Did you know that by the age of 65, a whopping 83% of one’s wealth comes from owning real estate? Whether it’s your personal residence or an investment property, real estate can be a powerful wealth-building tool. Among its many benefits, one strategy stands out: the 1031 Exchange.

The Power of 1031 Exchanges:

Real estate investing has a lot of advantages, but one of its biggest benefits is the ability to defer taxes using a 1031 Exchange.

A simple 1031 Exchange is a tax-deferred strategy that enables an investor to sway one investment property for another without incurring any immediate capital gains taxes. Investors can defer paying capital gains taxes on the sale of their investment property by reinvesting the full proceeds from the sale into a new investment property.

It’s a fantastic way to save on current expenses and continue building the investor’s real estate portfolio.

1031 Requirements:

- The property being sold, and the property being acquired must be like-kind, which generally means they are both real estate properties held for investment or business purposes.

- The fair market value of the replacement property must be equal to or greater than the sale price of the original property to defer all capital gains taxes.

- Within 45 days of selling the original property, the investor must identify potential replacement property(ies) in writing to a QI (Qualified Intermediary).

- The investor must close on the replacement property within 180 days of selling the original property or by the due date of their tax returns, including extensions, in the tax year that the original property was sold, whichever comes first.

Here is a 1031 Exchange in Action:

- Investment property was purchased 10 years ago for $188,000

- The investor put $65,000 in improvements to the property during the holding period, bringing the cost basis for the property to $253,000

- The house now needs a new roof, costing $30,000. An option, instead of spending $30,000 on a new roof, the investor decides to buy a newer investment property that does not require major improvements

- The current property is now worth $600,000, appreciating by $347,000 over the cost basis calculated above putting the investor in a position to pay a significant capital gains tax. Assuming a federal capital gains tax rate of 20% and a Colorado capital gains tax of 4.55%, the combined capital gains would be $85,189

- Using a 1031 Exchange, the investor is able to transfer all proceeds of the sold property towards the purchase of the new investment property, deferring any capital gains tax

Now that we understand how a 1031 Exchange can be a great tool for real estate investors, let’s discuss a 1031 “Reverse” Exchange.

A Reverse 1031 Exchange lets the investor buy the replacement property first, while still deferring capital gains taxes on the subsequent sale of the original investment property.

This is a great option when an investor finds an ideal replacement property that they don’t want to miss out on, but they haven’t yet sold the original property.

Financing a Reverse 1031 Exchange:

- To purchase the replacement investment property, the investor needs cash from the original investment property

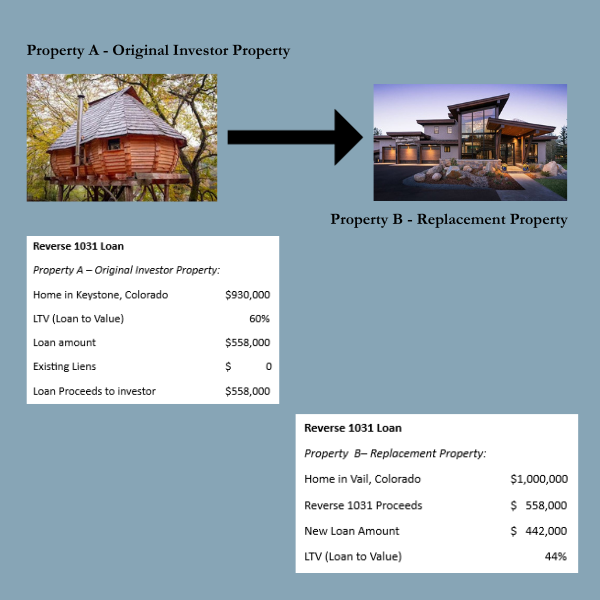

- Since the funds from the sale of the original investment property are not yet available, our Reverse 1031 loan can provide the funds to help buy the replacement property by allowing the investor to borrow against the equity in the original investment property.

- The Reverse 1031 loan is a six-month loan with “no payment due until the sale of the property or maturity of the” loan, whichever comes first. The Reverse 1031 loan will lend up to 60% LTV for a loan on an investment property.

- Accessing the equity in the original investment property, the investor can use the capital for a down payment on the replacement investment property.

- Does NOT interfere with the 1031 Exchange tax benefits

Reverse 1031 Exchange Example:

The Reverse 1031 loan can be a great alternative to the standard 1031 Exchange program. It allows the investor to utilize idle equity in an investment property to take advantage of another great opportunity without rushing to sell the existing property. Here are a few other advantages of a Reverse 1031 loan.

- It allows investors to proceed with the acquisition of the replacement property without having to wait to sell the existing property first.

- Investors can avoid missing out on potential replacement properties that may not be available for long.

- They can continue to collect rent on the original property while not making any loan payments

- Gives the investor time to make improvements on the original property so they can get the best price possible.

In conclusion, understanding the power of 1031 Exchanges and the innovative Reverse 1031 Exchange can be a game-changer in your real estate investment journey. However, it’s crucial to navigate these strategies wisely. Consult with a tax professional or financial advisor to tailor these approaches to your specific needs.

Unlock the full potential of your real estate investments—don’t let taxes hinder your growth. If you have questions or want to explore further, reach out to us. Your financial goals are our priority.