Feeling like you’re stuck in a bad sitcom plot where the main character’s bank account is the punchline? Well, welcome to the chaotic world of pandemic economics! As stimulus checks made their grand entrance and swift exit, they left us in a whirlwind of financial confusion. Suddenly, our credit card balances were doing jumping jacks, and our car loan payments were moonlighting as mortgage installments. But fear not, for amid this financial frenzy, could the elusive Bank Statement HELOC Loan be our knight in shining armor? Let’s embark on this comedic adventure and see if it’s the plot twist we’ve been waiting for to escape the clutches of financial doom!

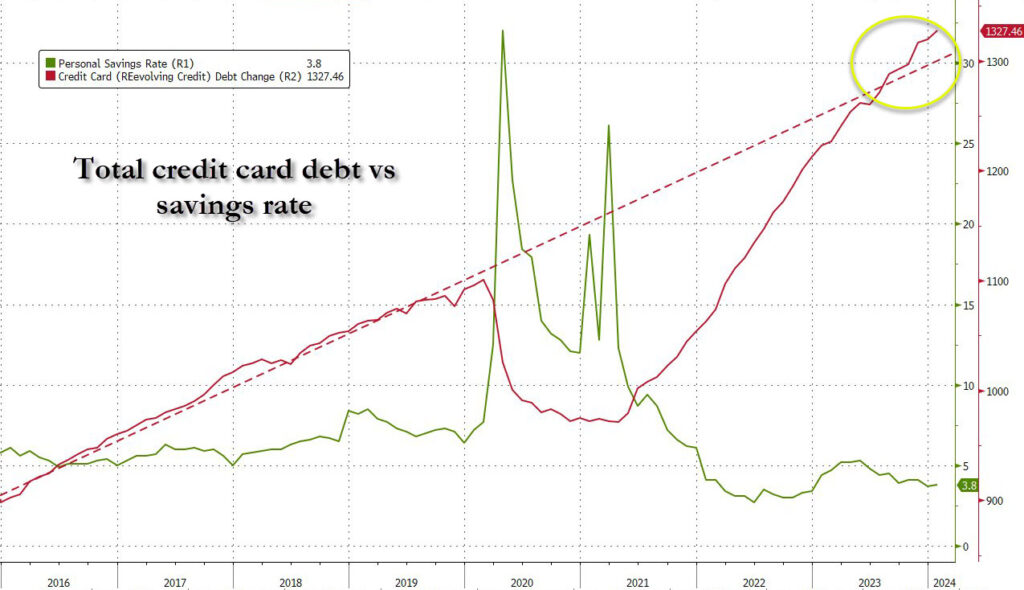

1. Savings Rate Pre-Pandemic:

The savings rate, approximately 10% pre-pandemic, soared as people received stimulus checks during lockdowns, leading to increased bank deposits. However, despite this surge, credit card balances hit an all-time high as people used stimulus funds to pay off debts.

Amidst reopening and subsequent stimulus checks, spending escalated rapidly, depleting savings and increasing reliance on credit cards, resulting in a new peak in credit card debt, compounded by soaring interest rates.

