Homeownership is one of the most powerful ways to build long-term wealth and skipping it could cost you financial security down the road.

1. Homeownership Builds Equity, Renting Does Not

Every mortgage payment you make increases your ownership stake in a valuable asset.

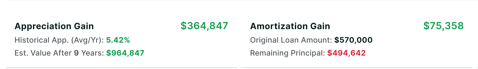

The “Buy vs. Rent” report shows a net gain of $349,043 after nine years of homeownership. Appreciation alone contributes $364,847, meaning the home’s value significantly increases over time. In contrast, renters build $0 equity—every dollar spent on rent is gone forever. Additionally, homeowners benefit from $75,358 in loan amortization gain, further growing their wealth.

Owning a home turns a major living expense into an investment.

2. Fixed Housing Costs Provide Stability

A mortgage locks in your housing payment, while rent keeps increasing.

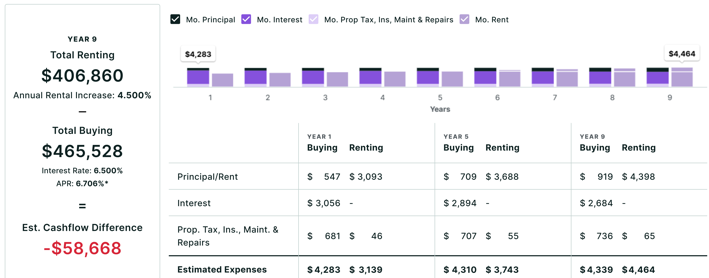

The report highlights that Year 1 rent starts at $3,093/month and increases to $4,398/month by Year 9 due to annual rent hikes of 4.5%. Meanwhile, a homeowner’s mortgage payment remains predictable, with principal and interest staying fixed. Over nine years, total rental costs amount to $406,860, compared to $465,528 for owning—but only homeowners build significant wealth in return.

Predictability in housing costs gives you more control over your financial future.

3. Tax Benefits Favor Homeowners

Owning a home comes with financial incentives that renting does not.

The report reveals a $19,577 tax benefit over renting after nine years. Homeowners can deduct mortgage interest and property taxes, reducing their taxable income. Renters, on the other hand, receive no comparable tax breaks, making their housing costs even less efficient.

Ignoring these tax benefits leaves money on the table.

Owning a home isn’t just about having a place to live, it’s about securing your financial future. If you can afford it, skipping homeownership could be a costly mistake.