Despite falling mortgage rates, many potential homebuyers are still hesitant to enter the market.

1. High Home Prices

Home prices remain high, making affordability a challenge for many buyers.

Even with lower mortgage rates, the elevated cost of homes in many areas means higher down payments and larger loan amounts. This can make monthly payments difficult to manage, especially for first-time buyers. For many, the current market conditions still feel out of reach financially, causing them to hold off on purchasing a home.

High prices are a significant barrier to affordability.

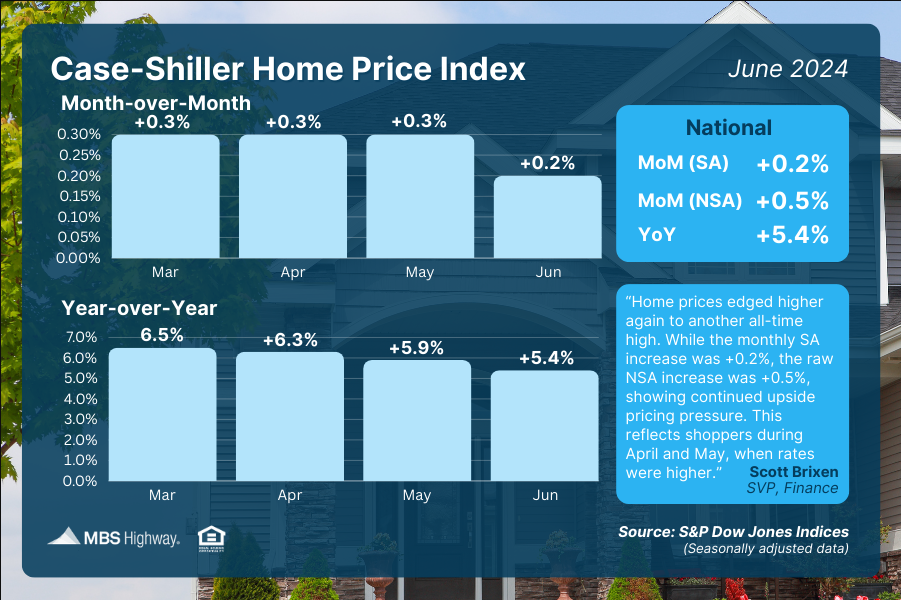

Case-Shiller Home Price Index (June 2024)

Another all-time high for national home prices! Case-Shiller’s Index showed that June brought a seasonally adjusted 0.2% rise from May, while prices were also 5.4% higher than a year earlier.

2. Economic Uncertainty

Concerns about job security and the economy make buyers cautious.

With ongoing economic uncertainty, many potential buyers worry about their ability to maintain a steady income and make consistent mortgage payments. Fears of job loss or reduced income can deter people from making long-term financial commitments like buying a house, even when mortgage rates are attractive.

Economic fears are leading buyers to take a wait-and-see approach.

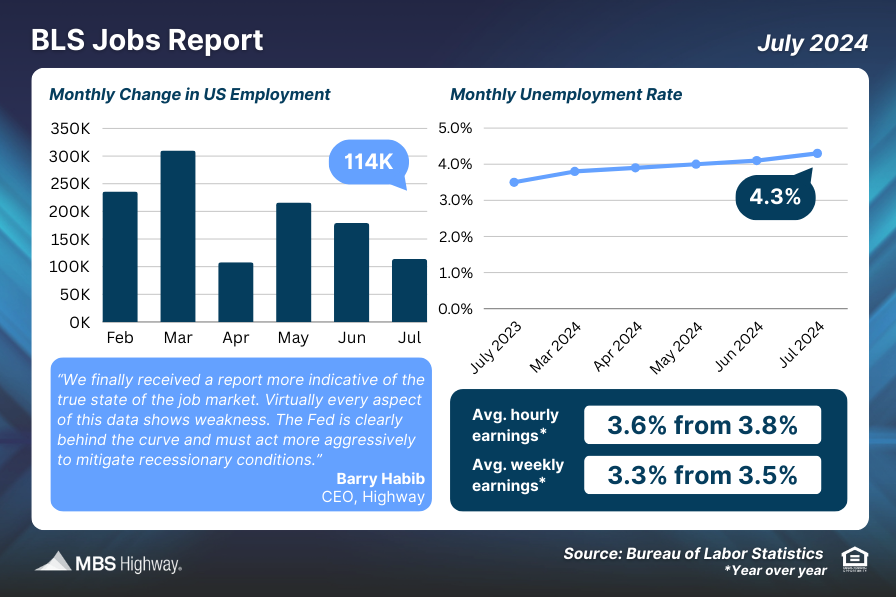

BLS Jobs Report (July 2024)

