The recent Fed rate cut doesn’t mean mortgage rates will drop immediately.

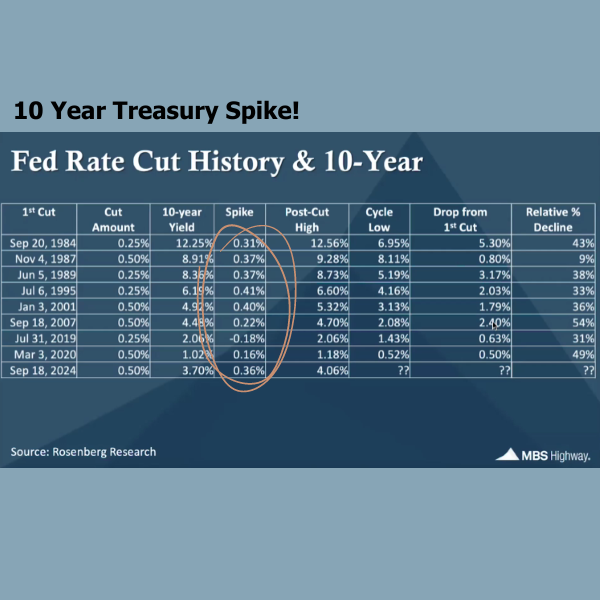

1. Initial Spike in 10-Year Treasury Yields

Historically, when the Fed cuts rates, the 10-year Treasury yield initially spikes before declining.

After past rate cuts, yields jumped up temporarily before a gradual decrease followed. We’ve seen this same spike happen recently after the September 2024 cut. This spike creates upward pressure on mortgage rates in the short term, as they are closely tied to Treasury yields. The key is patience; history suggests this spike is temporary.

Higher yields right after a cut can keep mortgage rates elevated for a short period.

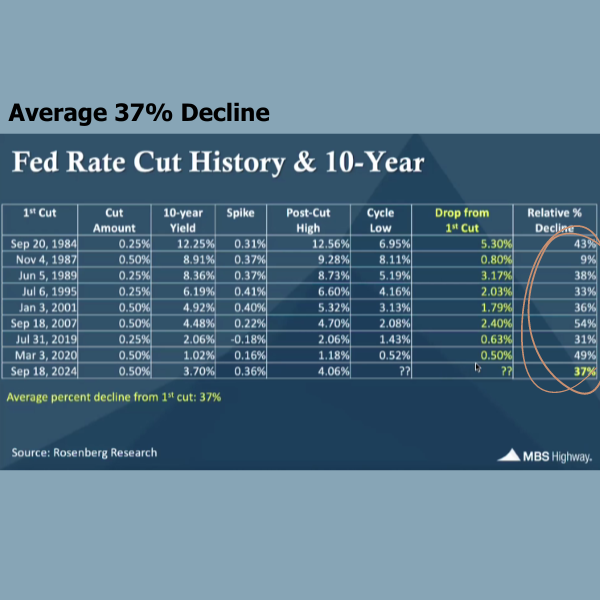

2. A 37% Decline in Yields Follows

On average, there’s a 37% decline in the 10-year Treasury yield after the initial spike.

Based on past data, after the initial surge, yields tend to drop significantly. For the current environment, a 37% drop from 3.7% suggests that the 10-year yield could drop to 2.35%. Once this happens, we can expect mortgage rates to follow suit and start decreasing. The timeline for this decline can vary, but the pattern is clear.

This decline will bring much-needed relief to those seeking lower mortgage rates.

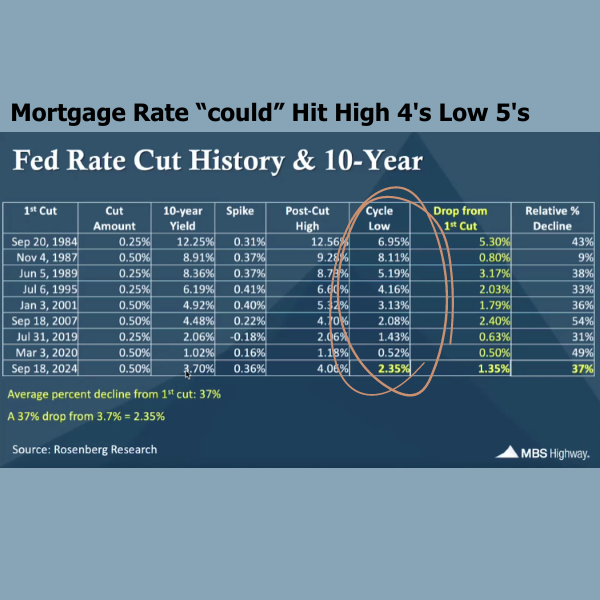

3. Mortgage Rates Could Hit 4.75%–5%

As Treasury yields decline, mortgage rates could follow and dip into the 4.75%–5% range.

If the 10-year Treasury yield drops to around 2.35%, and the spread typically applied to mortgages (approximately 250 basis points) holds, 30-year fixed mortgage rates could fall to the 4.75%–5% range. This will be good news for homebuyers, but it won’t happen overnight—watching the bond market is key.

A drop in Treasury yields will eventually translate to lower mortgage rates.

4. Watch the 10-Year Treasury Yield

Homebuyers should pay close attention to the 10-year Treasury yield for mortgage rate clues.

If you’re planning to buy a home, don’t just watch the headlines about the Fed’s actions—track the 10-year Treasury yield. It’s a leading indicator of mortgage rate trends. As the yield drops, expect mortgage rates to move downward as well, offering you better financing options.

Tracking Treasury yields can help you time your mortgage decision more effectively.

Lower mortgage rates are on the horizon, but patience is required. Keep an eye on the 10-year Treasury yield to gauge when the relief will come.