In today’s volatile real estate market, understanding the challenges and opportunities can make all the difference. Here’s a strategic approach to navigating the current market conditions, supported by recent data and charts.

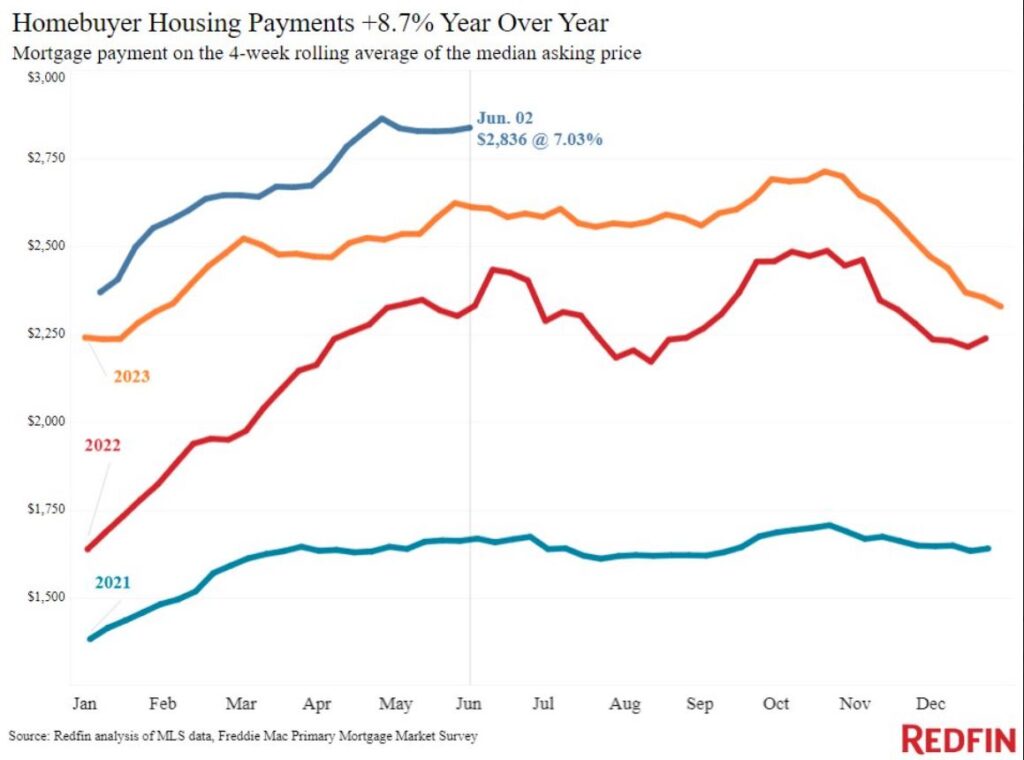

Understanding Mortgage Payment Trends

The first step is to address the rising cost of mortgage payments. Presenting the most recent chart from Redfin, which shows that year-over-year (YOY) mortgage payments are 8.7% higher than they were this time last year, is a valuable starting point. While this figure is a significant increase, it’s an improvement from the previous week’s 14.1% increase. This chart serves a dual purpose. It demonstrates awareness of the financial pressures buyers are facing and sets a tone of empathy and understanding.

Homebuyer Housing Payments Chart:

Why this is important: By acknowledging that mortgage payments are at their highest in the last four years and that housing affordability is the worst in the previous 20 years, you can better understand the stress involved in buying a home today. Recognizing these challenges helps build a stronger, more empathetic relationship between buyers and sellers.

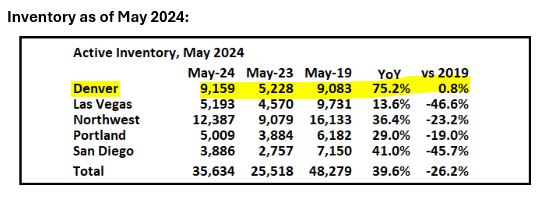

Highlighting Increased Housing Inventory

Next, consider the most recent housing inventory table, particularly focusing on May 2024. This table shows a substantial increase in inventory, at least in the Denver area.

