Buying your first home isn’t just about securing a place to live—it’s one of the smartest ways to build long-term wealth if you approach it with the right strategy.

1. Understand Your Budget

Your budget isn’t just the price of the house—it’s the true cost of ownership.

Calculate your monthly budget by including mortgage payments, property taxes, homeowners insurance, and potential maintenance costs. In general, use the “35/45 rule”: keep housing costs under 35% of your gross income and total debt under 45%. For example, if you earn $10,000 a month, aim for housing costs no higher than $3,500. Today’s real estate prices might require a higher percentage but keep this rule in mind when budgeting for a mortgage.

Your financial clarity is your strongest foundation. There are plenty of budget apps and spreadsheets available online. Here’s one I use, feel free to grab it!

2. Boost Your Credit Score

Your credit score will determine the interest rate you qualify for—and that can save you thousands.

Pay off any high-interest debt, don’t open new credit accounts, and ensure you’re paying every bill on time. For instance, a 1% difference in interest rates on a $300,000 loan can mean saving over $50,000 in interest across 30 years.

Your credit score is your ticket to better opportunities. Learn how to improve your credit score for FREE at Experian. This is a good option for the DYI, however, partnering with a credit specialist or a mortgage advisor who can put together a plan for improving your credit could also be a consideration.

3. Get Pre-Approved Before Shopping

A pre-approval gives you clarity and leverage when negotiating.

Meet with a lender to understand exactly how much you qualify for and secure a pre-approval letter. This shows sellers you’re serious. Imagine competing against another buyer—your pre-approval could be the deciding factor.

Preparation positions you as a strong buyer. Meeting with a mortgage advisor might be the most important step when starting your home-buying journey. Understanding the TOTAL cost of a mortgage loan, the monthly payment, cash to close, paying points to lower the rate…etc. needs to be presented early in the game to ensure long-term success. Learn about the TCA (Total Cost Analysis) report and how it has helped clients make the right decision when it comes to mortgage loans.

4. Prioritize Location Over Features

You can renovate a home, but you can’t move it.

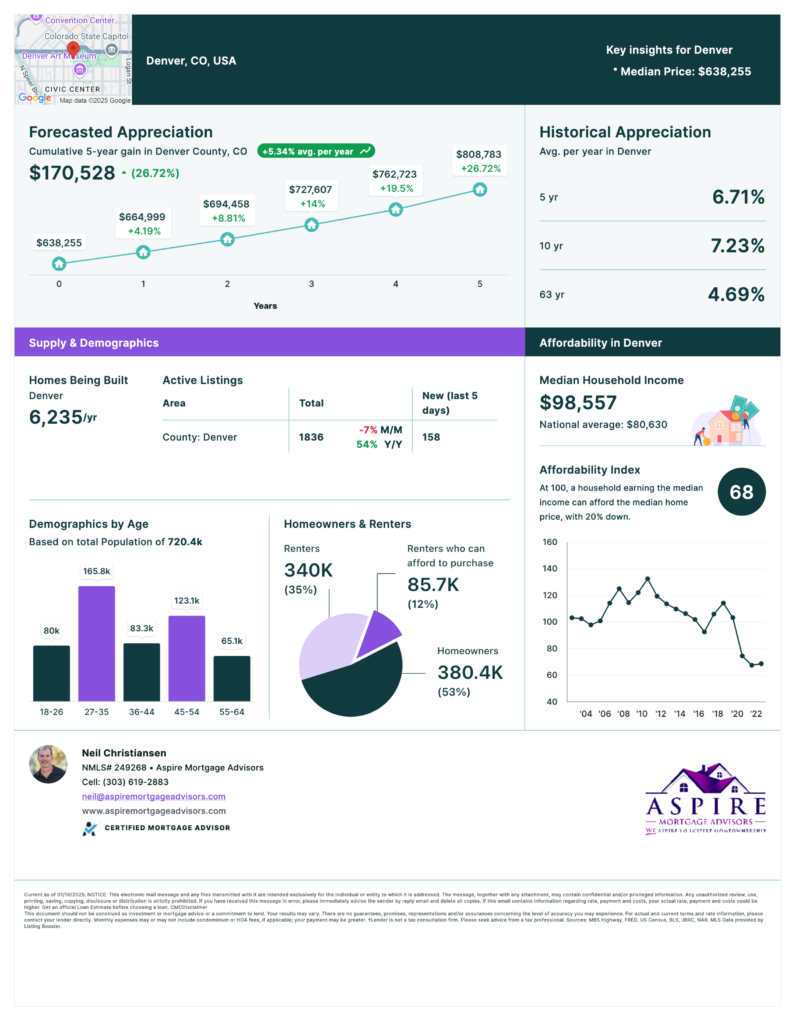

Choose a neighborhood with strong potential for growth, access to amenities, and a good school district—even if you don’t have kids. Homes in desirable areas tend to appreciate faster, building equity over time.

Your location decision will shape your long-term wealth. Get access to the Real Estate Report Card to understand the best places to live.

5. Think Long-Term, Not Just “Starter Home”

Your first home can be an investment, not just a milestone.

Look for properties that could serve as a rental in the future or have room to grow with your needs. For example, a duplex could allow you to live in one unit while renting out the other to cover your mortgage.

Smart first-home decisions pay dividends for years.

Buying your first home in 2025 is an opportunity to set yourself up for financial growth. Follow this framework to make a smart, wealth-building investment!