There’s more evidence of weakness in the labor sector. Job growth in July was well below estimates, as the BLS reported that 114K new jobs were created versus the 175K that were forecasted. Revisions to the data for May and June also cut 29K jobs from those months combined. The unemployment rate rose to 4.3%, the highest since 2021.

3. Limited Housing Inventory

A shortage of available homes makes finding the right property challenging.

Even if buyers are ready to purchase, the limited number of homes on the market can make it difficult to find suitable options. This scarcity can lead to bidding wars and drive prices even higher, further discouraging potential buyers. Many choose to wait until more options are available, hoping for better opportunities.

Low inventory creates a competitive and stressful buying environment.

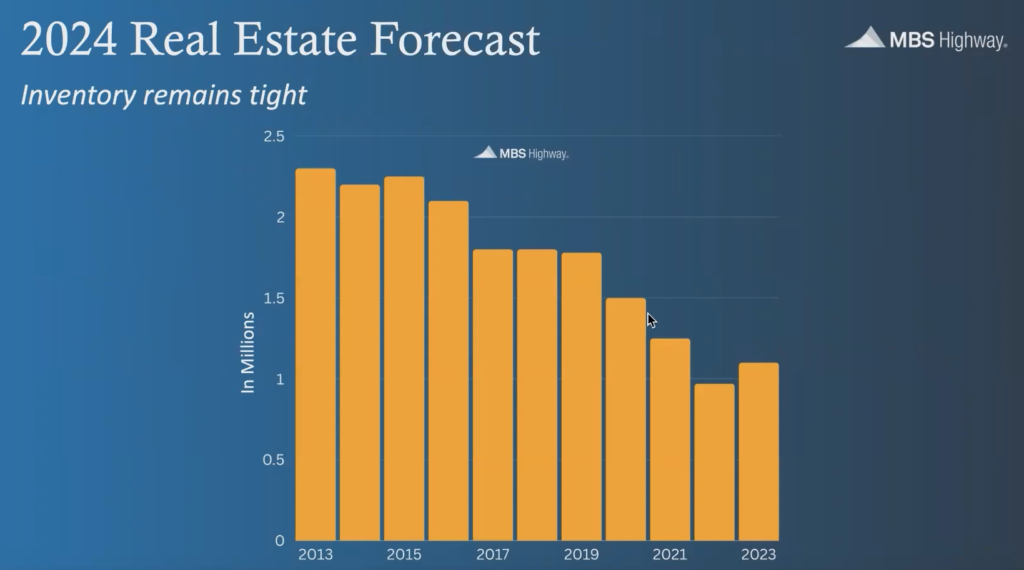

2024 Real Estate Forecast (inventory remains tight while the population goes up!)

4. Rising Inflation (although coming down, it still is “sticky” and above the Feds 2% target)

Inflation is increasing the cost of living, leaving less money for housing.

As inflation drives up the prices of everyday goods and services, homebuyers find themselves with less disposable income to allocate toward a mortgage. Higher costs for groceries, gas, and other essentials make it harder to save for a down payment or handle higher monthly housing expenses, leading many to delay their purchase.

Inflation reduces the financial flexibility needed to buy a home.

