1. Navigating Demand Surge: Implications of Reduced Existing Inventory

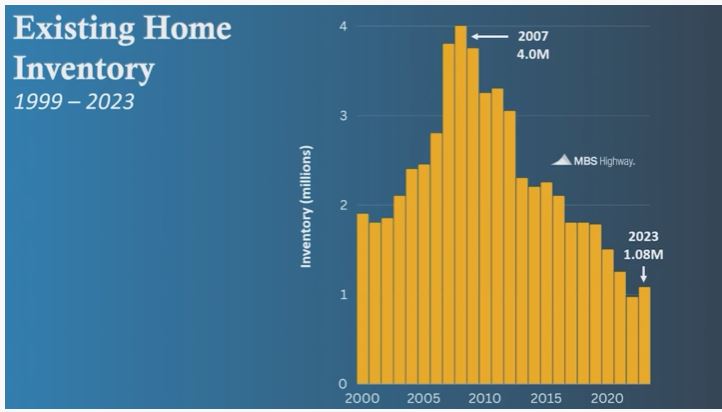

In a market characterized by approximately 1.08 million available properties (see chart below), the scarcity of existing inventory challenges the conventional notion of stability. The diminishing supply, driven by heightened demand, propels the real estate landscape into a dynamic phase, potentially leading to increased home prices. Recognizing this demand-driven shift is crucial for homebuyers and sellers aiming to navigate the evolving market.

Tip: Acknowledge that reduced inventory can result in increased competition and rising home prices, necessitating strategic approaches for both buyers and sellers.

Example: The current scenario challenges the traditional stability associated with ample inventory, highlighting the impact of demand-driven dynamics on the real estate landscape.

In Conclusion: The reduced existing inventory signals a shift towards a demand-driven market, necessitating strategic considerations for homebuyers and sellers.

2. Equilibrium Amidst Scarcity: The Role of Under-Contract Properties

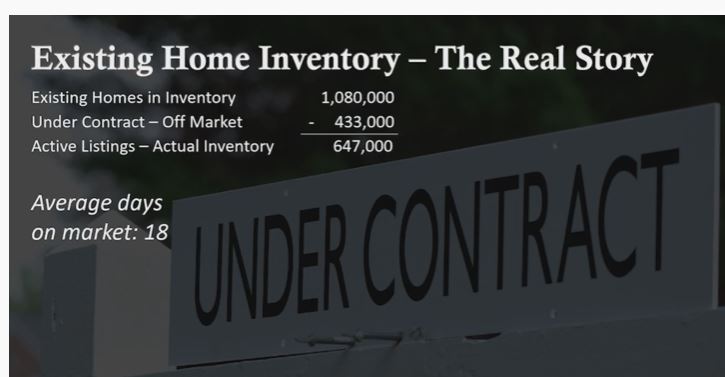

Examining properties under contract (~$433K) unveils a nuanced perspective (see chart below). Rather than achieving a traditional market balance, the scarcity of available properties, compounded by those under contract, creates an environment where demand and supply are delicately poised. This delicate equilibrium has implications for both homebuyers and sellers, presenting unique opportunities in a market characterized by scarcity.

Tip: Understand that market equilibrium, in the face of reduced inventory and under-contract properties, requires adaptable strategies for optimal outcomes.

Example: The interplay between scarcity and under-contract properties challenges the conventional idea of balance, offering opportunities for astute homebuyers and sellers.

In Conclusion: Recognizing the delicate equilibrium shaped by reduced inventory and under-contract properties unveils distinctive opportunities for homebuyers and sellers navigating the real estate landscape.

3. Population Growth: Fueling Demand

Comparing the U.S. population in 2007 (approximately 300 million) to today’s nearly 334 million emphasizes a substantial increase in demand (see chart below). The growing population contributes to the resilience of the real estate market, creating a favorable environment for sustained growth.

Tip: Align investment strategies with areas experiencing population growth for heightened potential returns.

Example: The increased population signifies a continuous demand for housing, a fundamental factor supporting the bullish outlook on real estate.

In Conclusion: A growing population amplifies the demand, reinforcing the real estate market’s strength.

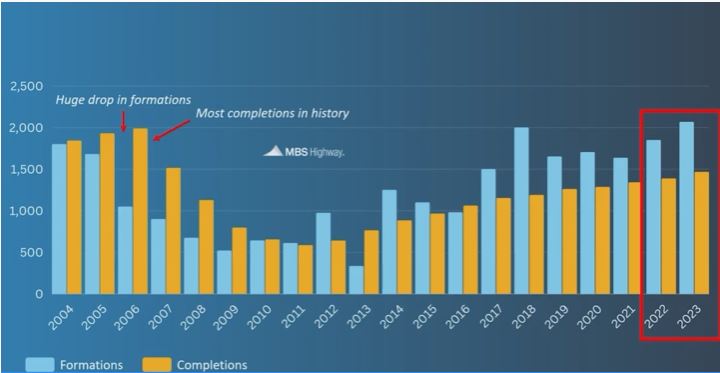

4. Household Formations vs. Home Completions: Addressing the Supply-Demand Discrepancy

The disparity between household formations (demand) and home completions (supply) further solidifies the optimistic perspective on real estate. With more households being formed than homes being completed, the market leans towards a favorable imbalance, fostering a climate of sustained demand (see chart below).

Tip: Focus on regions experiencing a lag in home completions relative to rising household formations.

Example: The supply-demand gap points towards investment opportunities, especially in areas witnessing rapid household formations.

In Conclusion: The growing misalignment between household formations and home completions underscores the enduring strength of the real estate market.

Encouraging Takeaway:

In navigating the real estate landscape of 2024, understanding the nuanced indicators of declining inventory, under-contract impact, population growth, and the supply-demand discrepancy empowers investors to make informed and bullish decisions. The data-driven approach provides a solid foundation for capitalizing on the robust potential within the real estate market.