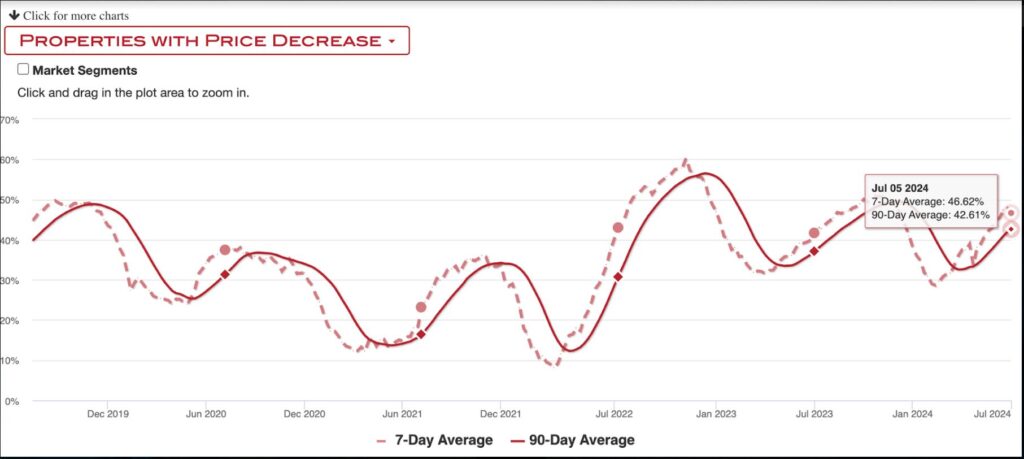

In today’s real estate market, here in Colorado, one could argue there are few bidding wars and recent data shows almost 50% of the properties are experiencing price “drops” not “increases”.

Price Decreases as of July 5th2024:

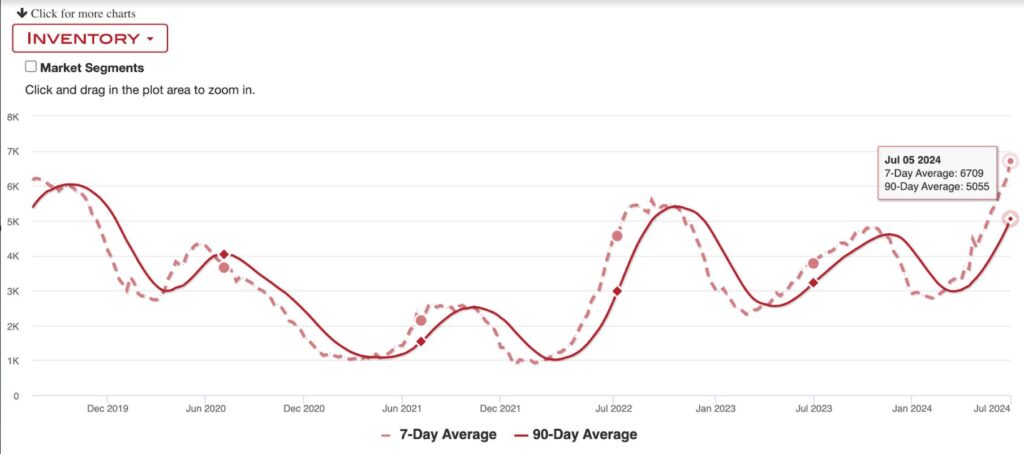

Moreover, the Denver-Aurora-Broomfield area has shown an increase in inventory over the last several weeks. We are now back above pre-pandemic levels and gaining momentum.

Inventory as of July 5th, 2024:

The data above suggests that bidding over the asking price might not be necessary for potential buyers at the moment. However, let’s delve into the most recent Fed Funds Rate chart to understand what the future might hold for interest rates.

