The Great Financial Crisis (GFC) was an outlier when it comes to home prices during recessions, and today’s market is a different story altogether.

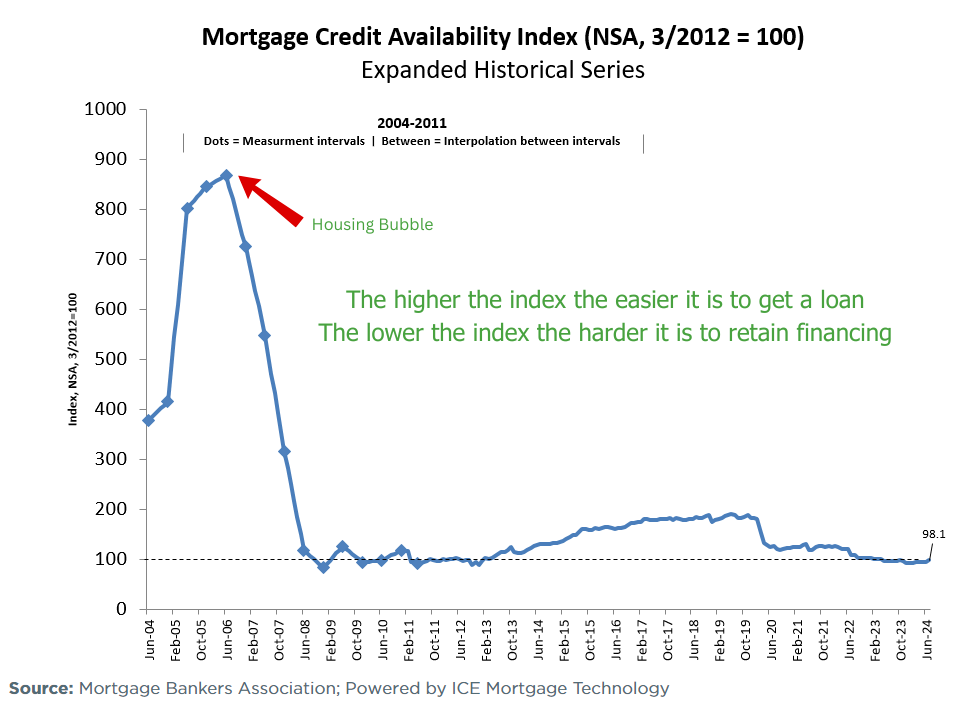

1. Credit Standards

Before the GFC, getting a mortgage was almost as easy as fogging a mirror.

Lending standards were incredibly loose, with banks approving mortgages for borrowers who lacked solid creditworthiness. In contrast, today’s credit environment is much tighter, with only qualified buyers able to access financing. This shift has reduced the risk of widespread defaults that flooded the market with distressed properties during the GFC. Stronger credit standards help sustain price stability, even in downturns.

Credit Lending Standards: Financing Is Much Tighter Today vs GFC

Tighter lending protects the housing market from massive sell-offs.

