First-time homebuyers should take advantage of the current market conditions to build wealth.

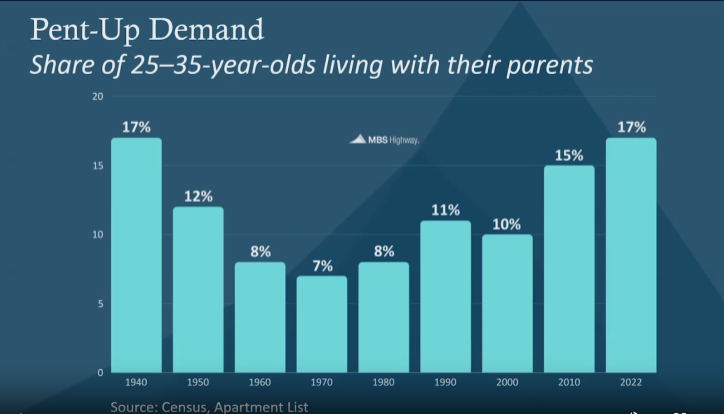

1. Pent-Up Demand

17% of those aged 25-35 still live at home, eager to enter the housing market.

Pent-Up Demand:

This group represents a significant pool of potential buyers who are ready to invest in their first homes. The demand from these young adults, combined with the desire for independence and investment, will likely drive up property values as they begin to purchase. For a first-time buyer, entering the market now before this wave hits can provide a strategic advantage. By securing a property before demand intensifies, you stand to gain both immediate equity and long-term appreciation.

Buying now lets you get ahead of the coming surge in demand.

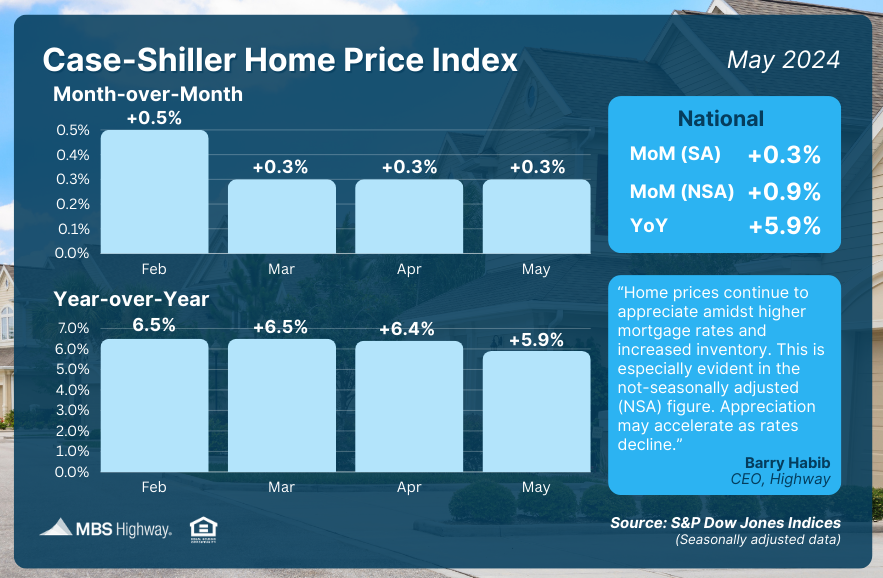

2. Home Appreciation Is Already on the Rise

Case-Shiller Home Price Index reports steady month-over-month and year-over-year home appreciation.

Case-Shiller Home Price Index:

Home prices are consistently increasing, a trend backed by data from reliable sources. If you’re waiting for a better deal, you might miss out as prices continue to climb. The steady rise in home values means that buying sooner rather than later can help you lock in a lower purchase price and start accumulating equity immediately. As home prices rise, so does your investment.

Waiting could cost you more; buying now ensures you benefit from rising property values.

3. Potential Fed Rate Cuts on the Horizon

The Fed could cut rates in their next meeting, making mortgages more affordable.

Christopher Waller’s Quote:

With inflation easing, unemployment rising, and consumer spending slowing, there’s growing speculation that the Federal Reserve might cut rates soon. Mary Daly, President of the San Francisco Fed, recently acknowledged the slowing labor market and hinted at the importance of avoiding a downturn. A rate cut could reduce mortgage costs, making it an ideal time to secure a home loan. By buying now, you could benefit from lower interest rates, reducing your long-term mortgage expenses.

Lower rates could be just around the corner, making this a prime time to buy.

The time to act is now—secure your first home and start building significant wealth in today’s promising market conditions.