The data doesn’t lie: despite media noise, housing fundamentals remain strong—and waiting to buy could cost you thousands.

1. Zillow Market Heat Index: Sellers Still Hold an Edge

The latest Zillow Market Heat Index shows Denver, CO slightly favoring sellers.

This means demand is still strong, and homes are moving. For homebuyers, this is an early sign that pricing pressure isn’t going away. Even if it’s not a red-hot market, a seller’s edge signals underlying strength—not collapse.

Buyers waiting for a crash may be waiting for something that simply isn’t happening.

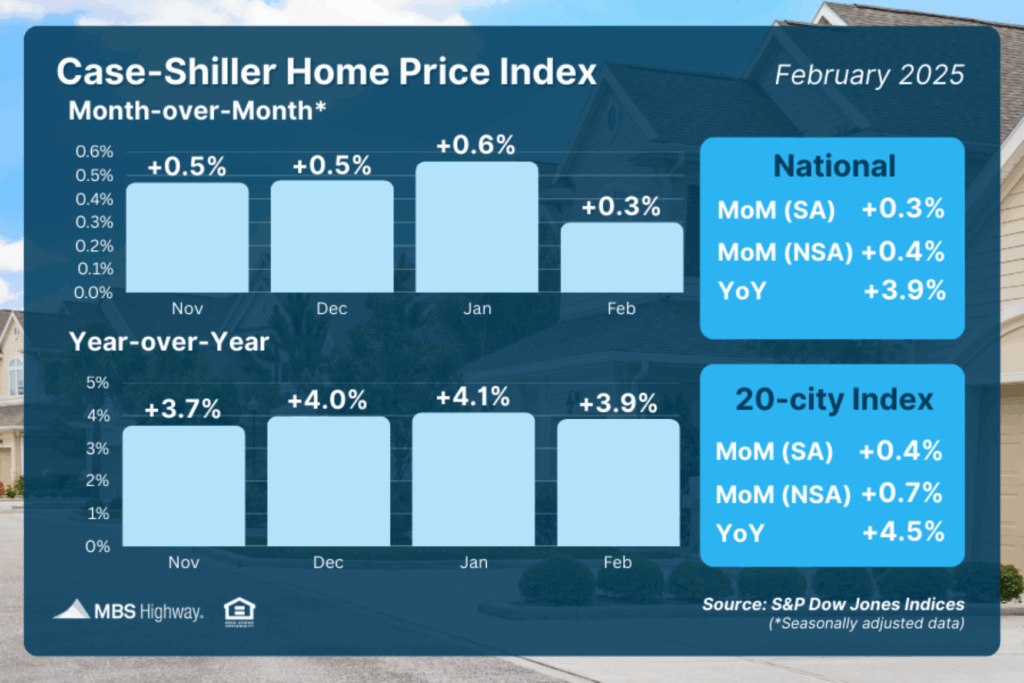

2. Case-Shiller Index: Home Prices Are Still Growing

National home prices are still increasing between 3–4% year over year—even amid high rates.

That level of appreciation might seem slow, but over five years it adds up to real wealth. A $500K home appreciating just 3.5% annually would grow over $93K in value. Housing is playing the long game.

Staying on the sidelines could mean missing out on major equity growth.

3. Mortgage Rates: Declining With More Room to Fall

We’re now coming off the 52-week mortgage rate highs—and forecasts show even better news.

According to Fannie Mae, mortgage rates are expected to drop steadily from 6.5% in Q2 2025 to 6.0% by Q4 2026. That’s a downward trend buyers can use to their advantage with refinancing strategies later.

Locking in a home today doesn’t mean being stuck with today’s rate forever.

The Cost of Waiting: A $25K Wealth Hit

If home values rise while rates drop, you’re still better off buying now.

In our “cost of waiting” scenario, someone who buys today versus waiting for rates to fall could build $25,000 more wealth over just a few years. That’s the combined benefit of appreciation and amortization.

Waiting often costs more than acting with a smart strategy.

The Cost of Waiting: A $25K Wealth Hit

If home values rise while rates drop, you’re still better off buying now.

In our “cost of waiting” scenario, someone who buys today versus waiting for rates to fall could build $25,000 more wealth over just a few years. That’s the combined benefit of appreciation and amortization.

Waiting often costs more than acting with a smart strategy.

You don’t need to time the market—you just need to understand it and partner with the right expert to make it work for you.

Want to see how waiting could impact your wealth?

Book your personalized Cost of Waiting presentation here