Homeowners can significantly improve their financial well-being by strategically managing non-mortgage debt and leveraging their assets to reduce mortgage amortization while building wealth.

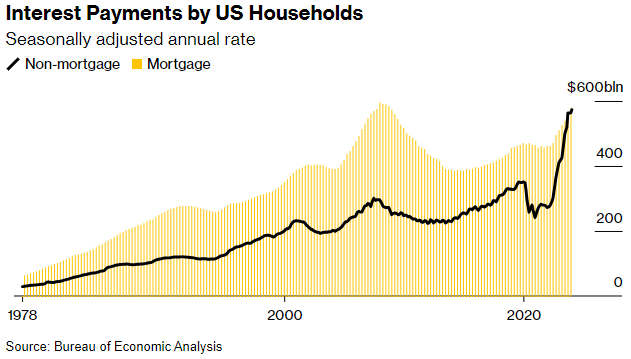

The chart below shows in the past year, interest payments by US households on non-mortgage debt reached a record high of $573 billion, nearing the amount spent on mortgage debt interest, which was $578 billion. This marks the first time non-mortgage debt interest is close to surpassing mortgage debt interest.

Managing non-mortgage debt effectively involves a multi-faceted approach. Here’s a proven 4-step framework to help homeowners crush debt, grow wealth, and reduce mortgage amortization:

1. List out all non-mortgage debts with precision: Begin by meticulously listing every non-mortgage debt, including credit cards, personal loans, vehicles, and student debt. Include the balances remaining and confirm the annual percentage rate for each. This clarity lays the foundation for effective debt management.

2. Leverage professional advice for strategic insights: Engage with a mortgage advisor or debt manager to gain insights into leveraging equity to restructure debt obligations. Their expertise can uncover opportunities that may not be apparent, potentially leading to significant savings and improved financial stability. 3. Utilize debt consolidation reports for informed decisions: Utilize debt consolidation reports to evaluate which debts should be prioritized for reduction or elimination. By consolidating debts strategically, homeowners can streamline payments, reduce interest rates, and accelerate the journey toward financial freedom.

The first chart depicts a scenario where a new mortgage is obtained without addressing any existing debts, which would prove disadvantageous given today’s mortgage rates. Conversely, the second chart illustrates a strategy where all debts are settled using available equity, resulting in substantial monthly savings.

Non-mortgage Debts NOT Being Paid Off:

Non-mortgage Debts Being Paid Off:

4. Channel savings towards mortgage reduction for long-term wealth: Strategically allocate the monthly savings from debt consolidation towards the mortgage. Calculate the overall savings in the reduction of amortization, as every additional payment contributes to long-term wealth accumulation. By optimizing mortgage payments, homeowners can expedite the payoff process and build substantial equity over time.

“What if” The Savings were Applied to the Principal:

In summary, by diligently organizing non-mortgage debts, seeking professional guidance, making informed decisions with consolidation, and directing savings towards mortgage reduction, homeowners can effectively crush debt, grow wealth, and minimize mortgage amortization, ultimately achieving financial success and security.