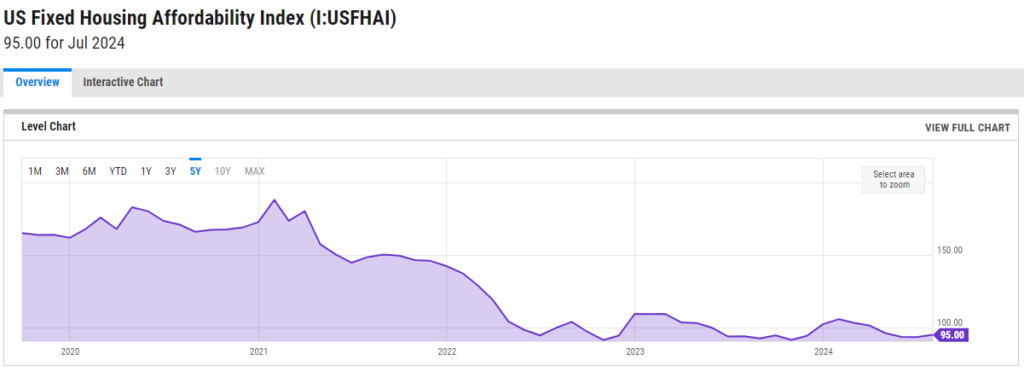

As of July 2024, the US Fixed Housing Affordability Index has fallen below 100, signaling that fewer Americans can afford real estate using the country’s median income.

US Fixed Housing Affordability Index:

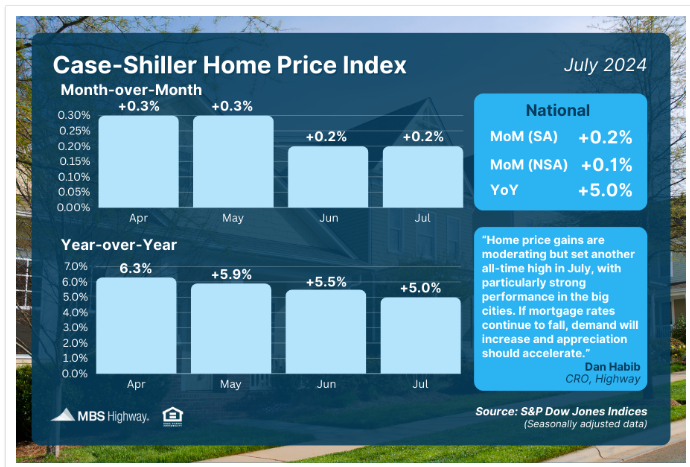

Meanwhile, the Case-Shiller Home Price Index shows a 5% year-over-year increase in home prices.

Case-Shiller Home Price Index, July 2024:

With mortgage rates dropping, increased demand could push prices even higher, making it crucial for both new and existing homeowners to follow a solid financial plan.

1. Save $1,000 for Emergencies

Without a basic emergency fund, unexpected expenses can derail your real estate goals.

Begin by saving $400 and setting it aside in a separate account for emergencies like car repairs or medical bills. Data from SmartAsset reveals that 52% of Americans struggle to cover a $1,000 emergency expense. By prioritizing this fund, you reduce the risk of relying on credit cards or loans to handle sudden costs. Over the next 6-12 months, gradually build it up to $1,000. This cushion will provide peace of mind and financial stability, allowing you to focus on larger financial goals.

A small emergency fund is the foundation of long-term financial health.

Step #1:

2. Reduce and Eliminate Consumer Debt

Debt limits your ability to afford housing and build wealth.

The total U.S. household debt has reached a staggering $17.8 trillion, according to the Federal Reserve Bank of New York. To free up more income for housing, use the Debt Snowball method—paying off debts from the smallest to the largest. With each debt cleared, you’ll see small wins that keep you motivated while reducing the overall burden. Clearing debts not only improves your financial health but also strengthens your home-buying power by improving your credit score and freeing up monthly cash flow.

Debt elimination frees up income for your future home purchase.

Step #2:

3. Save 3-6 Months of Living Expenses

A well-stocked savings account is your safety net in uncertain times.

Once your debts are under control, focus on saving 3-6 months of living expenses. Begin by calculating your monthly budget, then slowly accumulate enough to cover housing costs, groceries, utilities, and essentials. This safety net will protect you in case of job loss or an unexpected expense larger than $1,000. A strong savings account is critical to avoiding financial pitfalls like dipping back into debt, ensuring you are well-prepared for homeownership.

With these savings, you can weather financial storms and stay on track.

Step #3:

By following these steps, you’ll be equipped to manage rising home prices and secure the home of your dreams.

Download “Your Guide to a Mortgage Down Payment” to learn how to save for your home purchase today.