You don’t need to put down 20% to buy your first home — there are other options worth considering.

1. 20% Down Payment

A 20% down payment is the traditional approach and avoids mortgage insurance, but it’s not the only choice.

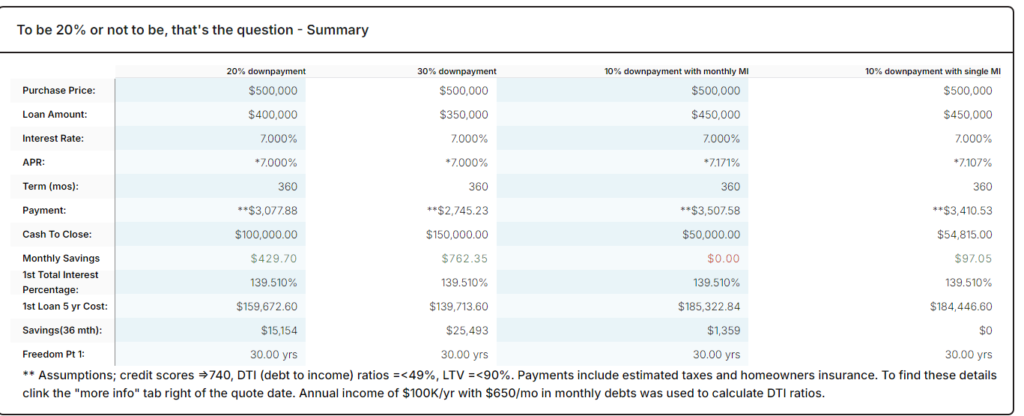

Putting down 20% on a $500,000 home means bringing $100,000 to closing. This reduces the loan amount to $400,000, leading to a manageable monthly payment of approximately $3,078.88. You’ll save on mortgage insurance, giving you about $429.70 monthly savings. Over the first five years, this option results in the lowest total interest cost.

This option is great if you have the cash on hand, but it isn’t a requirement to buy a home.

2. 30% Down Payment

A 30% down payment offers even more monthly savings, but it requires significant upfront cash.

With a 30% down payment ($150,000), your loan amount drops to $350,000, and the monthly payment is reduced to $2,745.23. This results in $762.35 in monthly savings compared to paying mortgage insurance. While your total interest costs are lower than the 20% option, this approach requires more cash upfront.

If you can afford the extra cash, this option offers peace of mind with lower monthly payments.

3. 10% Down Payment with Monthly Mortgage Insurance (MI)

With a 10% down payment, you’ll pay mortgage insurance monthly, but it keeps cash upfront lower.

Putting down 10% ($50,000) results in a higher loan amount of $450,000, with a monthly payment of $3,507.58 due to the added cost of monthly mortgage insurance. While it increases the monthly obligation, this option allows you to keep more money in savings or for other investments.

This is a good middle ground for those who prefer a lower initial investment, even if it means paying extra each month.

4. 10% Down Payment with Single MI Payment

A 10% down payment with a single mortgage insurance (MI) payment offers a way to avoid ongoing monthly MI costs.

For this option, you pay a one-time mortgage insurance premium upfront ($4,815), resulting in a lower monthly payment of $3,410.53. Like the previous 10% down option, it allows you to keep more cash at hand, but without the monthly MI cost that comes with it.

This is a strong option if you want a lower down payment but prefer to avoid monthly MI payments.

By understanding these options, you can make an informed choice that aligns with your financial goals and comfort level.

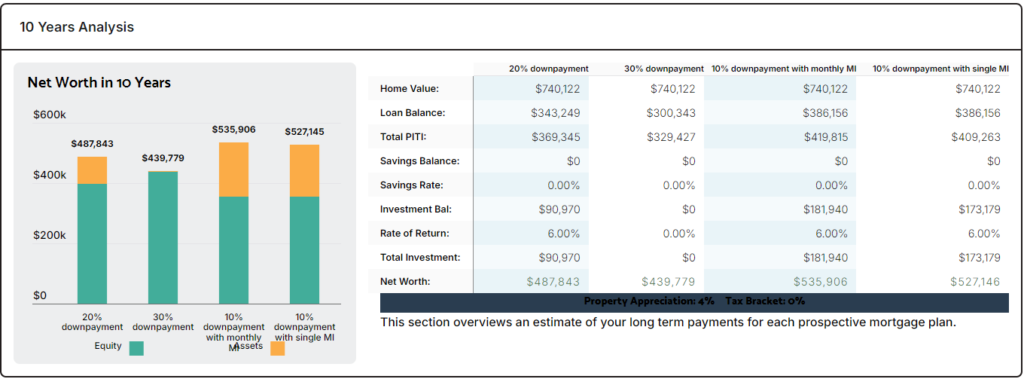

The Power of Investing the Difference

Choosing a lower down payment and investing the difference can significantly impact your long-term net worth. According to a 10-year analysis, putting 10% down with monthly mortgage insurance could yield the highest net worth at $535,906—higher than both the 20% and 30% down payment options. This approach allows you to keep more money in investments, leveraging growth over time.

This strategy shows that you don’t need a large down payment to build wealth through real estate. Sometimes, putting less down and investing the rest can be a smarter path to financial growth.