Homeowners can manage rising insurance costs and maintain affordable mortgages by following a straightforward plan, but let’s first look at a few charts to see where things are at with home prices and insurance expenses.

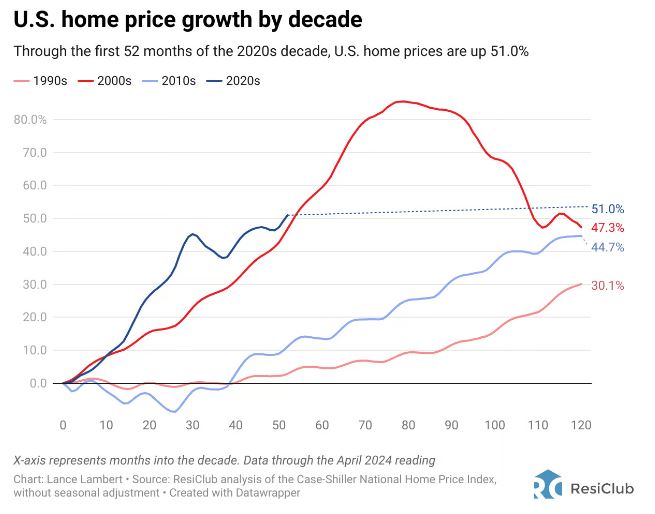

Home Prices Through The Last 3+ Decades:

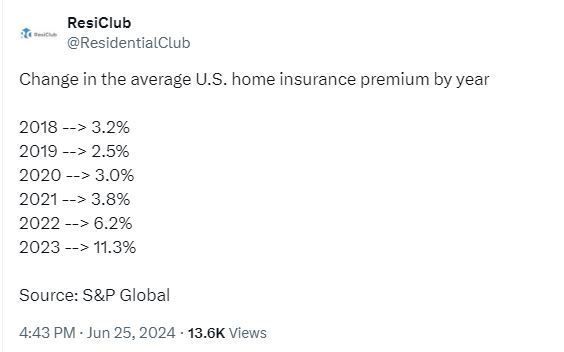

In the first chart above, it is amazing to see how close the 1990, 2000, and 2010s decades were averaging about 40% collectively, but to the start of the 2020 decade where it is already higher on average at approximately 50%, and if that was annualized it would equal about 175% at the end of the decade, or an annual home appreciation of ~14%. Higher home prices usually mean an increase in homeowners’ insurance, and as the chart below shows, it doesn’t look like there’s a premium break anytime soon.

Homeowners Insurance Premium By Year:

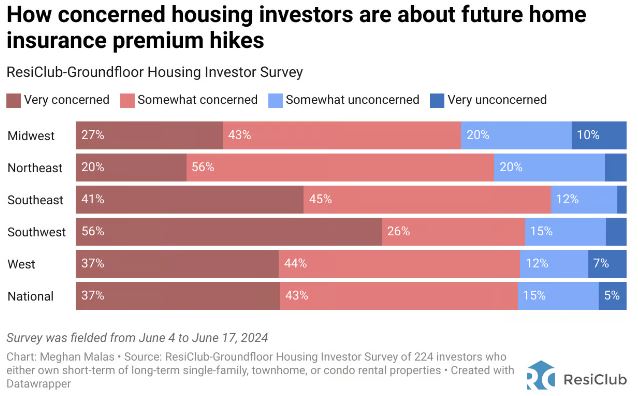

The last chart shows the sentiment of short and long-term real estate investors. The majority of those surveyed, or about 80% were either “very concerned” or “someone concerned” about future home insurance increases.

Sentiment of Real Estate Investors On Future Insurance Costs:

When one is considering buying a new home or investing in residential real estate, it is important to reach out to an insurance company or agent that can offer strategies on how to save on yearly premiums but have a policy in place that won’t bankrupt the homeowner if a claim is made.

Let’s review 4 simple strategies to help reduce policy premiums but provide good covers in case of a claim.

1. Review Your Policy Annually

Regularly updating your policy ensures it meets your current needs.

Insurance needs change over time, as do the terms and conditions of policies. An annual review helps identify unnecessary coverages and potential discounts. For example, if you’ve added security systems, you might qualify for lower premiums. Discussing changes with your insurer can optimize coverage and save money.

Consistent policy reviews keep insurance costs in check.

2. Increase Your Deductible

Higher deductibles can significantly lower your premium costs.

Opting for a higher deductible means you’ll pay more out-of-pocket in case of a claim, but your monthly premiums will be lower. For instance, raising your deductible from $500 to $1,000 can reduce your premiums by up to 25%. Ensure you have enough savings to cover the higher deductible if needed. This strategy balances upfront savings with manageable risk.

Choosing a higher deductible reduces monthly expenses effectively.

3. Bundle Insurance Policies

Combining multiple policies with the same provider can lead to substantial discounts.

Most insurance companies offer discounts if you bundle homeowners’ insurance with auto, life, or other types of insurance. This can simplify payments and reduce overall costs. For example, bundling home and auto insurance might save you up to 20% on premiums. Contact your insurer to explore bundling options and maximize savings.

Bundling policies is a smart way to cut insurance costs.

4. Implement Home Safety Improvements

Upgrading your home’s safety features can lower insurance premiums.

Investing in safety measures like smoke detectors, burglar alarms, and storm-resistant roofing can make your home safer and less risky to insure. Insurance companies often offer discounts for these improvements. For example, installing a modern security system can reduce premiums by 5-10%. These enhancements not only protect your home but also contribute to lower insurance costs.

Safety upgrades provide dual benefits of protection and premium reduction.

Following these steps can help homeowners effectively manage rising insurance costs and keep their mortgages affordable.

Need personalized advice? My wealth partners, specifically our insurance partners, offer FREE consultations and are happy to review your policies and make expert recommendations. Reach out today to secure your financial peace of mind.