The “marry the house, date the rate” mindset is leading too many buyers into financial instability.

1. Budgeting on Teaser Rates Is Risky

Short-term savings can hide long-term pain.

Buyers enticed by 2/1 buydowns often set budgets based on the reduced initial payment. This ignores the inevitable payment shock two years later. For example, someone starting at 5.25% (2/1 buydown) may see their rate rise to 7.25%, adding hundreds to their monthly payment. Budgeting for a temporary discount is not a strategy — it’s a gamble.

Smart buyers plan for the full-term rate from day one.

2. Refinancing Isn’t a Sure Thing

Assuming rates will drop is speculation, not strategy.

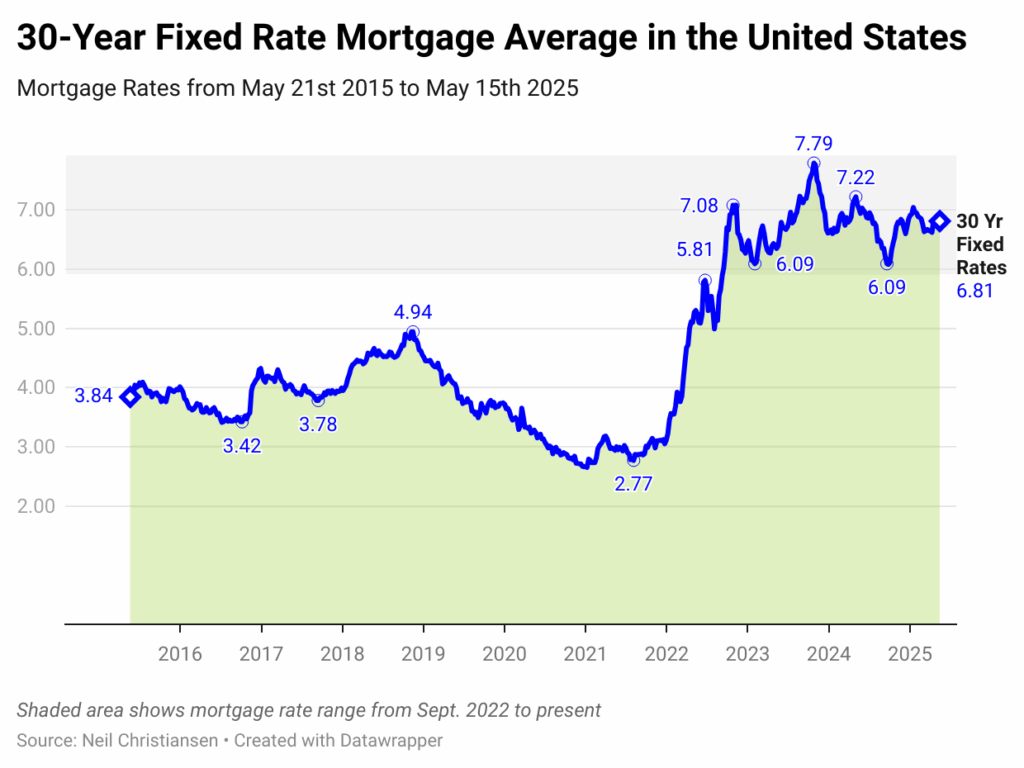

Look closely at the shaded section of the chart — from Sept. 2022 to today — and you’ll see rates have hovered in a tight range between 6% and nearly 8%. Buyers who purchased in late 2022 or 2023 expecting to refinance are either already at their final buydown rate, or about to be. Many are discovering that refinancing isn’t feasible, locking them into higher payments.

A plan based on “if rates drop” leaves too much to chance.

3. Stability Outperforms Optimism

Long-term affordability protects your future.

Even as a mortgage professional, I’ve structured 2/1 buydowns — but only when clients clearly understood and could afford their final rate. Those who budgeted for the full 6.875% rate are in a stronger position than those who relied on a future refinance. Today, peace of mind comes from preparing for the full picture.

Sustainable affordability should always beat speculative savings.

4. Real Data Confirms It

Let the numbers do the talking.

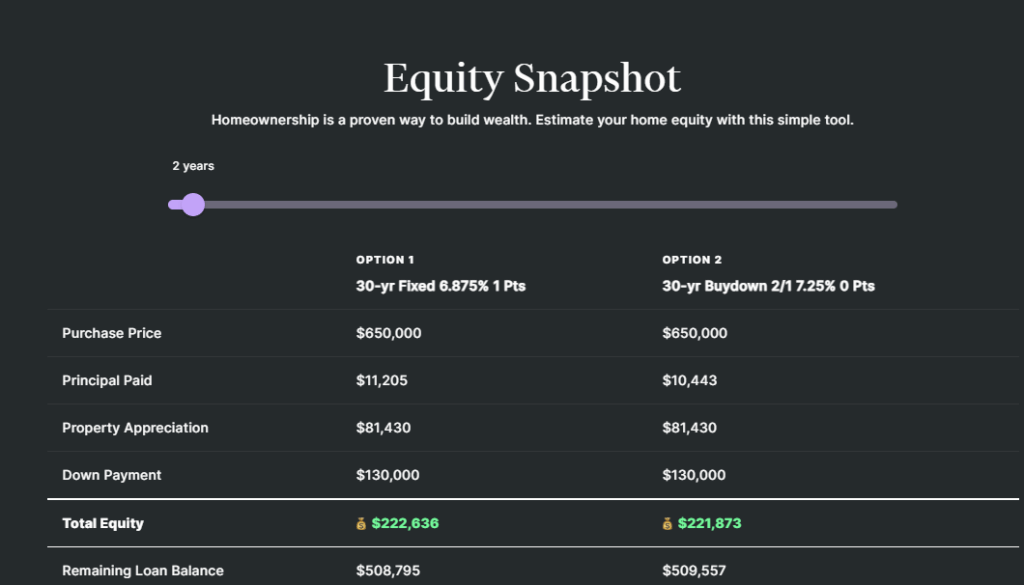

Two buyers purchase the same $650,000 home. One uses a 30-year fixed at 6.875%; the other opts for a 2/1 buydown ending at 7.25%. After two years, their equity is nearly identical: $222,636 vs $221,873. But only one has predictable payments and no looming increase.

Temporary savings rarely outweigh long-term clarity.

Encouraging Takeaway:

Rates haven’t dropped in three years. They may not drop anytime soon. Help your clients fall in love with the home and be confident they can afford the real rate — because if they can’t refinance, they’ll need to ride it out.