The real estate market is evolving rapidly, and understanding key trends is essential for making informed decisions. Whether you’re a real estate professional, investor, or future homebuyer, the insights below will help you navigate 2025’s housing market with confidence. From inventory levels to home price projections, these trends highlight opportunities and challenges to consider before buying or selling a home.

1. Inventory Trends and Projections

Inventory levels from 2015 to 2024 reveal critical shifts in housing availability.

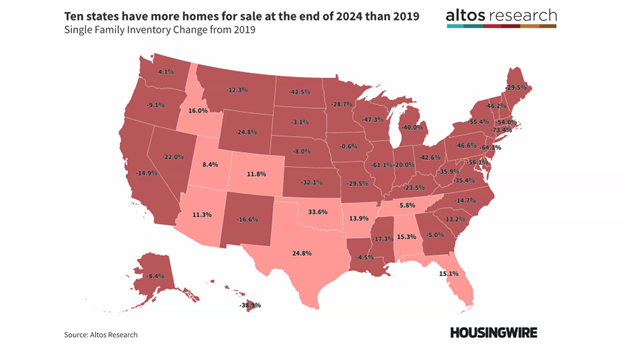

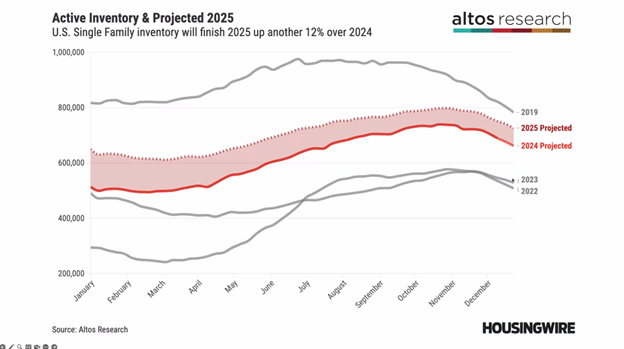

Single-family home inventory saw notable changes in 2024 compared to 2023. Some states ended 2024 with higher inventory levels than 2019, signaling potential shifts in local market dynamics (see accompanying image for details). Looking ahead, active inventory is projected to increase by 12% by the end of 2025, reflecting growing opportunities for buyers and sellers alike.

Tracking inventory shifts empowers informed decision-making for buyers and sellers.

2. Pending Contracts Show Recovery

Pending contracts for 2025 signal a growing buyer interest.

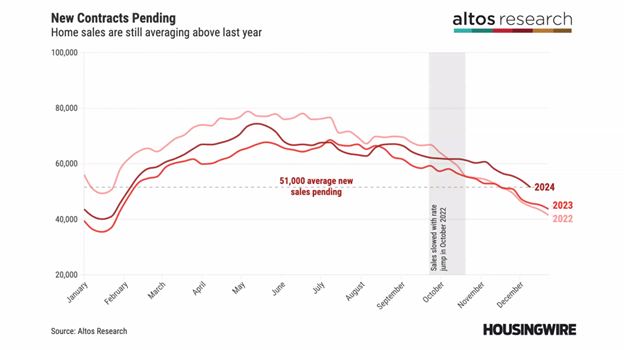

According to the accompanying image, new contracts pending in 2024 remained above both 2022 and 2023 levels, with an average of 51,000 sales pending. This consistent improvement highlights recovering buyer confidence and sustained market activity. Real estate professionals should note seasonal trends depicted in the image to anticipate and prepare for fluctuating demand throughout the year.

Pending contracts are a leading indicator of sustained demand in 2025.

3. Home Sales Growth Outlook

Home sales are set to increase steadily through 2025 and beyond.

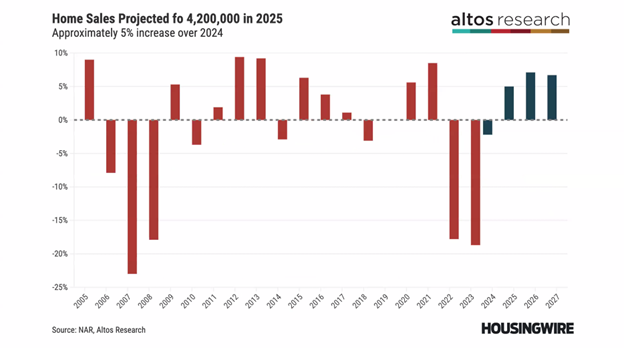

Projections for 2025 estimate 4.2 million home sales, representing about a 5% increase over 2024. Beyond that, slight but steady increases are expected in 2026 and 2027, reinforcing long-term market stability. This consistency provides reassurance for those hesitant about investing in a potentially volatile market.

