In today’s real estate landscape, it is important to understand all financing options when one is ready to make a move.

The real estate market shows homes sitting on the market longer than they have been for several years. When a homeowner is ready to make a move up, in some cases it makes sense to be non-contingent, meaning when an offer is made on a new property it strengthens the deal if the borrower(s) are non-contingent, or not having to sell their current residence to qualify for the new loan. This approach is a great way for the borrower to find the right house, have time to negotiate the best terms, and move into the new home with less stress.

The proven approach is a bridge loan to a permanent financing option. Let’s take the following example to show how a borrower could use this strategy.

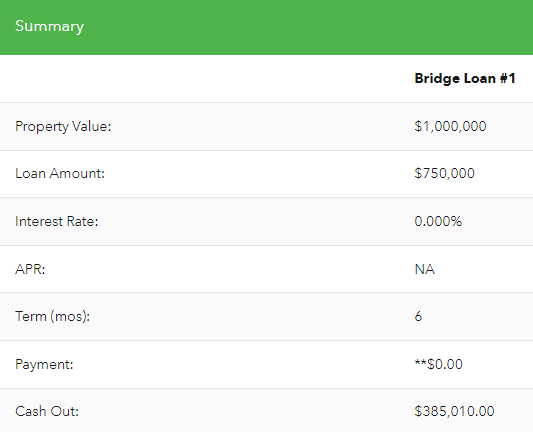

The table below shows how the bridge loan would apply to a homeowner’s current residence.

- An Automated Value Market (AVM) is determined, in this example the house was valued at $1,000,000

- The LTV guideline is 75% of the AVM, or $750,000 in this case

- 0% interest rate – 6 months of the existing PITI payment is collected and used to make the mortgage payment

- The cash-out amount is determined once all mortgage debts are paid off – this example shows the homeowner receiving $385,000+ to be used for the down payment on the new home.

The bridge loan is now in place allowing the homeowner to access the equity and use it for a new home down payment. Don’t forget the existing mortgage has been paid off, eliminating the monthly payment. The borrower can approach new properties as non-contingent.

Bridge Loan on Existing Home:

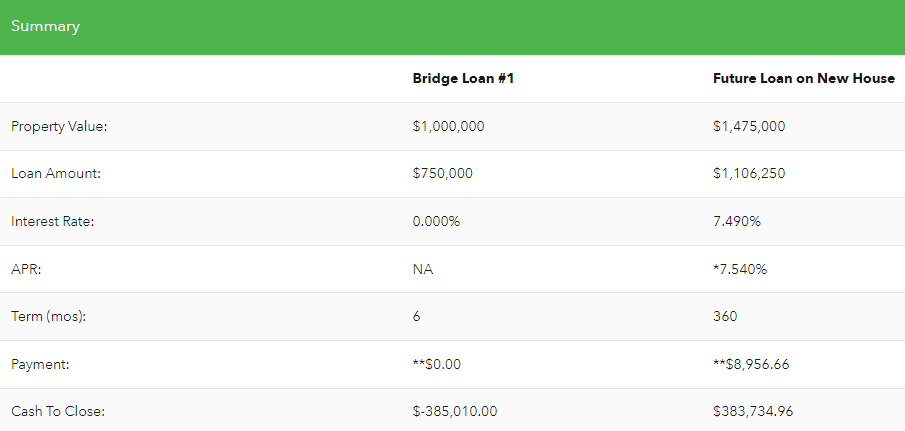

Now that the down payment funds are available, the future loan is established. In this example, the purchase is $1,475,000 with a new loan amount of $1,106,250. The cash to close represents a down payment amount of $368,750 plus the standard closing costs and prepaid items collected at the time of closing.

One advantage of using funds from an existing home is the borrower won’t need to consider selling stocks, tapping retirement accounts, and avoiding costly tax obligations.

Permanent Loan on New Home:

There are many ways a homeowner can structure their financing to make it attractive when they make offers. The bridge to permanent loan is one of them and is gaining traction in today’s ever-changing real estate market.

My team and I are happy to put together presentations specific to this proven approach. Feel free to connect with us to discuss it further.