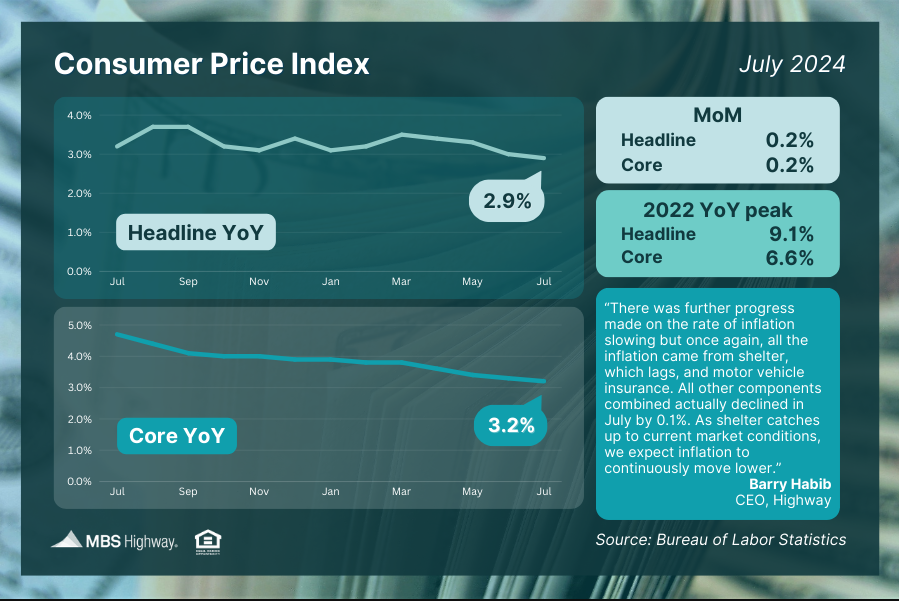

Consumer Price Index (July 2024)

More progress on inflation! July headline CPI eased to 2.9% YoY (from 3.0% in June), and core CPI dropped to 3.2% YoY (from 3.3%). The seriously lagging “shelter” component of CPI rose 0.4% MoM and drove 90% (!!!) of the overall 0.2% monthly increase. Many other major items (energy, new/used cars, airline fares, etc.) actually saw prices flat to down in July.

5. Mortgage Rate Volatility

Uncertainty about future mortgage rates creates hesitation.

While current mortgage rates may be low, potential buyers worry about volatility and the possibility of rates rising again. This uncertainty can lead to indecision, as buyers fear locking in a rate now only to see better options in the near future. This fear of making the wrong financial decision keeps many on the sidelines.

Mortgage rate volatility creates uncertainty and doubt for buyers.

While falling mortgage rates are tempting, these factors are causing many homebuyers to proceed with caution.

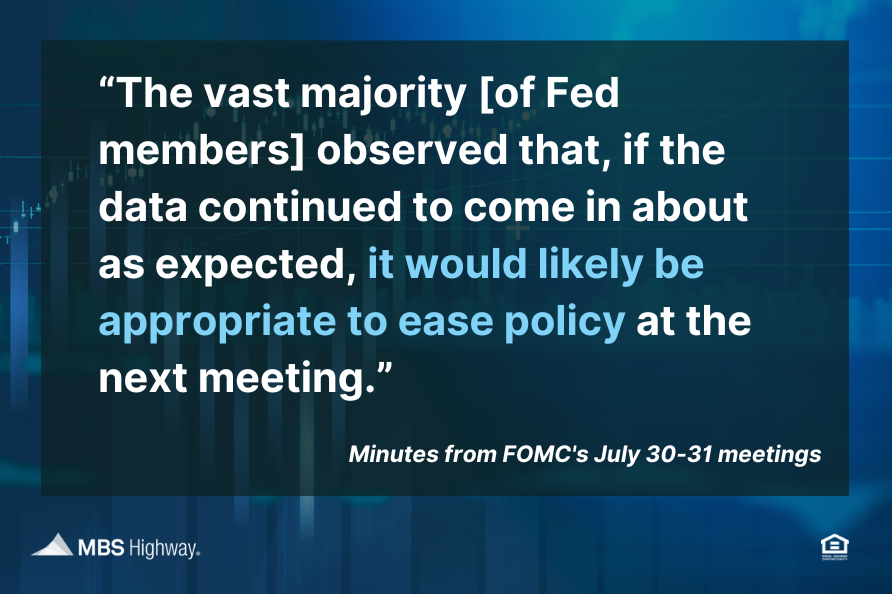

Fed lets the cut out of the bag

No reading between the lines here! The notes from the Fed’s last meeting were explicit about “likely” upcoming rate cuts.

Understanding these concerns can help navigate the market more confidently when the time is right.