Understanding the right data can make or break your home-buying decision.

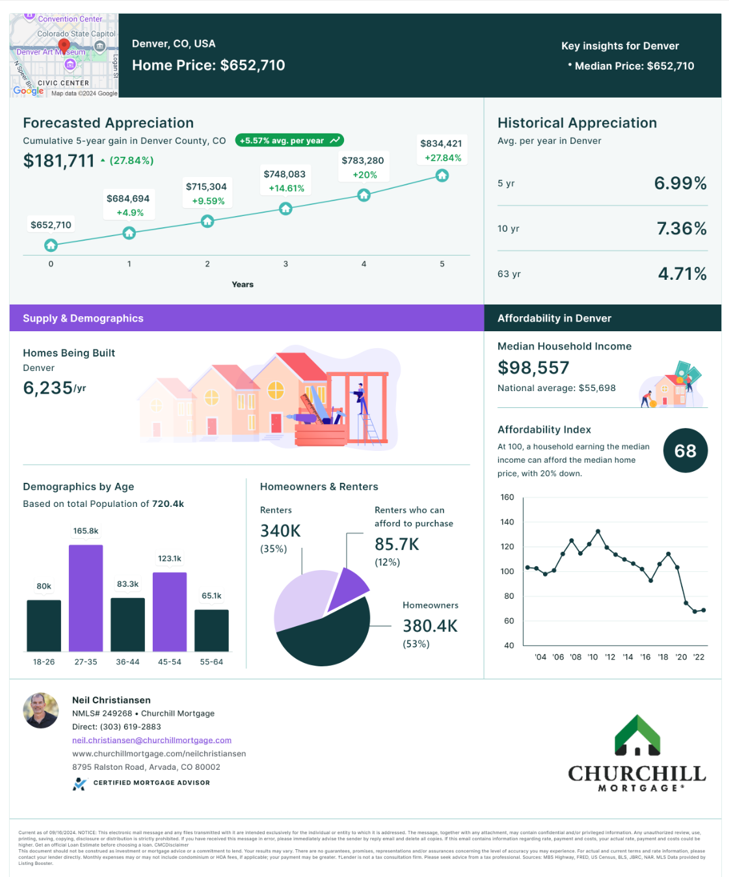

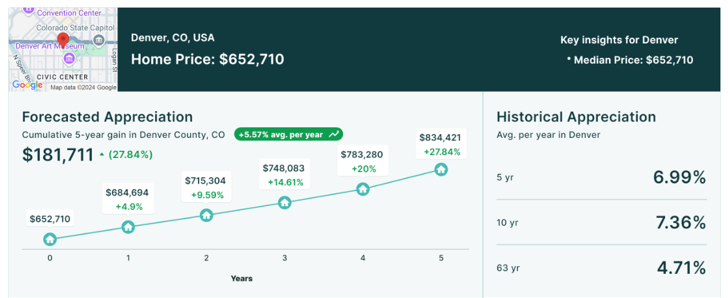

1. Forecasted and Historical Appreciation

Knowing how much a home’s value has appreciated over time is crucial.

In Denver, CO, for example, home prices are projected to increase by 5.57% per year, raising the median price from $652,710 to $834,421 over five years—a $180,000 jump! Historical appreciation numbers back this up, showing increases of 6.99% over 5 years, 7.36% over 10 years, and 4.71% over 63 years. These figures show that understanding both past and future trends is essential to making a smart investment.

Appreciation matters because it defines long-term equity growth.

Appreciation:

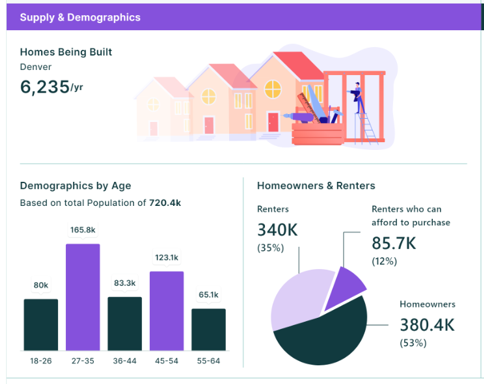

2. Supply and Demographics

A key factor in home price trends is supply versus demand.

In Denver, 6,235 new homes are built annually, but with a population of 720,000 and rising, the demand far outpaces supply. Plus, many renters in the area can afford to buy at today’s prices, further increasing competition. This imbalance ensures that price appreciation remains strong, making it important to get ahead of the curve.

Home availability and population shifts directly impact future prices.

Home Inventory and Demand:

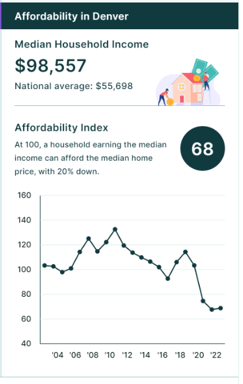

3. Affordability

Affordability is the bottom line for most buyers.

Denver’s affordability index sits at 68, meaning 68% of those earning the median income can afford the median-priced home with 20% down. If the index were at 100, home prices would be in line with income levels. This gap highlights affordability challenges, and understanding this figure helps buyers determine what they can truly afford in a hot market.

Affordability determines whether your dream home is within reach.

Affordability Index:

Your personalized real estate report card can provide clarity on these key factors. If you’d like one, feel free to reach out, and I’ll send it your way!

The Complete Real Estate Report Card: