Historical Context

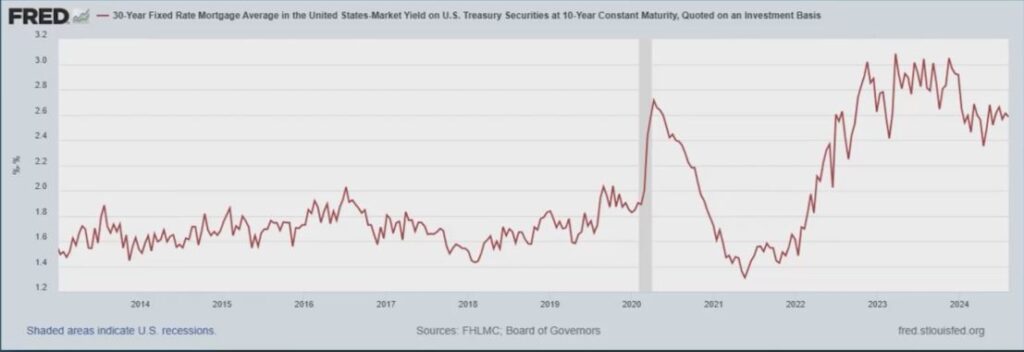

Looking at the past decade, from 2014 to 2019, the average spread between the 30-year fixed mortgage rate and the 10-year Treasury was about 2.0% (200 basis points). During the unusual period of 2020-2022, this spread decreased to approximately 1.5% (150 basis points) as the Fed bought mortgage-backed securities to keep rates low amidst the pandemic.

Current Trends

Since 2022, the spread has increased to as high as 3.0% (300 basis points) and has remained above 2.5%. This increase is due to the Fed halting the purchase of mortgage-backed securities and raising the Fed Funds rate to combat inflation.

Future Predictions

As inflation decreases, the Fed is considering rate cuts as early as September this year. If this occurs, we might see the 10-year Treasury drop below 4%. With a continued decline to 3.65%-3.80%, mortgage rates could fall to 6%-6.25%, assuming a 2.3% spread (230 basis points).

FRED chart showing the spreads between a 30 Year Fixed Mortgage and 10 year Treasury:

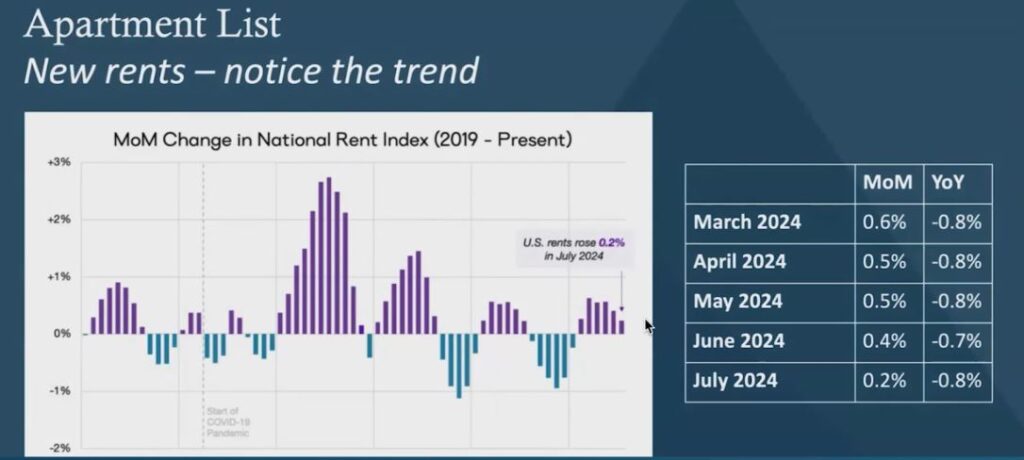

It’s important to understand that rates have stayed artificially high due to the lagging indicator of shelter, which makes up more than 40% of the overall percentage of the CPI (Consumer Price Index). As the image below shows, apartment rents are continuing to decrease and should accelerate in price drops going into the fall and winter months of 2024. This will continue to reduce overall inflation, allowing the Fed to cut rates multiple times in the coming months.

July Apartment Rents 2024:

The data above is promising and could help those thinking about purchasing or refinancing. Let’s take a look at two scenarios: a purchase transaction and a refinance transaction, and the benefits clients may experience at lower rates.

Loan Scenario #1: Purchase Options

Let’s explore how lower mortgage rates could benefit homebuyers. Currently, mortgage rates are higher, but if they decrease as predicted, buyers could either reduce their monthly payments or increase their purchasing power.

Example Calculation:

– Column One (Today’s Rates):

– Mortgage Rate: 7.00%

– Monthly Payment: $3,693/mo

– Column Two (Lower Monthly Payment):

– Mortgage Rate: 6.25%

– Monthly Payment: $3,455/mo

– Column Three (Increased Purchasing Power):

– Mortgage Rate: 6.25%

– Purchasing Power: $648,000

– Increase: ~10%

Purchase Scenarios:

