Homeownership is one of the most effective ways to build wealth and protect yourself from the long-term impacts of inflation.

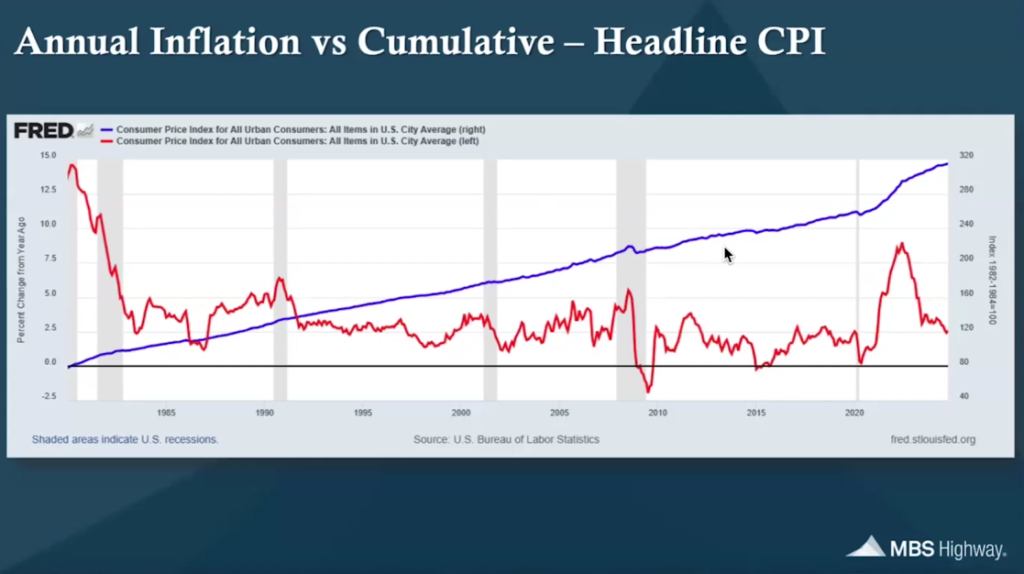

1. Homeownership Outpaces Inflation Over Time

Housing appreciates faster than inflation, making it a reliable hedge against rising costs.

The “Annual Inflation vs. Cumulative – Headline CPI” chart clearly shows that while inflation rates (red line) fluctuate, cumulative inflation (blue line) grows steadily. Home prices typically track or exceed cumulative inflation over the long term. Unlike rent, which rises with inflation, a fixed-rate mortgage stabilizes your housing costs and turns an expense into an asset.

Annual Inflation vs Cumulative – Headline CPI:

Homeownership benefits you from long-term appreciation, protecting your wealth as prices rise.

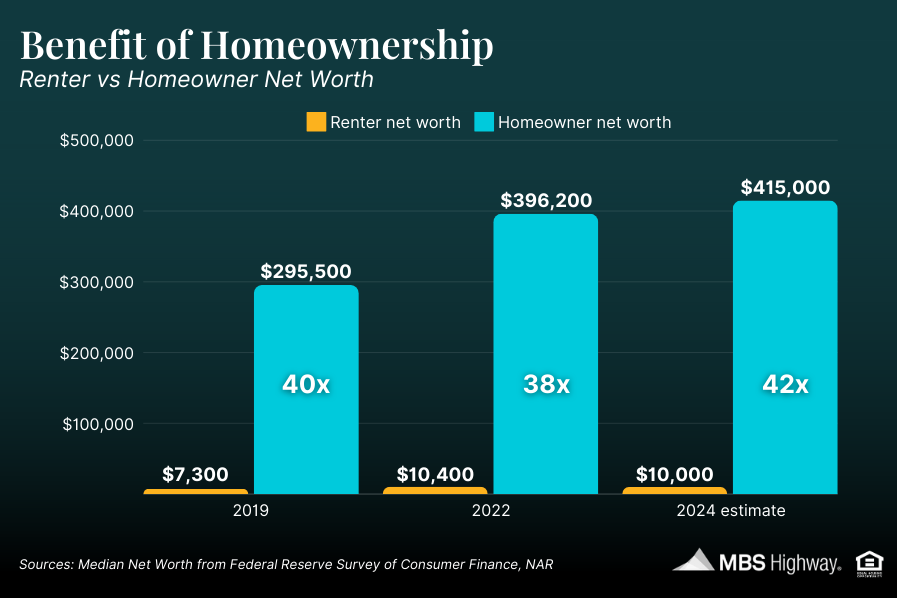

2. Homeowners Build Exponentially More Wealth Than Renters

Homeownership creates a 38-42x wealth gap compared to renting.

The “Benefit of Homeownership” chart highlights that the median net worth of a homeowner in 2024 is projected at $415,000, compared to just $10,000 for renters. This wealth accumulation comes from home equity, price appreciation, and forced savings. A mortgage payment builds your net worth, while rent pays your landlord’s.

Benefits of Homeownership:

Becoming a homeowner is the single biggest step to growing generational wealth.