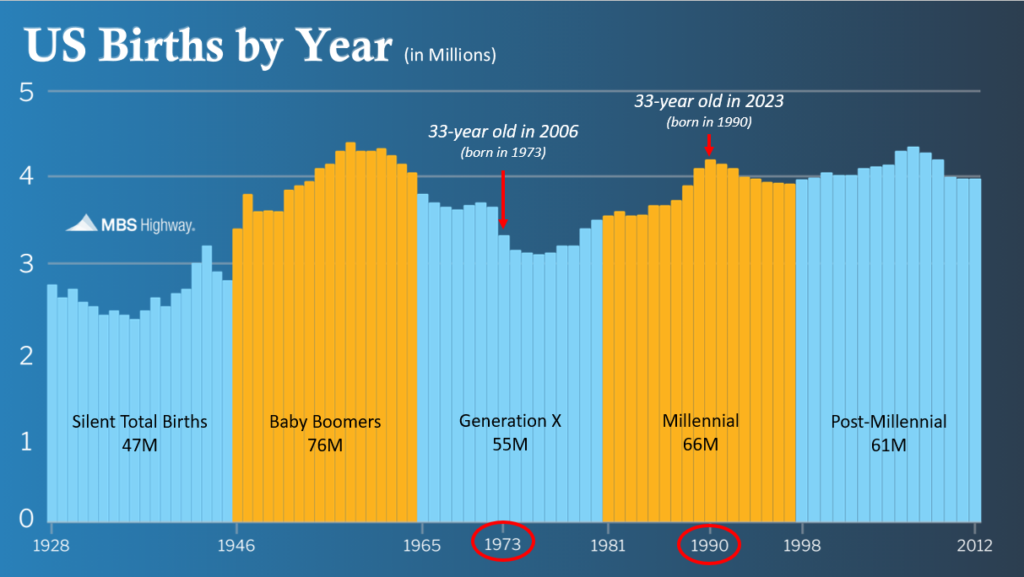

2. Supply and Demand Imbalance

The GFC saw an oversupply of homes with not enough demand.

During the early 2000s, builders constructed more homes than Generation X, the primary home-buying demographic, could absorb. This mismatch of supply and demand contributed to the sharp drop in home prices. Today’s market is very different: Millennials, a much larger demographic, are reaching peak home-buying age, driving demand far above available supply.

Generation X vs Millennials: The Difference in Demand!

Demographic demand is now pushing prices up, not down.

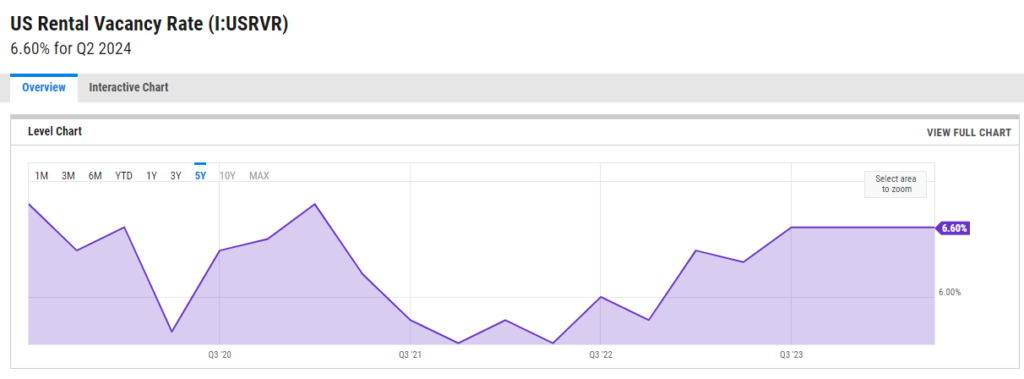

3. Low Vacancy Rates

Current vacancy rates are half of what they were during the GFC.

Back then, vacancy rates skyrocketed to 13%, fueled by speculative investors and overbuilding. Many had to sell at a loss, dragging prices down. Today, even though vacancy rates have slightly risen to 6.6%, they remain well below the levels that caused widespread price collapses during the GFC.

Low Vacancy Continues to Keep Home Prices Stable:

w vacancies create market stability and price resilience.

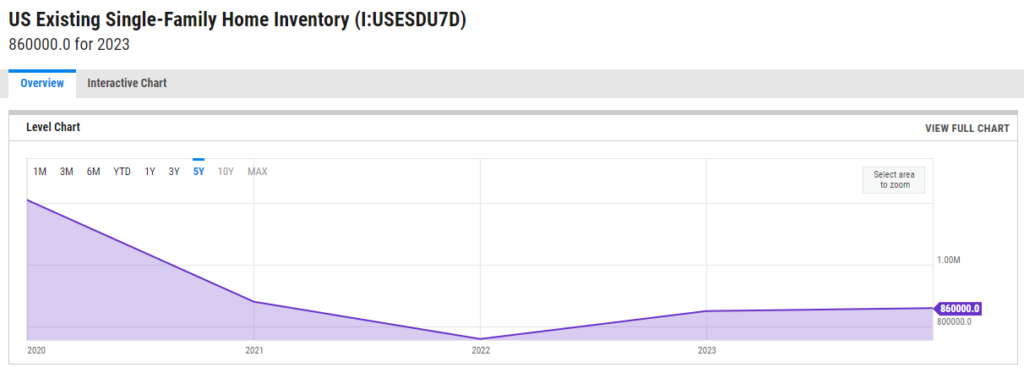

4. Inventory vs. Household Formations

The number of homes available today is far below what’s needed to meet demand.

