To thrive in the dynamic landscape of real estate investment, unlocking homebuyer confidence is paramount.

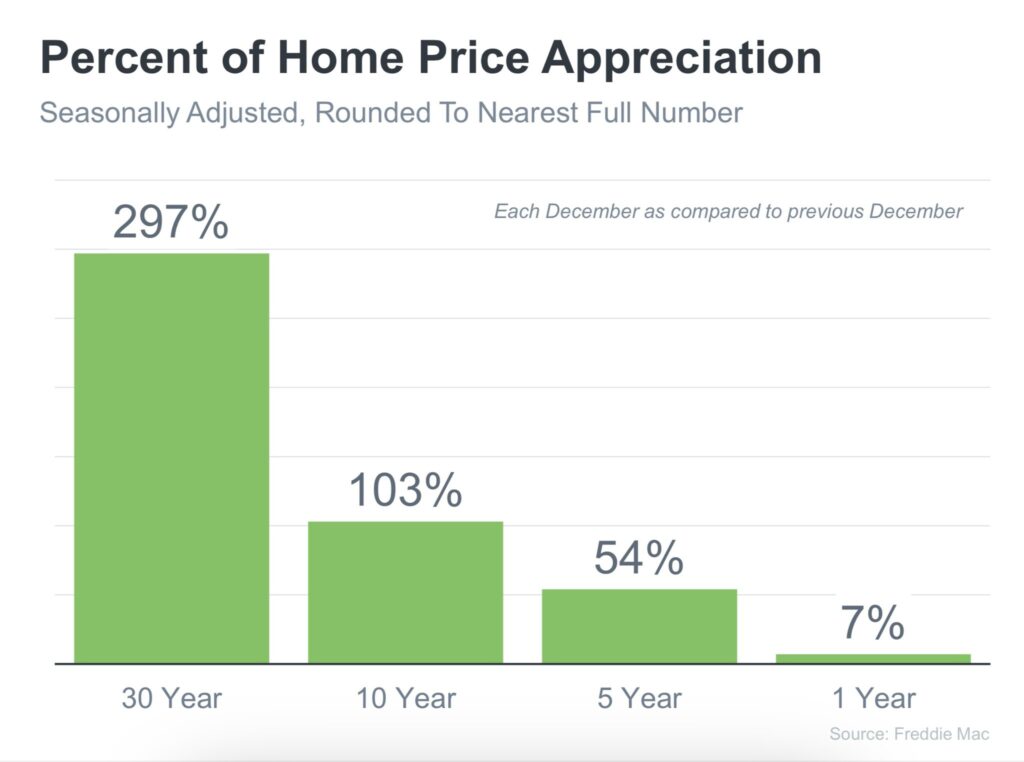

1. Understanding Home Appreciation Trends

Home appreciation trends offer crucial insights into the potential profitability of real estate investments. By studying charts illustrating home appreciation over various terms such as 1, 5, 10, and 30 years, investors can discern patterns and forecast future market conditions. Actively tracking these trends empowers homebuyers to make informed decisions, identifying opportune moments to buy or sell properties. For instance, a sustained upward trajectory in home appreciation may signal a lucrative market ripe for opportunity, while a plateau or decline might indicate caution or alternative investment strategies.

