If you’ve been tuning in to mass media, you might think the housing market is on the verge of collapse. Diana Olick of CNBC, a long-time bear on real estate, recently highlighted a dip in existing home sales for March 2025, suggesting a growing “chill” in the market.

But let’s zoom out — because the full picture tells a very different story.

Insight #1: Prices Are Rising — Not Falling

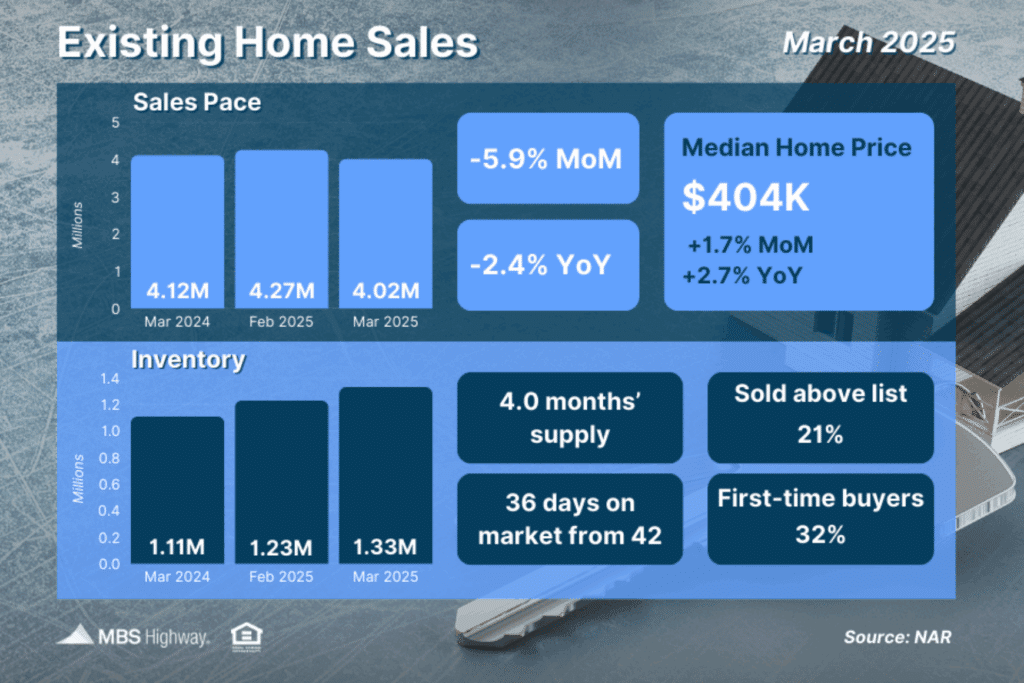

Despite fewer homes sold, the median home price rose 1.7% in March, reaching $404,000 — the highest ever for March.

This is one of the strongest monthly gains in recent years — a clear sign of ongoing demand and stability.

Insight #2: Inventory Is Still Tight

Yes, inventory increased year-over-year, but it’s still 3 million homes fewer than during the 2008 housing bubble.

This isn’t oversupply — it’s a market trying to normalize after years of extreme shortage.

Insight #3: Homes Are Selling Fast and Over Asking

Homes spent 36 days on the market, down from 42 in February — and 21% of them sold above asking.

First-time buyers made up 32% of sales, showing continued market strength from new entrants.

So while the headlines might lead with fear, the fundamentals point toward resilience.

Homeownership remains one of the most stable, appreciating assets available — especially in uncertain times.

Want to See How Homeownership Fits Into Your Budget?

Get a FREE Total Cost Analysis (TCA) report tailored to your goals.

Click here to request yours now