Existing Single-Family Inventory:

Household formations are outpacing new inventory, creating a shortage of available homes. This contrasts with the GFC, where inventory flooded the market, which ensures that prices are more likely to stay stable or even rise, even in an economic downturn.

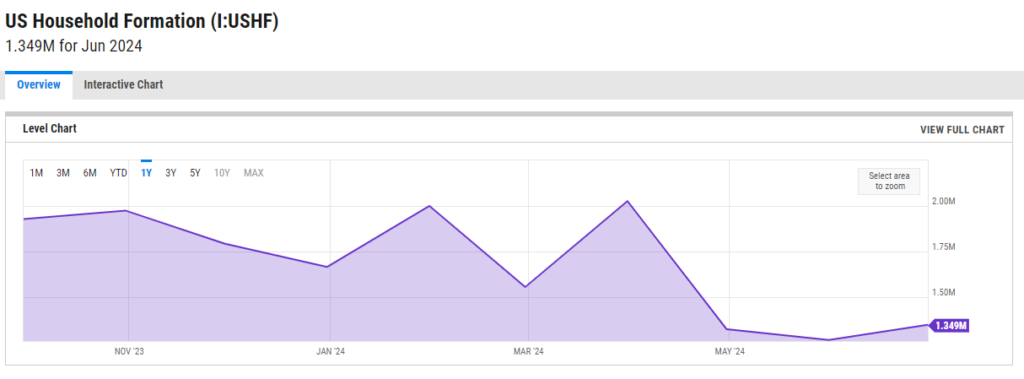

Household Formations:

This scarcity keeps home prices supported, despite recessionary pressures.

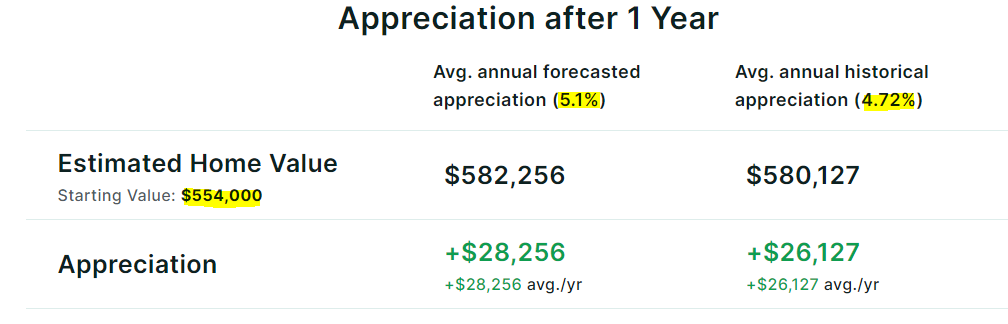

Buying a home today can still be a solid wealth-building strategy. I’ve included a simple but powerful example of how much one could receive in equity in just 1 year –

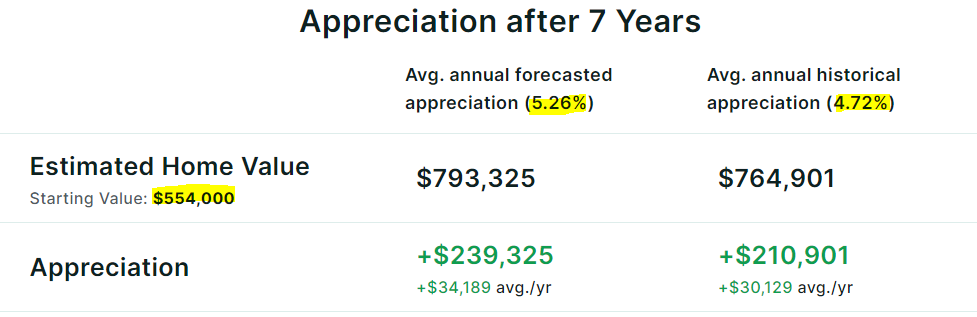

And 7 Years:

In both examples when the assumption is approximately 5% in home appreciation the amount of equity a homebuyer could earn is substantial. In just 1 year one could increase their net worth by almost $29K and over 7 years the numbers look even better earning between $200K-$240K!

A recession might slow the overall economy down but real estate tends to be a good alternative investment, both short and long term.