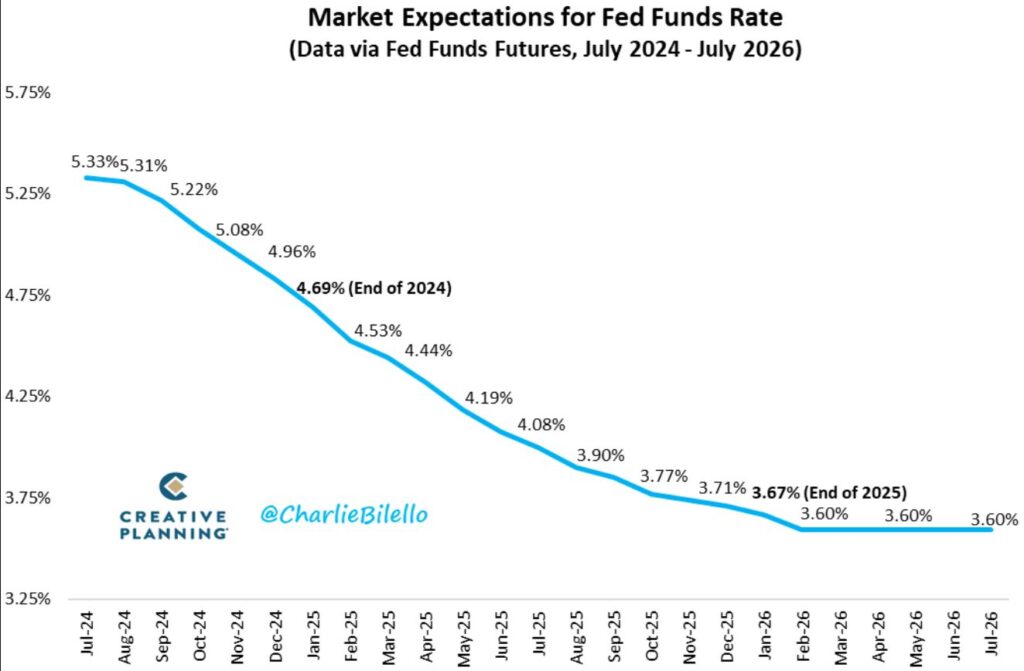

Market Expectations for Fed Funds Rate (July 2024 – July 2026):

As the chart shows, there’s a gradual drop in rates expected over the next two years, with the market now pricing in 2-3 Fed rate cuts before the end of the year and four more cuts in 2025. This shift in expectations, driven by declining inflation and rising unemployment rates, suggests that rate cuts could happen sooner than previously anticipated.

If rates were to fall, it could spur those waiting on the sidelines to enter the market, potentially reigniting bidding wars. Media outlets speculate that decreased rates could cause demand to outstrip supply once again.

The good news is with our bid over-asking calculator we can demonstrate to the buyer if bidding over the asking price is a wise financial decision. Let’s remove the emotion and look at this mathematical in the example below.

Bid Over Asking Price Evaluation. 2 Questions to Ask a Potential Homebuyer:

- How long will it take to break even?

- What happens in the future?

Estimated current value $650,000

Current asking price $650,000

Bid above asking price $660,000 (need to come in $10K higher to win!)

#1 How long does it take to break even?

Based on a one-year forecasted appreciation rate in the Denver Metro area, it would take approximately 3.5 months to break even. Considering it takes 30 days to close and a couple of months before the first mortgage payment, the bid over the asking price would be recouped relatively quickly.

#2 What happens in the future?

Over the next five years, with an estimated appreciation rate of 4.58%, slightly above the 63-year historical average of 4.52%, the projected value of the house would be $813,000, yielding a profit of $153,000.

In summary, a buyer could purchase a home slightly overvalued at the beginning of the transaction (as the red figure shows in the chart below). But over time the asset grows at a healthy clip, growing their net worth significantly and helping them build generational wealth as time goes on.

Ready to Make Your Move?

Contact us today to use our bid over-asking calculator and get expert guidance tailored to your unique situation. Let’s ensure you’re making the smartest investment in your dream home.