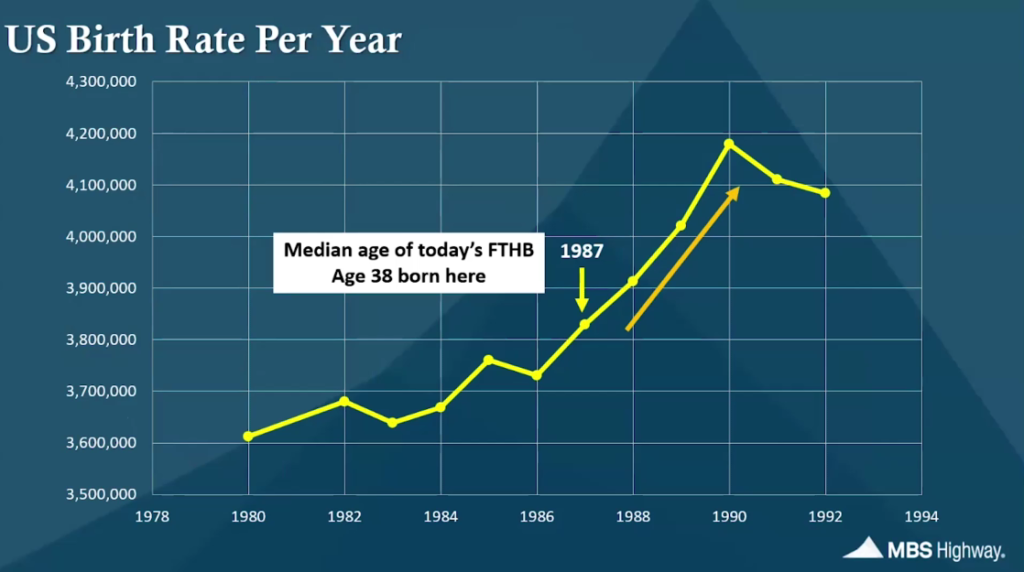

3. Rising Demand Will Sustain Home Prices

Demographics are driving additional demand for homes.

The “US Birth Rate Per Year” chart shows a peak in 1987—the average age of today’s first-time homebuyer is 38, born in that year. This means more potential buyers are entering the market now and over the next several years. Coupled with limited housing supply, demand will likely keep home prices stable or rising, even amid economic shifts.

US Birth Rate Per Year:

Investing in a home now positions you to benefit from this market dynamic.

Why a Rent vs. Buy Report is Essential

If you’re renting or debating whether renting is the better option, a personalized Rent vs. Buy report can give you the clarity you need.

This report includes:

– A side-by-side comparison of projected monthly costs for renting versus owning.

– How home price appreciation and equity can grow your net worth over time.

– Custom scenarios based on your income, savings, and market conditions.

A clear, personalized analysis can empower you to make a sound, informed decision when the opportunity to buy arises.

Homeownership is more than a place to live—it’s a strategic path to building wealth and securing your financial future. Reach out today to create your personalized Rent vs. Buy report and take the first step toward owning your future!

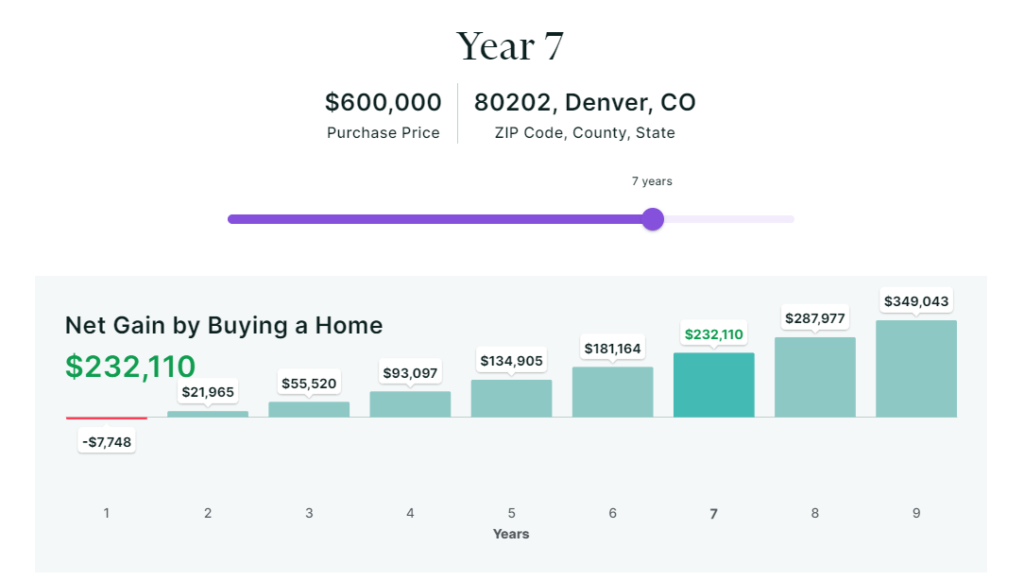

Rent Vs Buy Report Sample: