Home equity is one of the most powerful financial tools for homeowners, but many underestimate its potential.

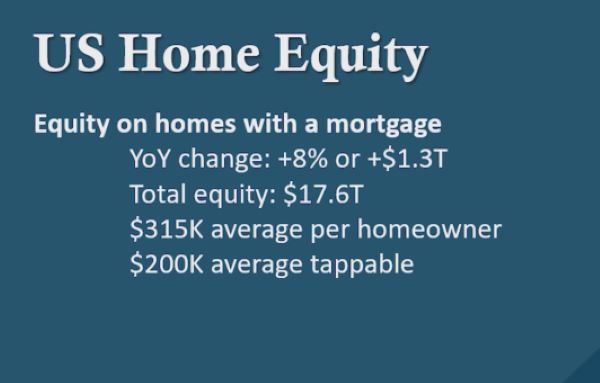

1. Year-Over-Year Equity Growth is Booming

In just one year, homeowners with mortgages have seen their home equity grow by 8%, adding a staggering $1.3 trillion to their wealth.

The average homeowner now holds $315,000 in total equity, with $200,000 of that being “tappable” — meaning it’s available to use for debt consolidation, home improvement, or even boosting retirement savings. For many, this could be the key to paying off high-interest debt or increasing the value of their home.

Homeowners have more financial flexibility than they think:

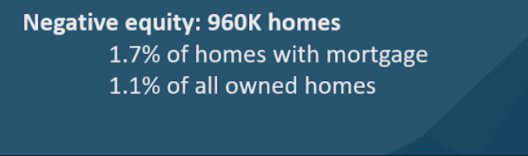

2. Negative Equity is Rare

Only 960,000 homes, or 1.7% of homes with a mortgage, are underwater, meaning the mortgage balance is higher than the home’s value.

That’s just 1.1% of all homes in the U.S.Despite the small percentage, it’s crucial to stay mindful of the housing market and avoid borrowing too much against your home, ensuring your equity continues to grow rather than diminish.

Most homeowners are in a strong equity position:

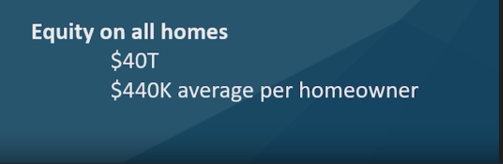

3. Total Equity in All U.S. Homes is $40 Trillion

Across all U.S. homes, equity has reached an astounding $40 trillion, with the average homeowner sitting on $440,000 of equity.

This includes both mortgaged and paid-off homes. Whether you own your home outright or still have a mortgage, you’re likely sitting on a significant asset that can transform your financial future.

Home equity is a wealth-building engine:

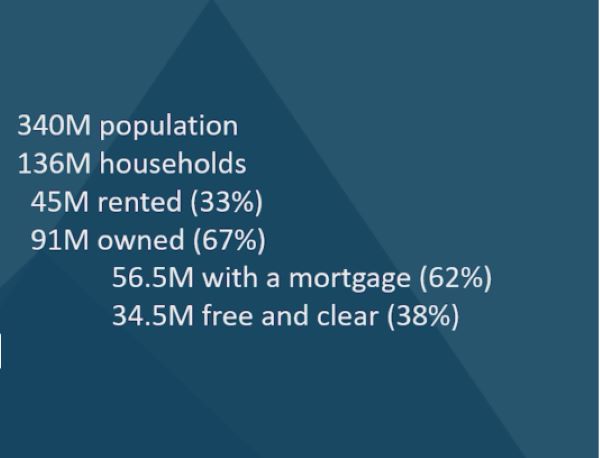

4. More Than Half of Homeowners Have a Mortgage

Out of 91 million homeowners, 57 million (62%) have a mortgage, while 35 million own their homes free and clear.

This split reflects the reality that most homeowners are still paying off their homes, but the 38% who are mortgage-free have unlocked the full potential of their home’s equity. If they choose to tap into that equity, it would create a new mortgage payment, but the ability to access that capital opens up financial opportunities for things like debt reduction or investment.

Owning your home outright gives you options, but tapping equity requires careful planning:

Imagine a homeowner who taps into $50,000 of their home equity to pay off credit card debt with a 20% interest rate. Not only would they reduce their monthly payments, but they would also save thousands in interest, freeing up cash for retirement savings or other investments.

Using home equity wisely can dramatically improve your financial future.