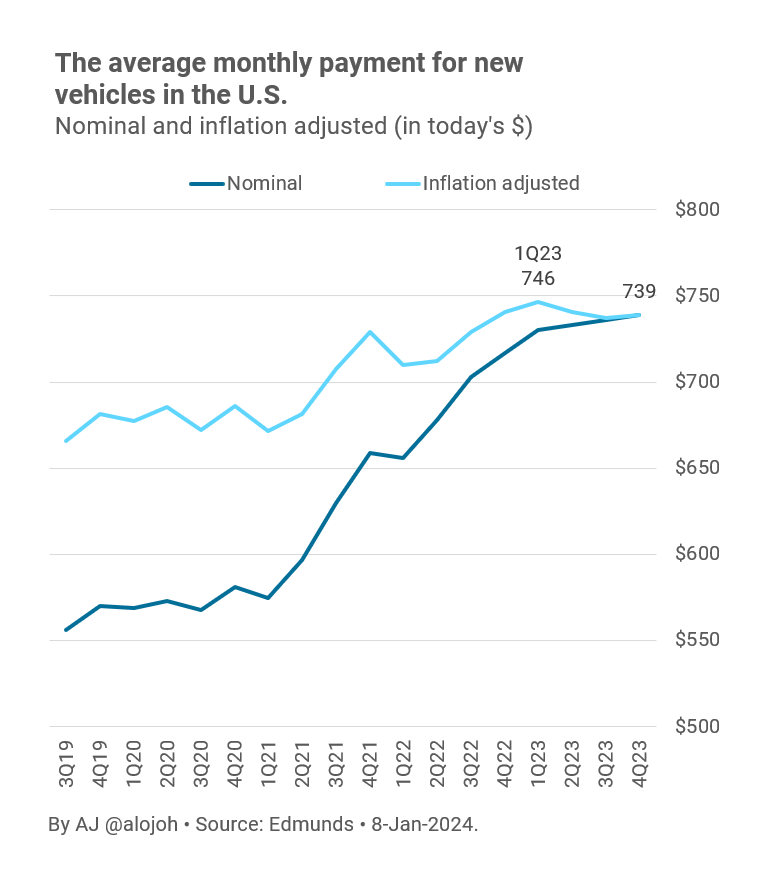

2. Escalating Car Loan Burden:

Over the past three years, the average car payment has doubled to $800, with a significant portion exceeding $1,000. Lengthening loan terms to six years exacerbates the financial strain, with 17% of borrowers facing such burdensome payments.

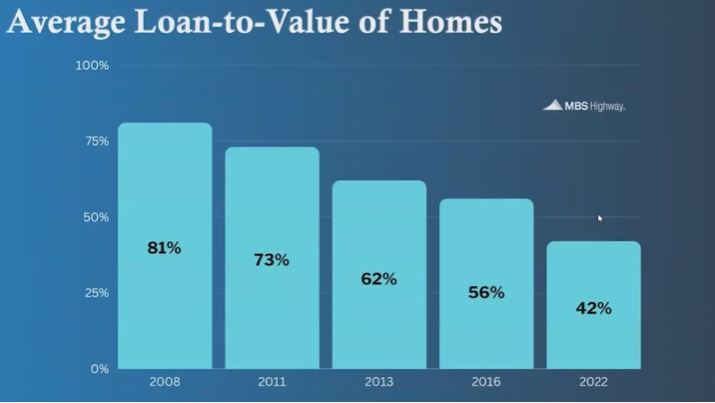

3. Leveraging Home Equity:

Despite escalating debt burdens, home equity remains a largely untapped resource, averaging 58%. Compared to the housing bubble era’s 19%, homeowners possess substantial equity potential, potentially offering a lifeline amidst mounting debt.

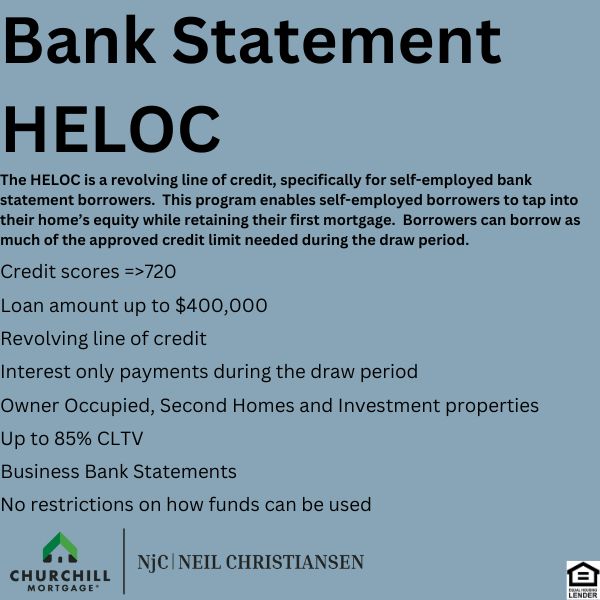

Explore the potential of a Home Equity Line of Credit (HELOC) to leverage home equity responsibly, consolidating high-interest debts and reducing overall financial strain.

In conclusion, amidst rising debt burdens and dwindling savings, strategic utilization of home equity through a Bank Statement HELOC Loan presents a viable pathway to alleviate financial pressures and achieve lasting stability.

Take charge of your financial future by exploring avenues for debt consolidation, savings accumulation, and prudent use of home equity to secure long-term financial freedom and stability.