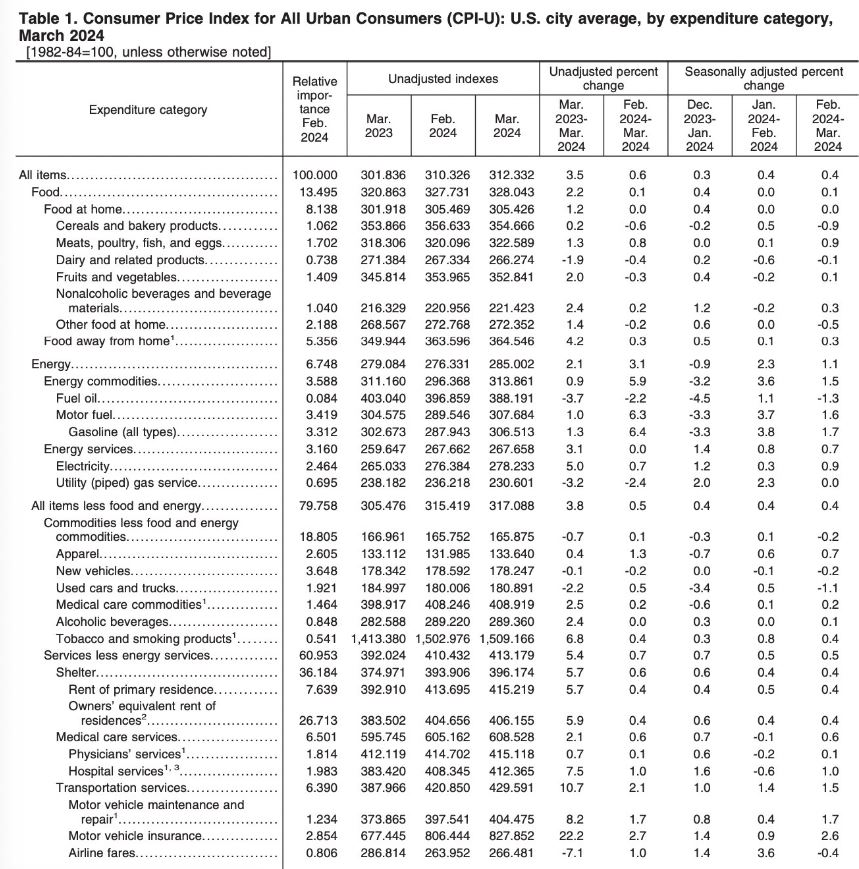

CPI (consumer price index) is a monthly report that tracks a bucket of goods and services, calculating the month-over-month cost of each category. It then averages the monthly percentages over 12 months and reports year-over-year inflation. The chart below shows what is included in the CPI to help figure out inflation.

CPI Seasonally adjusted changes from the preceding month:

So how does CPI affect the housing market and what could buyers experience as these monthly reports come out for the rest of the year?

To summarize this month’s report (which was released on April 10th) showed an increase in inflation. The image below shows a breakdown of where inflation continues to come from as the March Consumer Price Index report showed that overall inflation rose 0.4% for the month, which was greater than estimates of 0.3%. Year over year, inflation increased from 3.2% to 3.5%, which was 0.1% hotter, or 3.4% expected. Inflation looks to be going in the opposite direction where the Feds are hoping to achieve their benchmark of closer to 2%. It seems clear the interest rate cuts that we have been hearing about are fading and may only see 1-2 cuts (with a 6.5%, up from 2.9% just last month, chance the Feds won’t cut rates at all in 2024) later in the year if any at all.

Consumer Price Index – March 2024:

One thing to note, of the 0.378% MOM reading on Headline inflation, .20% came from shelter and .10% was from motor vehicle insurance. If or when these services start decreasing, we should see overall inflation come down. Unfortunately, with the cost of housing and insurance, both homeowners and motor vehicles, inflation looks to be “sticky” in the coming months keeping inflation higher for longer.

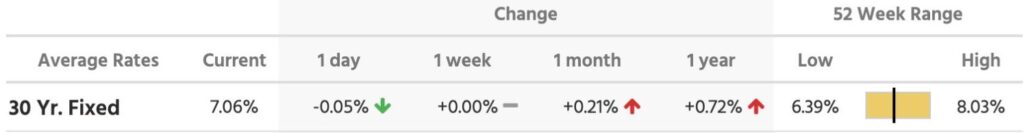

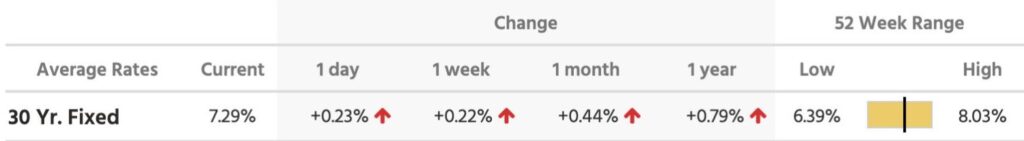

How will this March spike and future inflation report impact homebuyers’ buying power? Here’s the difference between rates on April 9th vs April 10th after the March CPI report was released.

4/9/24 Rates:

4/10/24 Rates:

It increased rates approximately .25% from 7.06% to 7.29%. On a loan amount of $500,000, this increased the payment by ~$75/mo. or almost $1000 over 12 months. With debt-to-income (DTI) ratios at their highest levels we’ve seen in the last decade, minimizing a borrower’s payment will be critical in getting them approved and into their new house. If rates continue to climb, DTI ratios will exceed guidelines and hurt borrowers buying power.

The narrative over the past 12-18 months has been that mortgage rates will eventually decrease. However, this hasn’t happened yet and could take longer than most thought. If rates stay at current levels, the Cost of Waiting to buy a home will get more expensive.

The current models expected rates to fall and showed why “now” would still be a good time to consider buying a home. But if mortgage rates stay elevated, Cost of Waiting models would need to be adjusted and would prove even further that buying a home sooner would help a buyer more than what was previously displayed.

Net Cost of Waiting – Rate now (or 7.375%) would stay the same over the next 12 months:

The earlier models reflected a negative cumulative payment difference (due to rates decreasing over the next 6-12 months) vs if rates were to stay at today’s levels over the next 12 months. Bottom line, if you decided to wait to buy a home over the next 6-12 months you would miss out on $2,184 more wealth accumulation in this example.

The bottom line is real estate seems to continue to get more expensive as time goes on. With natural appreciation set to increase 5% year over year and now mortgage rates staying higher for longer, delaying a purchase may be a bad decision if real estate is part of one’s wealth pillars.

Let us help prepare your custom Cost of Waiting analysis and see if jumping into the real estate market is the right thing to do. Here’s a quick example of how the Cost of Waiting analysis can help in your decision on whether now is a good time to buy. Cost of Waiting – Real Estate Example: