In an era where home equity stakes are as coveted as the last slice of pizza at a party, let me tell you, the saga of using this goldmine to break free from financial chains is one epic tale. Picture this: the average American homeowner’s equity is sitting pretty at a jaw-dropping $299,000, with a chunk of it just waiting to be tapped into – like a hidden treasure chest buried in your backyard (minus the pirate ship). And get this, nearly half of these homeowners are strutting around like equity-rich rock stars, with loan balances less than half the value of their homes. With negative equity taking a nosedive and underwater mortgages becoming as rare as a unicorn sighting, it’s clear that home equity is the superhero cape in the fight against financial woes. So, buckle up, because we’re about to dive headfirst into a whirlwind of financial shenanigans, where home equity takes center stage, and the laughs are guaranteed.

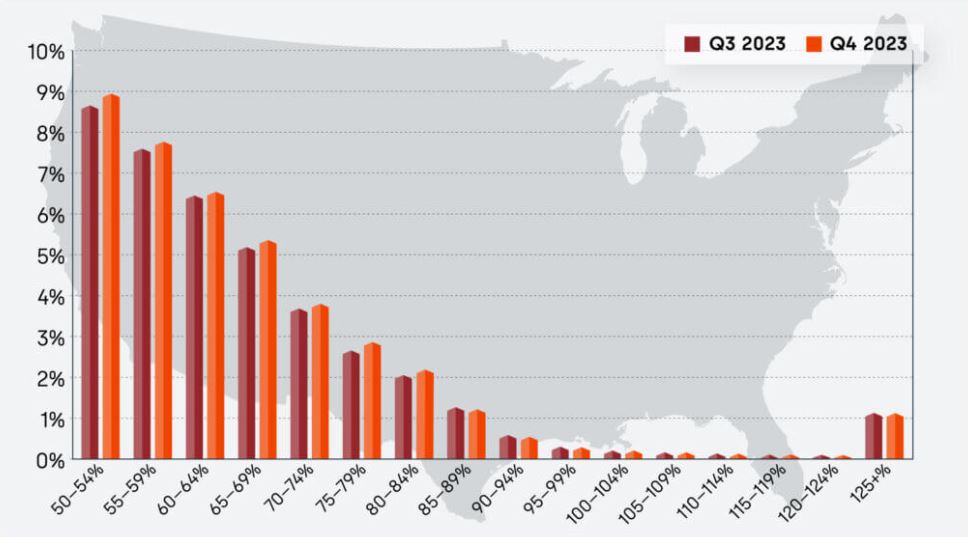

Loan-to-Value Ratio (LTV)

This chart shows national homeowner equity distribution across multiple LTV segments:

As I ventured down the winding road to financial freedom, I stumbled upon a tale that not only enlightened me but also tickled my funny bone. Picture this: my client, let’s call her Sarah, was knee-deep in the quicksand of consumer debt. It was like a bad sitcom, with interest rates playing the villainous laugh track in the background. But fear not, for Sarah wasn’t one to let life’s financial mishaps steal the show. Armed with a strategic plan and a pinch of audacity, she decided to tap into her home equity, waving goodbye to those pesky debts faster than you can say, “Lights, camera, action!”

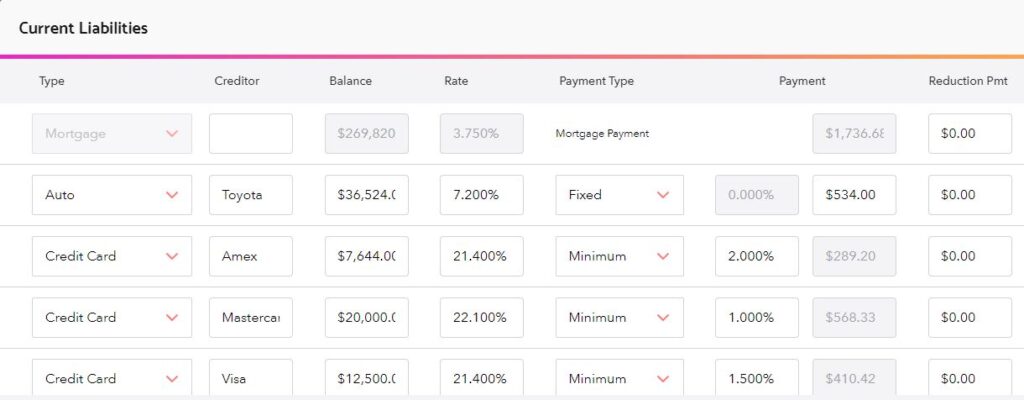

This chart shows Sarah’s current liabilities, the balances, monthly payments, and the APR of each liability:

