Rising consumer debt is eating away at homeowners’ ability to build wealth. It’s time to put your home equity to work and take control of your financial future.

1. The Growing Burden of Non-Housing Debt

Consumer debt has reached staggering levels, with credit card balances alone sitting at $1.17 trillion—up by $65 billion in just one quarter (Q3 2024).

This mounting debt is costly, with average credit card APRs exceeding 20%. Each dollar spent on interest is a dollar that could have gone toward building wealth. Homeowners with significant equity are in a unique position to consolidate high-interest debt and redirect cash flow toward appreciating assets. Imagine paying 6-8% on a HELOC versus 20% on credit cards—it’s a game-changer.

Non-housing debt doesn’t just limit your financial flexibility; it erodes your ability to invest in your future.

2. Why HELOCs and HELOANs Are Ideal in Today’s Mortgage Market

Most homeowners today hold first mortgages with rates below 5%. Refinancing to access equity at today’s higher rates would be financially unwise.

That’s where HELOCs and HELOANs shine. These second-position products allow homeowners to tap into their equity without jeopardizing their low first mortgage rates. For example, a HELOC can help eliminate high-interest credit card debt while preserving your primary mortgage terms.

Leveraging these products ensures smarter access to cash without compromising your overall financial strategy.

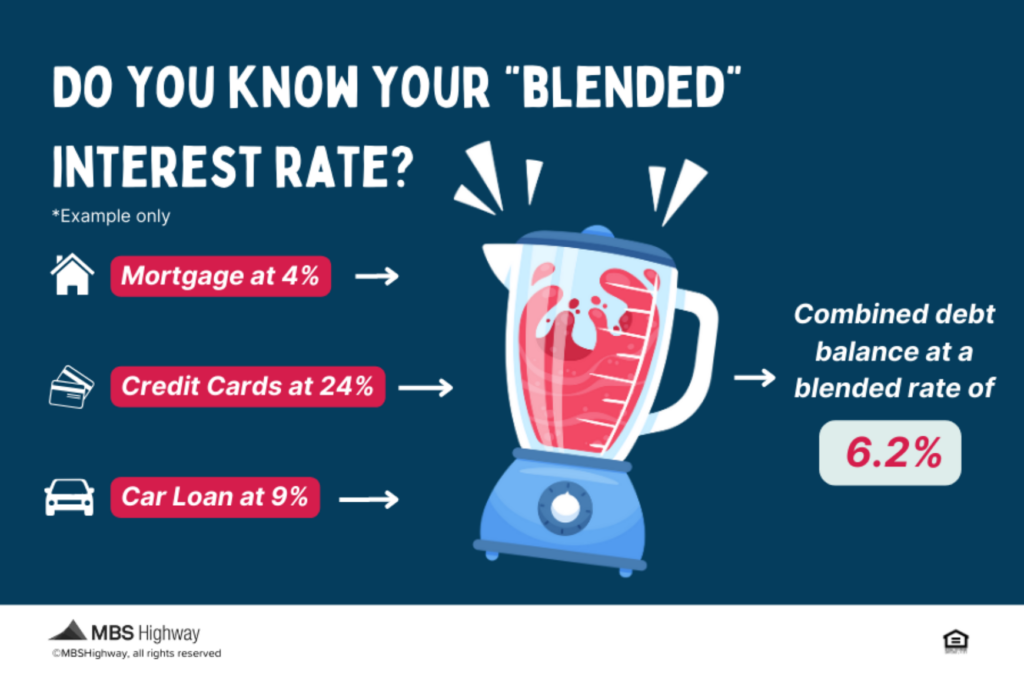

3. The Power of Calculating Your Blended Rate

Understanding your blended rate—the combined interest rate of your mortgage and other debts—is key to making informed decisions.

Let’s say you have a $200,000 mortgage at 4% and $50,000 in credit card debt at 20%. Your blended rate is much higher than your mortgage rate alone. Using a HELOC to replace the high-interest debt could significantly lower this rate, improving monthly cash flow and freeing up resources for wealth-building.

Calculating your blended rate shows the true cost of debt and reveals opportunities to optimize your finances.

4. Take Action: Get a Free Blended Rate Analysis

The first step to reclaiming your cash flow is understanding your financial picture. With our process, calculating your personalized blended rate takes less than 1 minute and can be delivered directly to you via text for convenience and quick access.

Once you see the numbers, applying for a HELOC is just as simple. The application process takes less than 5 minutes, and you can receive full approval with funds available within 5 business days.

Take advantage of this streamlined approach to improve your financial flexibility and make smarter choices with your home equity.

5. Secure Your Financial Future Today

Home equity is a powerful tool, but it’s only useful if you leverage it strategically. Consolidating debt, improving cash flow, and redirecting savings toward investments can set you on a path to long-term wealth.

Take control of your finances now—your future self will thank you.

Does this draft align with your vision? Let me know if you’d like any adjustments or additional details!