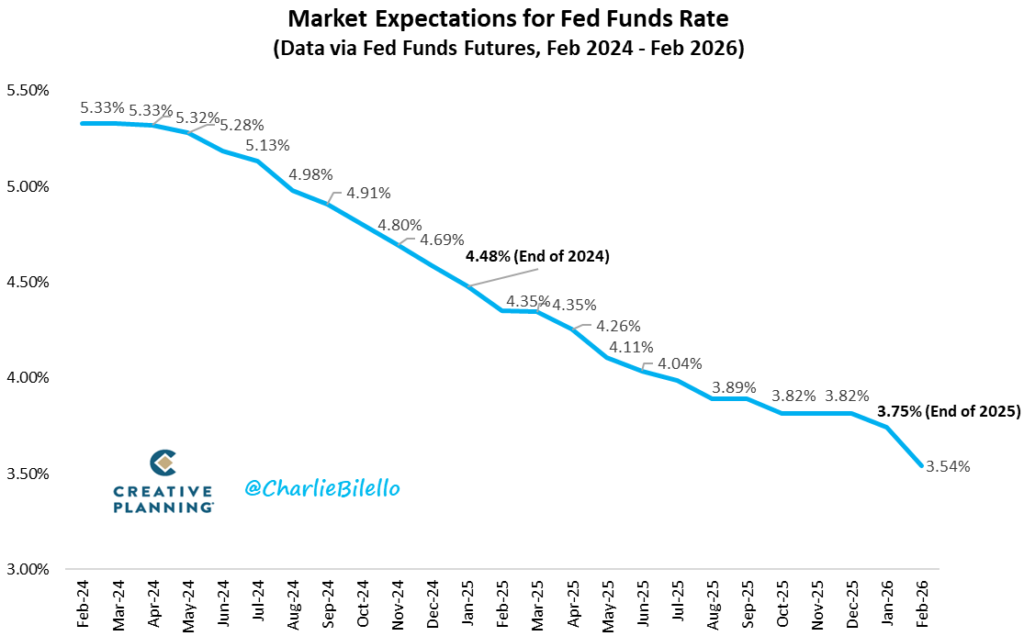

2. Monitoring Federal Reserve Actions

The Federal Reserve’s monetary policy profoundly influences real estate markets, particularly through its management of the federal funds rate. By examining charts depicting market expectations of future Fed fund rate movements, homebuyers can anticipate shifts in borrowing costs and overall market sentiment. With projections suggesting a potential decrease in the Fed fund rate by the end of 2024, followed by further declines into 2025, savvy homebuyers can strategically position themselves to capitalize on favorable financing conditions and stimulate homebuyer confidence.

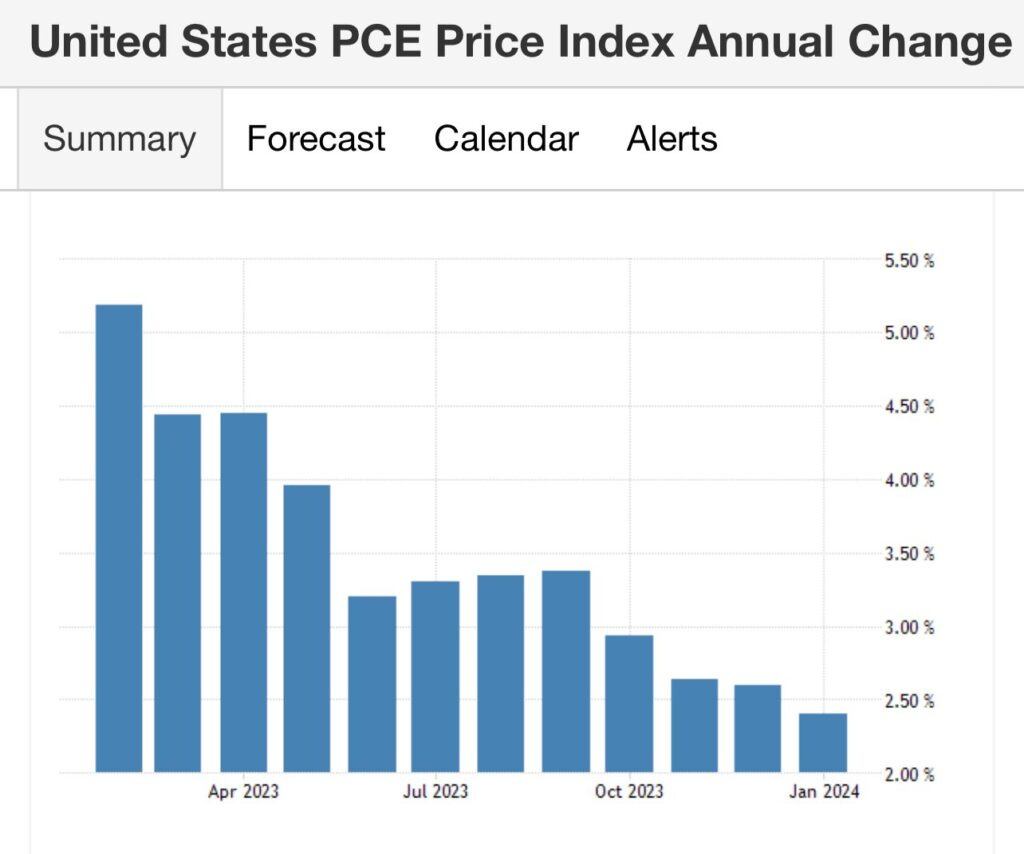

3. Analyzing Personal Consumption Expenditure (PCE) Trends

The Personal Consumption Expenditure (PCE) report serves as a vital indicator for gauging inflationary pressures and guiding Federal Reserve policy decisions. Charts illustrating the downturn of PCE indicate a decline in consumer spending, suggesting a moderation in inflationary pressures. This trend aligns with the Federal Reserve’s cautious approach to monetary policy, characterized by its most restrictive stance since September 2007. By closely monitoring PCE trends, homebuyers can adapt their investment strategies accordingly, navigating market conditions with confidence and precision.

In conclusion, by comprehensively analyzing home appreciation, Federal Reserve actions, and PCE trends, prospective homebuyers can implement a strategic blueprint for long-term real estate investment success in 2024. By staying informed and adaptable, individuals can unlock confidence in their real estate investment decisions and capitalize on lucrative opportunities in the dynamic market landscape.