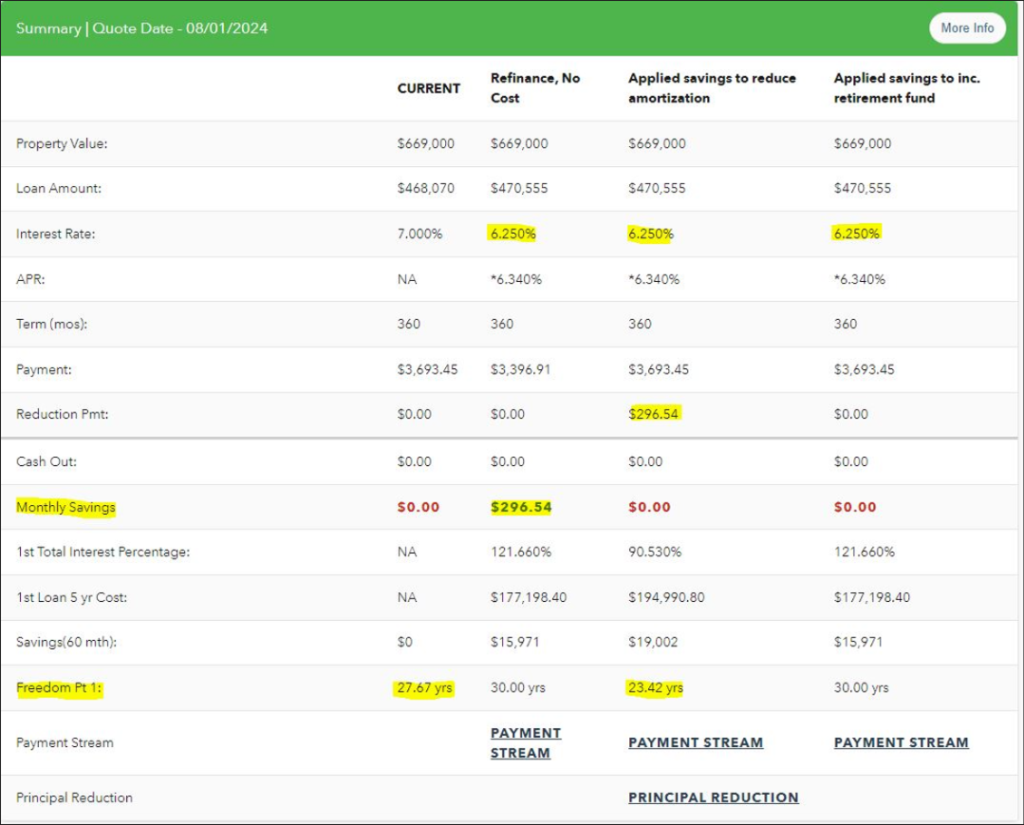

Loan Scenario #2: Refinance Options

Existing homeowners can benefit from lower mortgage rates through refinancing. Here are three potential options: a standard refinance to lower monthly payments, accelerated amortization to pay off the mortgage faster, and an investment strategy to increase net worth.

Standard Refinance (Column One):

– Current Mortgage Rate: 7.00%

– New Mortgage Rate: 6.25%

– Monthly Savings: ~$300

Accelerated Amortization (Column Two):

– Current Monthly Payment: $3,693/mo

– New Lower Rate: 6.25%

– Reduced Loan Term: Over 4 years

– Total Interest Savings: $17,956

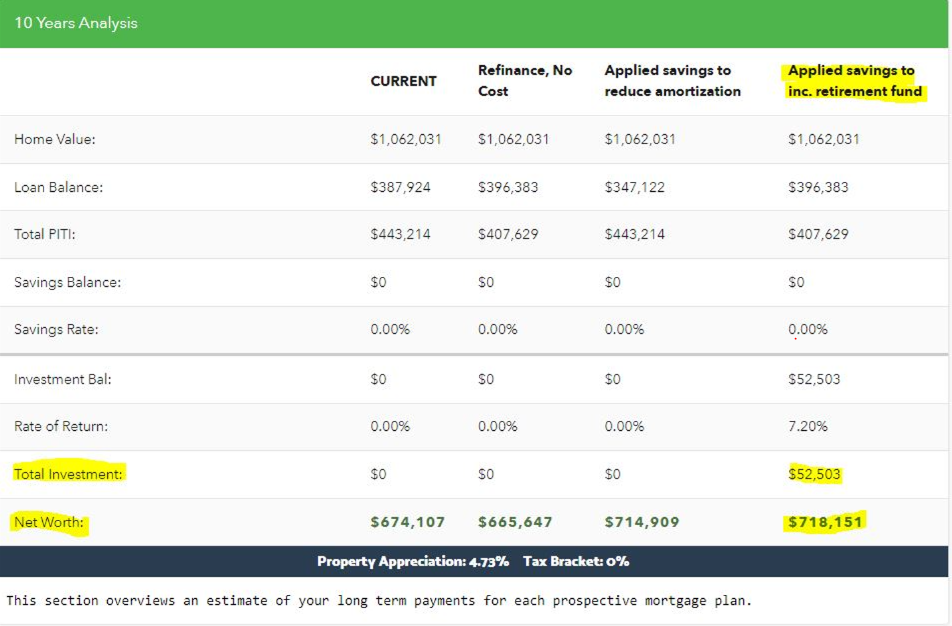

Investment Strategy (Column Three):

– Monthly Savings: ~$300/mo

– Investment Option: Fund a retirement account or similar

– Projected Increase in Net Worth: Over $52K (Assuming a 7.2% return on investment)

Refinance Scenarios:

Net Worth (investment the savings, earning 7.2% over 10 years):

Summary

The options above may help today’s homebuyer and existing homeowner plan accordingly, whether they look to purchase in 2024 or improve their existing mortgage terms and strategize the best approach to increasing their net worth. In either case, it looks like we can finally see a much-needed improvement in mortgage rates. This should spur activity among buyers who have been sitting on the fence, waiting for rates to fall, along with homeowners who purchased within the last couple of years in a high-rate environment, to reduce their monthly mortgage obligations.

To be prepared for this potential opportunity, reach out to receive a FREE mortgage presentation, whether it is for a purchase or if a refinance could help with your monthly cash flow. My team and I will create the report and email it over for you to review.