Steady growth signals resilience in residential real estate.

4. Modest Price Appreciation in 2025

Expect stable home price growth as rates and economic factors align.

While home prices are expected to rise only slightly in 2025, this stability reflects a balancing act between mortgage rates (likely in the mid to upper 6% range) and a relatively strong economy. Buyers gain from predictable pricing, while sellers benefit from a gradual appreciation of their assets.

Moderate price growth favors both cautious buyers and optimistic sellers.

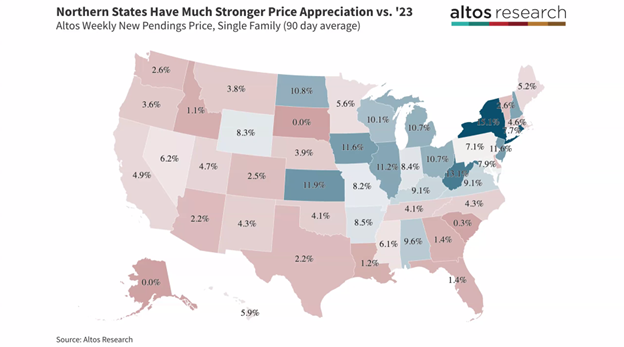

5. State-by-State Price Appreciation

Some states outpace others in home price gains.

Certain states experienced notable home price appreciation in 2024 (see accompanying regional data image). Factors such as local demand, job growth, and migration patterns contribute to these variations. Understanding these trends can help professionals tailor strategies to specific markets.

Location remains key to understanding price trends.

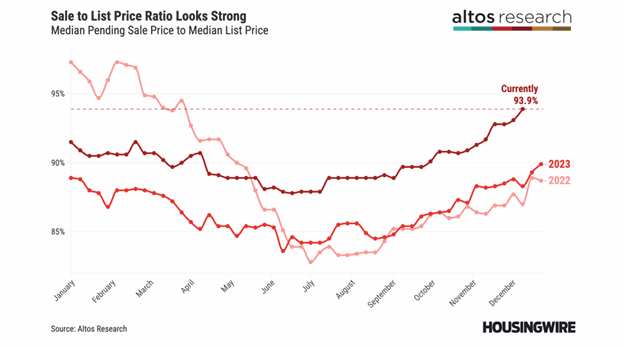

6. Sale-to-List Price Ratio Stays Strong

The 93.9% sale-to-list price ratio shows healthy market conditions.

This strong ratio reflects a balanced market where sellers can expect reasonable offers and buyers are still finding value. Sellers should focus on strategic pricing to optimize outcomes while buyers can approach negotiations with clarity.

A strong ratio indicates a balanced market in the year ahead.

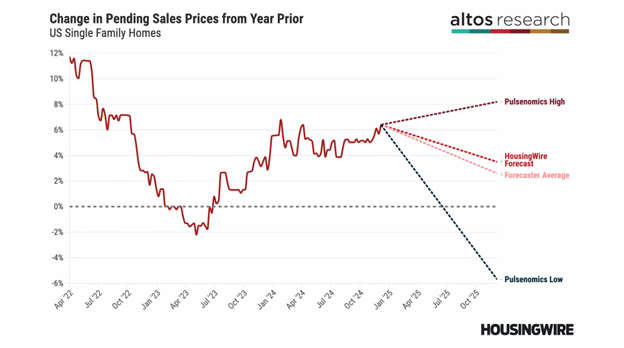

7. 2025 Price Forecasts: Optimism with Caution

National home prices are expected to rise by 2-4% in 2025.

While 2024 is closing with a 5% average appreciation, forecasts from Pulsenomics suggest a more modest gain for 2025. This tempered growth indicates a stable but cautious outlook, allowing stakeholders to plan with realistic expectations.

Slight gains suggest a healthy, stable year for real estate.

Final Takeaway

By analyzing these trends, real estate professionals, investors, and buyers can make smarter, more confident decisions in 2025’s dynamic housing market.

If you’re considering buying a home but are unsure whether now is the right time, request our Cost of Waiting analysis. This personalized report shows the financial impact of waiting to purchase versus buying now, factoring in appreciation and mortgage principal paydown. Discover how making a move today could save you money in the long run.