Deciding whether to buy or rent a home is a significant financial choice that can be complicated by many assumptions and costs. Simplifying the decision-making process by focusing on key variables can provide clarity.

This article aims to streamline the decision-making process by offering insight into the factors crucial for deciding whether buying or renting is the right choice for your housing needs. By the end, you will be equipped with the knowledge to make an informed decision about your future abode. Let’s delve into a simplified model for the buy vs. rent decision.

Factor #1: Monthly Rent

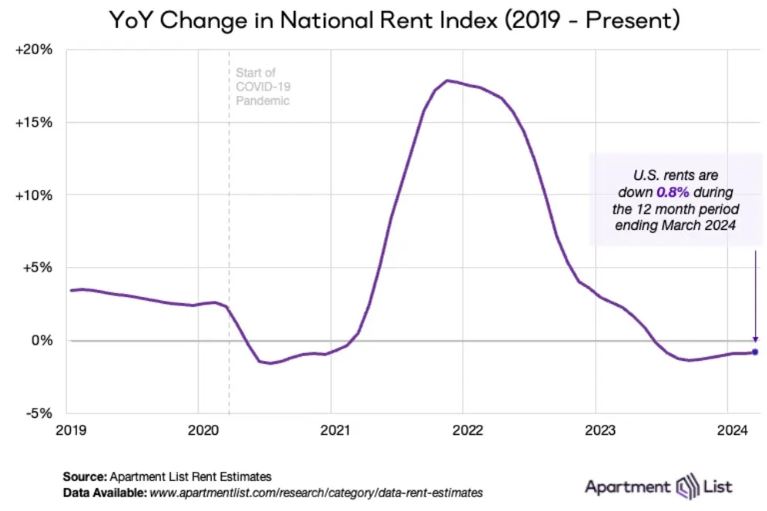

The primary expense linked to renting involves the monthly rental payment and how it fluctuates over extended durations. Unlike a fixed mortgage payment, rental payments usually increase once per year when a new lease is negotiated. Rental rates have recently been declining and only modestly up in the last 12-month period ending March 2024. Due to the lack of a fixed payment, like a mortgage payment, the fluctuation in rental rates can reduce the success of renting, making it a better decision to buy a home.

Factor #2: Monthly Mortgage Payment

This is the sum needed to cover your borrowing expenses for buying your home. The key factors influencing this include the loan amount and the interest rate applicable to your borrowing. Over time, a fixed payment generally benefits homeowners. As future payments are made, an increase in principle is realized, and the loan balance decreases quickly due to the fixed payment. Unlike renters who might experience increases in their rent payment over the same period.

It is important to not forget the added expenses when owning a home, i.e., maintenance, homeowner’s insurance, and property taxes. These items need to be considered when comparing buying vs renting.

Factor #3: Overall Future Inflation

Although we don’t know the direction of future inflation, the broader scope of inflation significantly affects renters, as they continually face rising rental costs over time. All things being equal, lower future inflation favors renters, while higher future inflation benefits homeowners. Importantly, rental inflation tends to slightly outpace overall inflation.

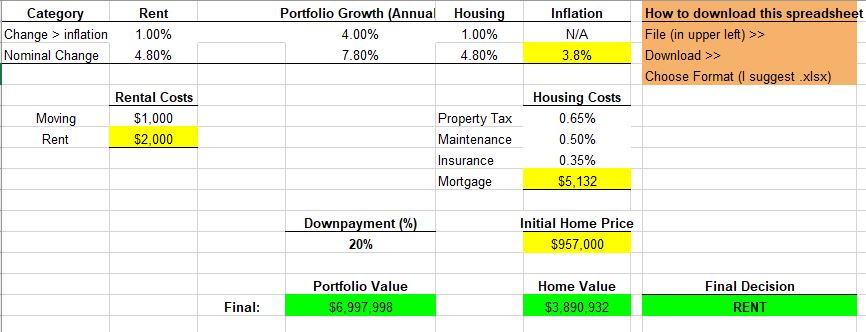

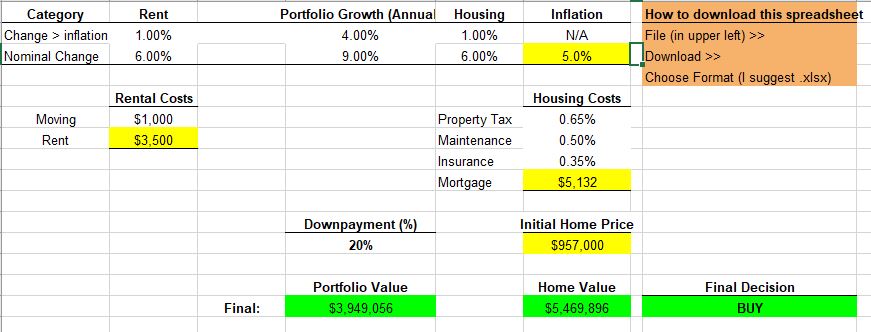

Let’s take a look at how these 3 factors influence the buy or rent decision. I have highlighted the most important ones (rent, mortgage, and future inflation) in yellow for you.

Example 1: Rent at $2000/mo, an inflation percentage of 3.8%, and a mortgage payment using today’s average 30-year fixed-rate at a conforming loan amount. This example would suggest renting would be the better choice.

Example 2: By raising the inflation rate 1.2% above the historic average and raising the rent from $2K/mo to $3500/mo., the better option would be to buy. Future inflation plays a big role in homebuying success.

Viewed through this lens, buying a home essentially serves as a safeguard against future inflation. When expecting high inflation, opting to buy helps secure housing costs at a fixed rate, while renters face the challenge of continuously rising rental prices. Conversely, in periods of low inflation, homeowners may face disadvantages if they commit to mortgages with rates that don’t adjust over time. Additionally, it’s essential to consider not only the overall inflation rate but also how housing fares compare to it. While historically housing and rents have surpassed general inflation by around 1% annually, if home prices and rental rates increase more slowly than overall inflation, renting becomes a more appealing option, all other factors still being constant.

Ultimately, understanding these dynamics empowers individuals to make informed decisions about their housing choices, considering both current circumstances and future projections.