Sarah wanted to keep her existing rate on her first mortgage, so she decided to apply for a HELOC (Home Equity Line of Credit) and eliminate all of her debts using the credit line.

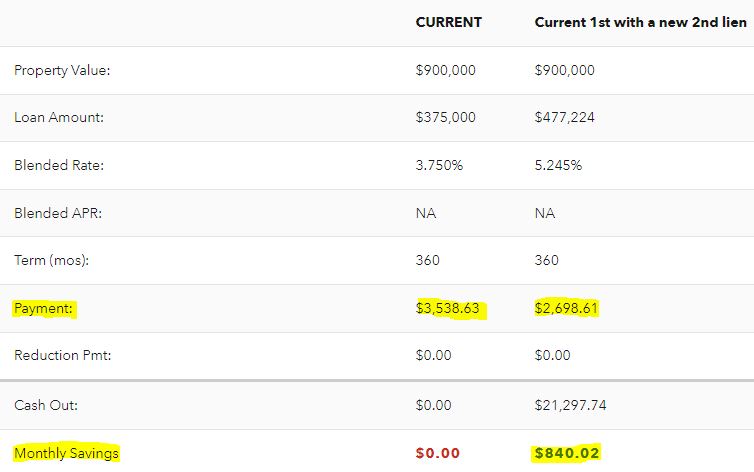

This strategy lowered her overall budgeted monthly payments (mortgage and consumer debts) by $840.02 per month:

But wait, there’s more! With her newfound financial flexibility, Sarah didn’t just kick back and relax. Oh no, she went full-on superhero mode, channeling her savings toward paying off her mortgage quicker than a cheetah on caffeine. Cue the dramatic music as years melted away from her repayment timeline, leaving traditional finance strategies in the dust.

This chart shows the debt freedom path, and how applying the savings to the mortgage can accelerate the payoff, reducing years off the mortgage term:

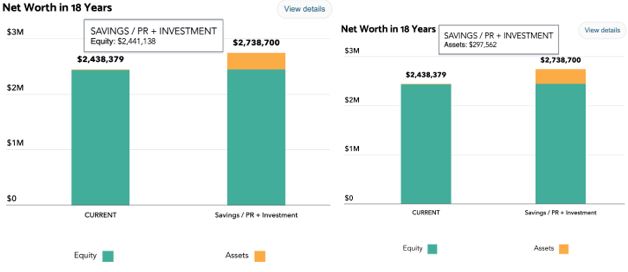

Now, here comes the plot twist. Instead of retiring to a life of financial monotony, Sarah decided to sprinkle a little magic into her investment game. She took those surplus funds and waltzed them into a risk-free, high-yield investment, like a financial fairy godmother granting wishes left and right. And guess what? The ending was better than a Hollywood blockbuster. Sarah’s net worth soared by a whopping 12%, leaving skeptics scratching their heads and financial wizards applauding her genius.

The next two charts show the 12% increase in overall net worth, from an equity and investment perspective:

So, what’s the moral of this comedic financial fable? Well, besides the fact that life’s adventures are best enjoyed with a side of humor, Sarah’s journey teaches us that with a dash of creativity and a dollop of courage, even the most daunting financial challenges can be conquered. So, grab your popcorn and settle in, because the show’s just getting started, and the laughs are guaranteed.

Ready to embark on your own financial adventure? If you’re curious to see how tapping into your home equity could transform your financial future, why not take the first step today? Reach out to us for a free consultation and personalized report, tailored to your unique circumstances. Let’s turn your financial dreams into reality – one strategic move at a time.