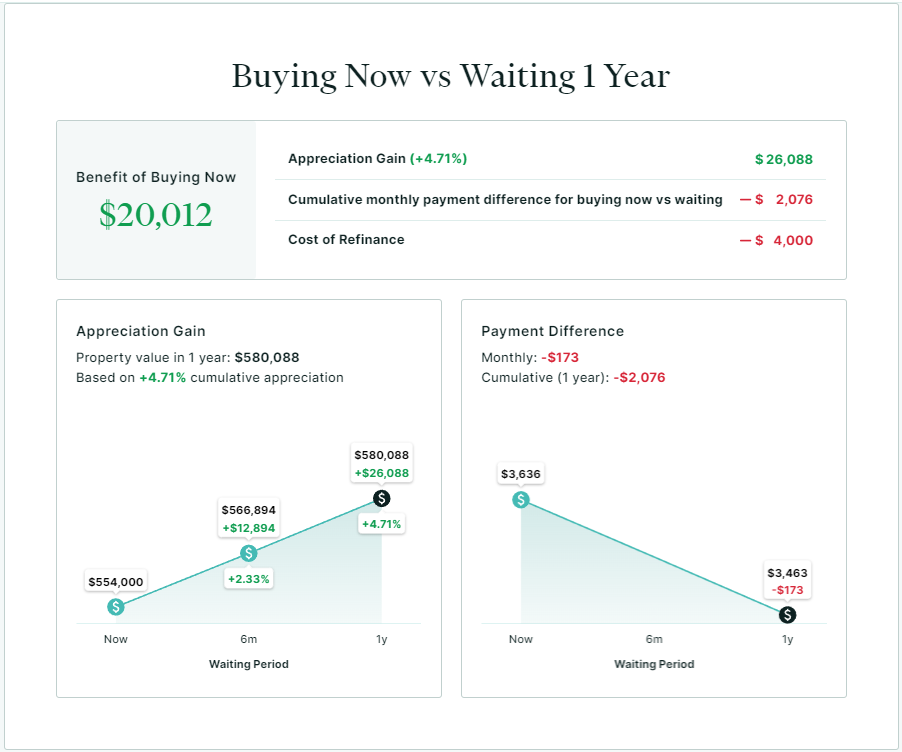

An example comparing buying now versus waiting 6-12 months shows that potential savings from a rate drop could be outweighed by increased home prices and reduced inventory. Additionally, renting longer may result in losing out on equity building and tax benefits that come with homeownership.

Buying sooner may save more in the long run than waiting for a slightly lower rate.

Here’s How Much Waiting To Buy Will Cost You:

The best time to buy is when you’re financially ready, not when rates hit an arbitrary number.

The decision to buy a home shouldn’t hinge solely on mortgage rates. While waiting for lower rates may seem tempting, you could miss out on long-term benefits like building equity and securing a better deal in today’s market conditions. Rates may decrease, but the cost of waiting—higher home prices, increased competition, or lost equity—could leave you paying more in the end.

Ready to see how waiting could affect your specific situation? Reach out today for a FREE, personalized “cost of waiting” presentation tailored to your needs. Don’t miss your chance to make an informed decision!