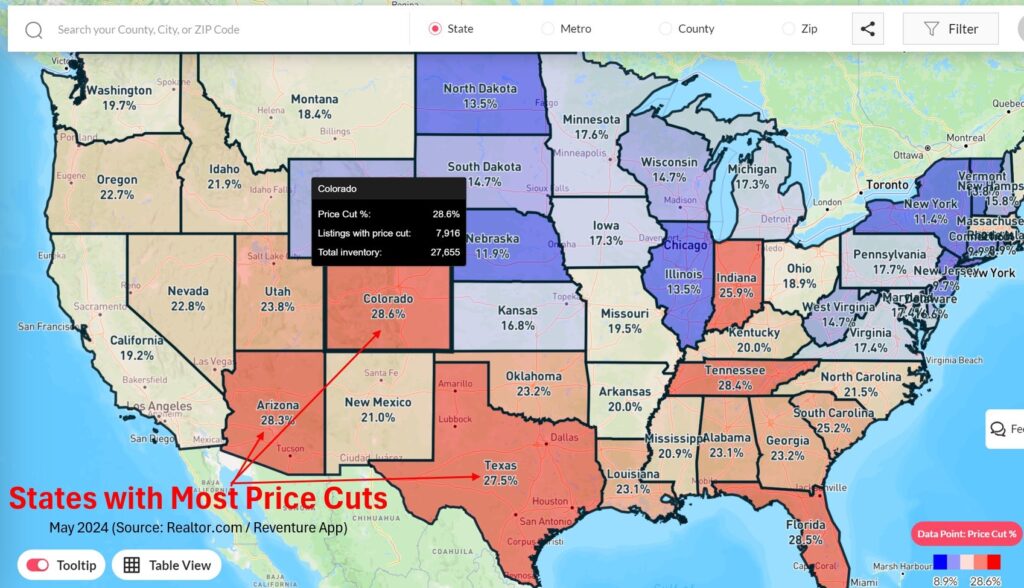

Why this matters: For potential buyers, an increase in inventory translates to more choices and potentially lower prices. This information offers hope and a sense of opportunity. It’s not just about more homes being available; it’s about a shift towards a more favorable market for buyers. This point is reinforced with a chart highlighting Colorado as a leader in price decreases nationwide.

Chart Showing States With Most Price Cuts:

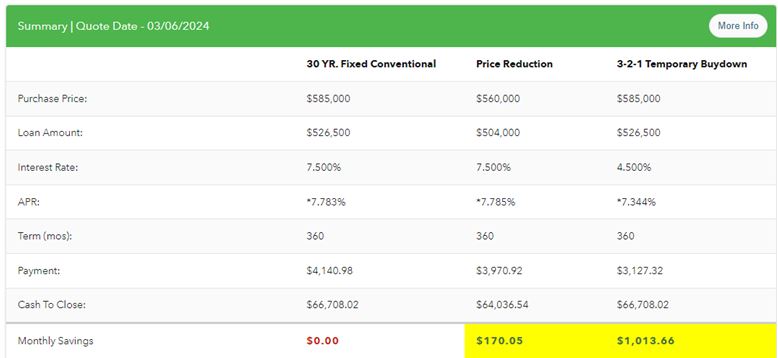

Addressing the Payment Issue

Finally, address the BIGGEST concern for most buyers: the monthly payment. Armed with the knowledge of increased inventory and potential price drops, consider a detailed TCA (Total Cost Analysis) presentation. This includes comparisons between a standard 30-year fixed loan, the impact of price reductions, and a 321 buy-down summary.

Payment Option Example:

Why this is effective: Understanding these options empowers buyers to make informed decisions. It’s not just about navigating the current market; it’s about finding solutions that make financial sense. Knowing the benefits of a 321 buy-down can be a game-changer.

By staying informed and considering all available options, you can make the best decision for your financial future. If you’re ready to explore your options and take advantage of the current market conditions, contact a trusted real estate professional today. Your journey to finding the perfect home starts with the right knowledge and support.